GER30 And AUD/USD Analysis: April 17, 2018

FxPro Financial Services Ltd | Apr 17, 2018 05:35AM ET

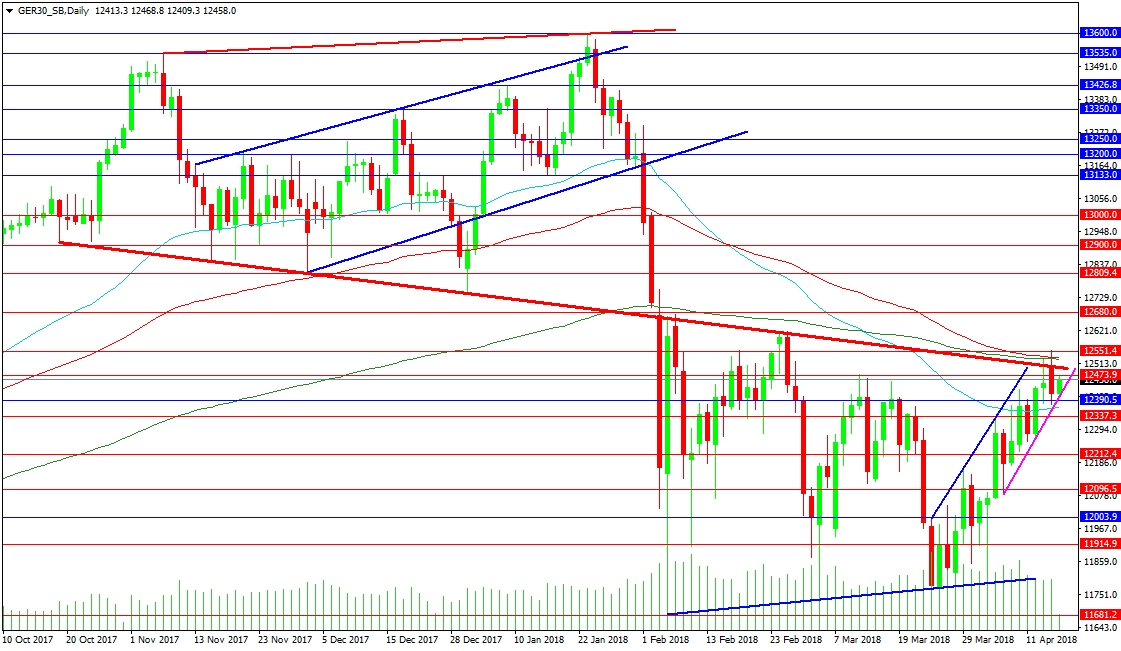

The German index has moved higher to test the falling red trend line at 12500.00 but failed to stay above the level, after running into strong resistance at 12550.00. The bullish channel that price has been trading within has held, and the index is now moving higher again towards 12500.00. A sustained break above 12550.00 would squeeze bearish positions and entice bulls to re-engage with the market, with targets at 12680.0 and 12809.40. A break above those levels targets 12900.00 and 13000.00, followed by previous support at 13133.00. A move above this level would put the high of 13600.00 in view.

Support can be seen at the 12390.00 level, followed by the 50 DMA at 12367.20. A loss here would potentially hand control back to bears, with nearby targets at 12212.40 and 12096.50, followed by 12000.00. A break below that level could be interesting, as bulls have re-entered the market between there and the 11681.20 level. However, a loss of the rising support trend line at 11810.00 could force some bulls to liquidate their long trades, sending price lower.

AUD/USD

The RBA released its Meeting Minutes overnight, striking a cautious tone. Also released were Chinese data showing a slight cooling in economic strength. The other driver in this pair is the prevailing USD weakness. This has led to a weak break out above the blue resistance trend line over the last couple of days. The moving averages are clustered around the trend line, which has slowed the breakout. The descending wedge pattern illustrated on the chart below is usually seen as a continuation pattern, which in this case reinforces the upward trend. A break above 0.78000 is now needed to drive the price higher and take out Friday’s high. This would put the 0.78900 level in focus, followed by 0.79550 and 0.80000. Should the pair continue to trend higher, it would target 0.80350 and the high at 0.81352.

Support is located at the broken trend line at 0.77533 today, with the 0.77170 level below. The area around 0.76534 has found buyers in the past and is a key area of support. A loss of that area would target the 0.76000 zone, followed by the previous low around 0.75000.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.