General Elections Inject Volatility Into Currency Markets

AvaTrade | Sep 26, 2017 01:41AM ET

Overview

Germany’s election results sent the euro lower. While Angela Merkel secured her fourth term as chancellor, the margin in which her party won by was much smaller than in past elections. Merkel’s Christian Democrat party and the Liberal Free Democrats will now form a coalition. The euro is now 0.4% weaker against the dollar.

Equities

European stocks are shrugging off the disappointing election results, trading mostly higher. Germany’s DAX 30 is 0.1% stronger while France’s CAC 40 is flat. The DJ Euro Stoxx 50 is 0.1% higher and OMX 30 is 0.36% higher.

US stocks are more subdued. The S&P 500 has given up 0.09%, the Dow Jones has lost 0.08% and the tech-heavy Nasdaq 100 is down 0.12%.

Commodities

The stronger dollar has weighed on gold. Additionally, concerns over North Korea’s threats have diminished leaving less demand for safe-haven assets. The precious metal is 0.3% lower.

Crude oil is 0.26% lower while Brent oil has dropped by 0.23%. The lack of clarity from the weekend’s meeting of OPEC and non-OPEC allies has forced bearish investors out of hibernation.

Investors were hoping for an extension of production cuts past the deadline of March 2018, however the cartel gave little information on the issue. Russia’s Alexander Novak stated that “I think we can return to this issue not earlier than January next year,”

Forex

Another election sent jolts of volatility into equity markets, this time in New Zealand. No clear mandate was elected, leaving the nation in limbo for the next few weeks. The uncertainty sent the New Zealand dollar 1% weaker against its US counterpart.

The dollar was 0.2% stronger against a basket of its peers. Meanwhile, the pound climbed 0.2% against the dollar. Sterling is now 0.62% stronger against the euro after the disappointing result in Germany.

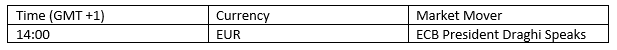

Coming up

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.