Generating 2% – 4% In Bull Markets: How To Take Advantage Of Out-Of-The-Money Stri

Dr. Alan Ellman | Jun 24, 2018 12:13AM ET

The 3 required skills for covered call writing and selling cash-secured puts are stock selection, option selection and position management. This article will use real-life examples highlighting the first 2 of these skill sets in a bull market environment.

Article assumptions and guidelines

- Portfolio is set up in a bull market environment

- Target goals for initial time value returns are 2% – 4%

- $50k cash available

- Select 5 different stocks in 5 different industries

- Adequate cash allocation

- 2% – 4% of total cash available reserved for exit strategy execution, if needed

- Premium Report dated 12/15/2017 for 1/19/2018 expirations is used for stock selection

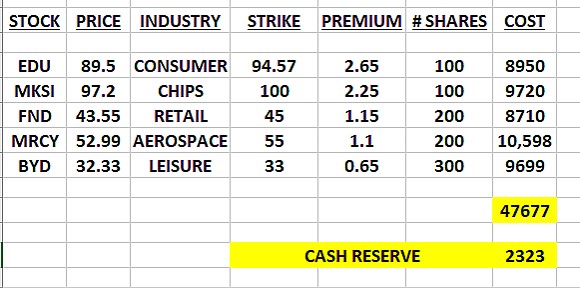

Stocks selected

Selection guidelines achieved

- 5 different stocks

- 5 different industries

- Cash allocation near $10,000.00 per position (no single position dominates from a cash investment perspective)

- Adequate cash reserve ($2323.00) for potential exit strategy opportunities

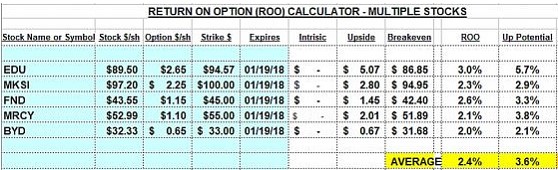

Calculating Initial time value portfolio returns

Calculation guidelines achieved

Returns fall into our target 2% – 4% range (2.4%)

Establishing a significant upside potential bull market opportunity (3.6%)

Discussion

When targeting initial time value return goals (ROO) for our covered call writing portfolios of 2% – 4%, we are using these stats to set up the portfolios. Final results can be lower or higher. In bull markets we favor out-of-the-money strikes which offer the opportunities for share appreciation up to the strike price in addition to the option premiums…two income streams per position. In the real-life portfolio highlighted in this article, the average initial return (ROO) was 2.4% and the potential share appreciation averaged 3.6%. This created a portfolio with a possible 6%, 1-month return. Stock and option selection were discussed in this article but I would be remiss if I didn’t mention the importance of position management in our final returns. Also, two final points:

- The odd $94.95 strike for MKSI was a result of a contract adjustment after a corporate event

- Bid prices were used for the calculations. Leveraging the may have elevated the returns displayed

Market tone

This week’s economic news of importance:

- NAHB home builders’ index June 68 (70 last)

- Housing starts May 1.301 Million (1.300 million expected)

- Building permits May 1.301 million (1.364 million last)

- Existing home sales May 5.43 million (5.52 million expected)

- Weekly jobless claims 6/16 218,000 (220,000 expected)

- Philly Fed June 19.9 (29.0 expected)

- Leading indicators May 0.2% (0.4% last)

- Markit manufacturing PMI June 54.6 (56.4 last)

- Markit services PMI June 56.5 (56.8 last)

THE WEEK AHEAD

Mon June 25th

- Chicago Fed national activity index May

- New home sales May

Tue June 26th

- Case-Shiller home price index April

- Consumer confidence index June

Wed June 27th

- Durable goods orders May

- Pending home sales May

Thu June 28th

- Weekly jobless claims through 6/23

- GDP revision Q1

Fri June 29th

- Personal income May

- Consumer spending May

- Chicago PMI June

- Consumer sentiment (final) June

For the week, the S&P 500 moved down by 0.89% for a year-to-date return of 3.04%

Summary

IBD: Confirmed uptrend

GMI : 5/6- Buy signal since market close of April 18, 2018

BCI: Favoring 3 out-of-the-money calls for every 2 in-the-money calls.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a neutral tone. In the past six months, the S&P 500 was up 3% while the VIX (13.77) moved up by 40%.

Wishing you much success,

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.