General Electric And Goldman Sachs Could Weigh On This Market

Brian Gilmartin | Nov 18, 2018 12:02AM ET

It’s not just the China trade talks, and the Fed’s interest rate hikes that are making investors nervous.

Duplicating the process from my earlier post here let’s have a look at General Electric's (NYSE:GE) and Goldman Sachs's (NYSE:GS) 2019 EPS estimates and their trend:

- GE: $1.04, $1.01, $0.86 -15%

- GS: $24.49, $25.26, $25.64 +1.5%

(Source: IBES by Refinitiv)

For those readers that didn’t look at the earlier post, the first EPS estimate for GE and Goldman is the estimate as of June 30, while the second estimate is the consensus EPS estimate as of September 30, and the third estimate is the consensus EPS estimate for both companies as of Friday, November 16th. The fourth column is the 6-week percentage change in the consensus estimate.

GE’s consensus EPS estimate for 2019 has fallen 16% in just the last 6 weeks, while Goldman’s EPS estimate is +1.5% despite a tough tape.

General Electric:

Lawrence McDonald, author of The Bear Traps Report and a frequent CNBC contributor, showed the above chart in his Wednesday Bear Traps Report, which is worth passing on to readers.

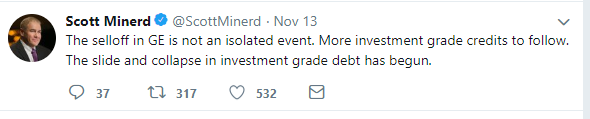

There is a problem at GE, as Bloomberg’s Lisa Abramowicz discusses here , which will put further stress on the investment-grade corporate bond market. Scott Minerd, Guggenheim’s Global CIO (such a weighty title) sent out this tweet this week, which didn’t comfort bond investors in the least:

There seems to be a lot of focus on the BBB-rated segment of the corporate bond market, given GE’s price action, and the drop in crude oil prices. There is now – per the reports – a good part of what used to be investment-grade credits (meaning BBB-rated or higher) trading at below-investment-grade or junk-bond spreads.

Goldman Sachs:

Another A-/BBB rated investment-grade credit is under pressure (the stock price anyway) this week, and the issue may be more serious than investors realize. The 1MDB scandal that started with a Goldman Malaysia financing smacks a little bit of the Salomon scandal in the early 1990’s that cost John Gutfreund his job and ultimately led to the demise of the banking and trading giant.

The US Justice Department is now looking into the 1MDB scandal (Barron’s wrote about the scandal here this week).

Here is the issue: In the Solly Treasury bid-rigging scandal in the early 1990’s it started out similar to Goldman’s 1MDB scandal in that it was thought to be contained with the Treasury trader but ultimately it came out that Gutfreund had been alerted that something was suspect with the Treasury auctions, and never did anything about it.

The Salomon bid-rigging scandal ultimately became a criminal investigation that went to the very top and the “comfidence-sensitive” funding that Solly and all broker-dealers are reliant on fled quickly. John McFarlane, the Salomon Treasurer at the time was ultimately credited with keeping Solly from collapsing completely after the criminal indictment and which allowed Solly to remain afloat until Citigroup (NYSE:C) bought the firm in the late 1990’s.

Goldman Sachs has $229 billion in longer-term debt outstanding and another $42 billion of “short-term borrowings” as of the 9/30/18 10-Q.

It’s been a while since I’ve been a corporate credit analyst and really dug into the liquidity and funding of the broker-dealer sector, and I’m not even sure if the “confidence-sensitive” funding even exists anymore but I couldn’t help see the similarities while reading (for the 4th time) “The Making of An American Capitalist” by Roger Lowenstein this week. The book is about the personal and business history of Warren Buffett and the chapters about the Salomon Treasury scandal are eerily similar to what is happening with Goldman and Malaysia. Mr. Buffett was in investor in Salomon Brothers and Mr. Buffett is still an investor in Goldman Sachs.

Summary / Conclusion: While everyone is focused on GE, Goldman’s debt outstanding is 3x as large (both short and long-term). However this post is in no way meant to impugn Goldman’s integrity or Lloyd Blankfein’s integrity or honesty, but because I happened to be reading about the Salomon scandal in Roger Lowenstein’s great work on Mr. Buffett, I couldn’t help but draw comparisons to the two events. As what happened with Salomon in the bid-rigging scandal, when the Justice Department starts turning over rocks, you never know who knew what when.

Goldman’s stock has taken out (i.e. traded below) its both its 2018 and 2017 lows. $200 per share for the banking giant is cheap, with tangible book value (TBV) at $186 per share, unless there are other shoes to drop.

Finally, although it has been quite a while since I’ve seen the graphic, during the 1980’s and 1990’s there used to be a research piece that noted the financial defaults used to signal the end of the Fed tightening cycles through the 1980’s and 1990’s: The Mexican Debt Crisis occurred in 1982, Continental Bank blew up in 1985 (?), the October ’87 Crash, and then the Drexel Burnham bankruptcy, and the failed United Air Lines High Yield deal in the late 1980’s marked the peak of that cycle as the first Gulf War started in January, 1991, while Orange County’s default and the Mexican peso devaluation halted the 1994 fed funds rate increases. We still haven’t listed the Long-Term Capital Crisis of July – August, 1998 and then the NASDAQ collapse that started in early 2000.

Will history repeat this time and if so, will that default be either GE or Goldman? GE still seems far more obvious than Goldman, which has seen credit spreads widen out just 15 bp’s recently (per one trusted source) although Goldman is also rated just low A/A3/BBB+ on the credit spectrum.

Goldman hasn’t been owned for clients since shares were trading in the low $240s since I think it’s a business model better suited to the 1980’s and 1990’s. Goldman actually has less money under management than Schwab, TD Ameritrade and Morgan Stanley.

A default by either company remains a remote probability, but something is keeping this market anxious. Certainly the trend in the EPS estimates look better for Goldman than GE today.

Fed tightening cycles usually end with some entity going “poof” (that’s a scientific term) and you have to wonder who that will be.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.