Getting Around To Shorting VMWare

Dragonfly Capital | Jun 13, 2013 02:52AM ET

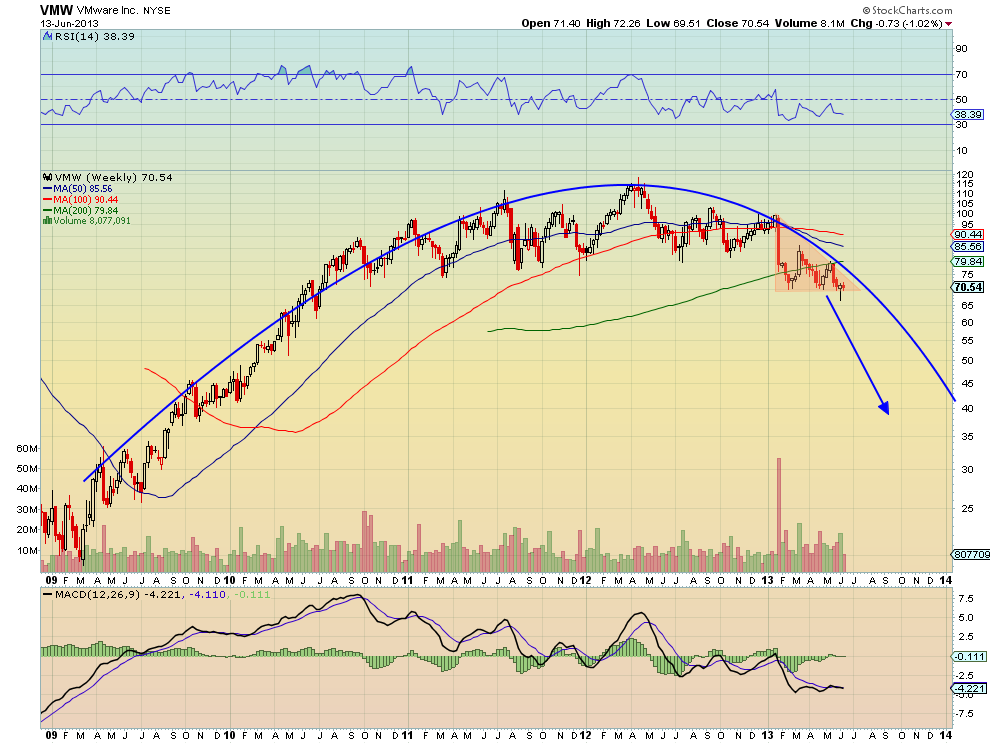

Since then I have been looking for a reason and entry to be short. With the sideways motion for the last two weeks, it has done just that. The chart below shows that it has been building a descending triangle over support at 70 since February. The target on the break below takes it to 40. Both the bearish Relative Strength Index (RSI) and the Moving Average Convergence Divergence indicator (MACD) support more downside. The accumulation/distribution is rolling lower. Distribution confirming the rounding top was seen back on June 4. The short interest is less than 3%, so the risk of a squeeze is small. A close below 70 on the weekly chart seals the deal on the short trade.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.