Gemini Lists Dogecoin, Sending Price To New Highs

Crypto Briefing | May 05, 2021 01:14AM ET

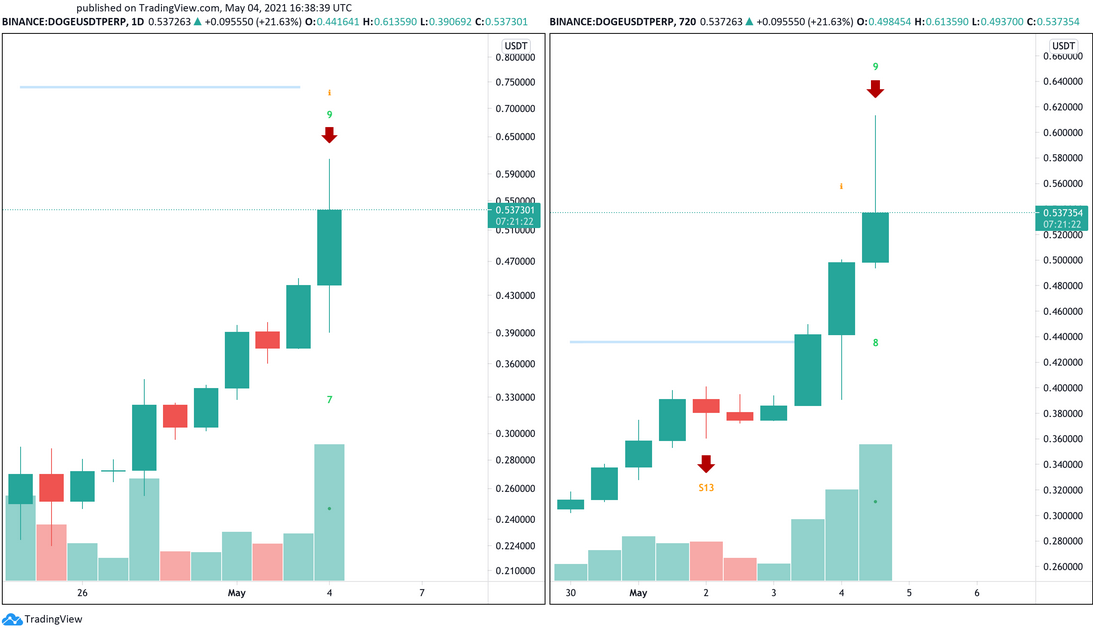

Dogecoin hit a new all-time high following an exchange listing announcement.

Key Takeaways

- Gemini revealed that it was listing Dogecoin for trading, and that the coin would be available beginning May 4,

- The announcement saw a significant number of investors rush to exchanges to buy some Dogecoin.

- DOGE's price has risen by more than 46% in the last few hours, at the time of writing.

Gemini has joined the Dogecoin mania. The New York-based cryptocurrency exchange revealed that it will add support for DOGE, sending the coin’s price to a new all-time high.

Dogecoin Skyrockets On Gemini Listing

In a blog post, Gemini announced that starting yesterday, May 4, users would be able to deposit Dogecoin into their accounts.

Trading against the US dollar was to begin on the platform’s API and active trader applications. Following a successful rollout, Gemini will open Dogecoin trading on mobile and web applications.

DOGE will also be tradeable against several other fiat currency trading pairs, including the British Pound, Euro, Canadian Dollar, Australian Dollar, Hong Kong Dollar, and Singapore Dollar.

Gemini justified its decision to list Dogecoin in light of its rapid rise and the possibility that it could lose value just as quickly.

“Yes, [Dogecoin] a meme coin, but all money is a meme. And all money is both an idea and a matter of faith or belief in it. Over the multi-millennia history of money, the majority of money (be it shells, beads, precious metals, etc.) has been what we the people say it is and believe it is,” Gemini explained.

Dogecoin will be listed alongside over 40 other cryptocurrencies that Gemini currently supports on its trading platform.

FOMO Kicks In

FOMO struck the market following Gemini’s announcement. Dogecoin’s market value has surged by more than 46% yesterday, rising from $0.42 to a new high above $0.61.

Despite the impressive price action that Dogecoin experienced yesterday, technicals spell trouble.

The Tom DeMark (TD) Sequential indicator was presenting sell signals in the form of green nine candlesticks on both the daily and 12-hour charts. The bearish formations forecasted a one to four candlestick correction before the continuation of the uptrend.

With this in mind, market participants should implement a robust risk management strategy when trading DOGE.

Even though this altcoin may have more room to rise, insiders who bought in earlier are likely to take profits.

The technicals strongly suggest this outcome.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.