GBP/USD Trends In Conflict, Next Few Days Key

Faraday Research | Oct 04, 2018 12:54AM ET

After stellar economic data, including Theresa May’s dance moves ?). In all seriousness, Britain’s Prime Minister generally “stuck to the script” in her speech to the Conservative party house, stating that she “will not let the country down on Brexit” and that “ruling out a no deal exit would weaken the UK’s negotiating position.” The slight weakness over the last two weeks notwithstanding, investors still believe that the EU and UK will ultimately reach an agreement to avoid a so-called “hard” Brexit scenario, so headlines will continue to drive the pair over coming weeks and months.

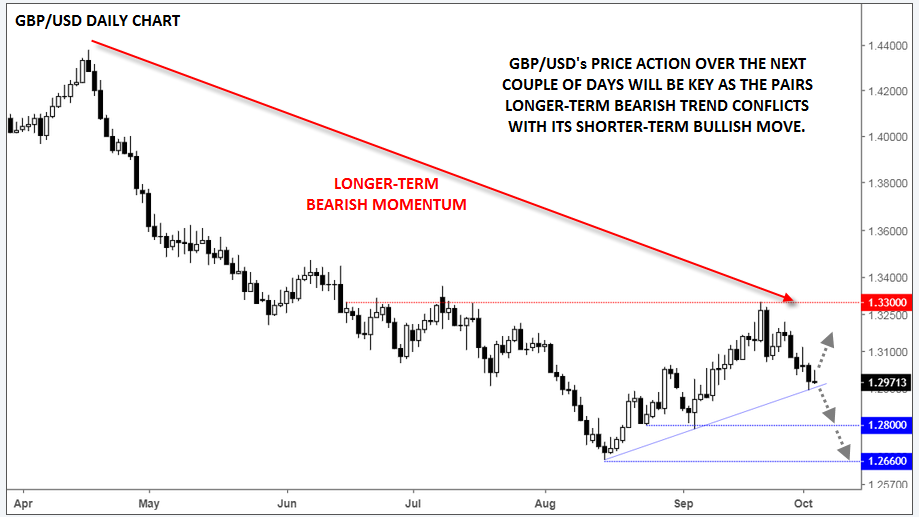

Technically speaking, GBP/USD’s outlook depends on your timeframe. Since peaking near 1.4400 in April, the pair traded down more than 1,700 pips through the summer to hit a low around 1.2660 in mid-August, clearly establishing the longer-term bearish momentum. The pair has since bounced back modestly, topping out near resistance at 1.3300 last month before pulling back to the nascent bullish trend line near 1.2950 as of writing.

Whenever longer-term and shorter-term trends conflict, it’s generally a good rule of thumb to defer to the longer-term trend. After all, it takes more traders, trading more money, for longer to create a long-term trend. That said, all trends eventually come to an end, so traders should always be wary of a market reversal.

Apply the above thought process to GBP/USD, a break of the near-term bullish trend line and yesterday’s low around 1.2940 would suggest that the longer-term bearish trend may be resuming for a test of previous support levels at 1.2800 and 1.2660. As long as the week’s low holds however, the pair could see a bounce to unwind a portion of the recent selloff. That said, longer-term traders may maintain a bearish bias below strong resistance in the 1.3300 zone.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.