Getting Comfortable With Volatility

Blair Jensen | Oct 04, 2015 02:09AM ET

The most significant thing I’m seeing this week is my measures of risk strengthening amid large range days and high volatility. Market participants are getting comfortable with wide swings in their portfolios. The improvement in my measures of risk still aren’t enough to clear my market risk indicator , but a continued rally next week just might do it.

On the other hand, my measures of stock market quality, trend, and strength all fell this week even with four days of rally. This action is similar to what I was seeing a few weeks ago that indicate we’re probably seeing another dead cat bounce. Last week I said that I intended to take some profit from the hedge if the market retested the August low. I didn’t do it for a couple of reasons. The major reason is that at the lows on Monday the hedged portfolios were roughly allocated still at 50% long, 33% aggressively hedged (with mid term volatility), 17% short the S&P 500 Index. As a result, I would have only softened the hedge by selling some volatility and buying a S&P 500 short. I prefer to actually get more long when the market is making a low. The second reason was the tepid response from my core indicators since the Monday low. I’m continuing to be patient and waiting for either my market risk indicator to clear or a break lower before changing any allocations.

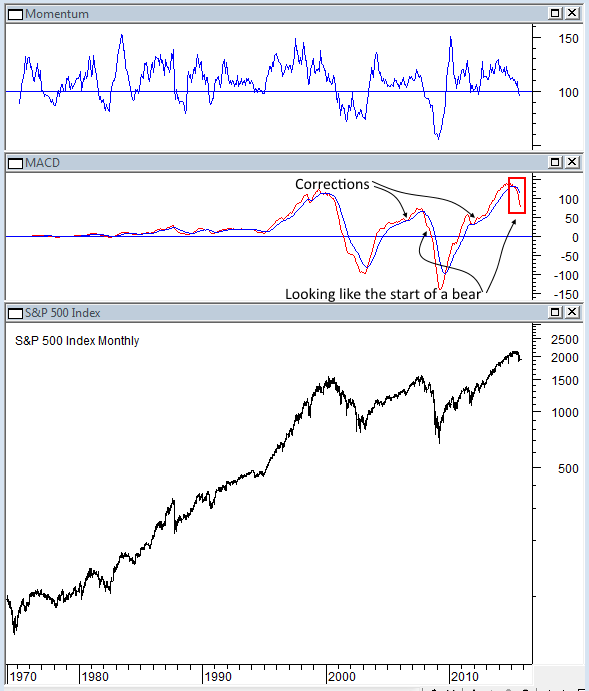

One thing of interest is that long term momentum is starting to paint a clear picture of the start of a bear market. Notice the difference between corrections that take small dips to bear markets that have MACD and momentum plunging.

Conclusion

Market participants are getting comfortable with volatility, but core indicators aren’t improving. I’ll be exercising patience while I wait for my market risk indicator to clear or price to plunge lower. Either of those events will have me adding long exposure to the hedged portfolios.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.