GBP/JPY And EUR/JPY Analysis – February 20, 2018

FxPro Financial Services Ltd | Feb 20, 2018 06:53AM ET

Bank of Japan Governor Kuroda was reappointed to a rare second term last week, with the implication that the Japanese yen cannot rely on any interest-rate hikes. Kuroda is expected to continue with monetary accommodation, negative base rates and direct management of the bank’s own government bond yield curve. Despite all this, the Japanese yen has been trading at 15-month highs against the US dollar and it is possible that Kuroda will attempt to talk down the country’s currency as it starts causing problems for Japanese exporters.

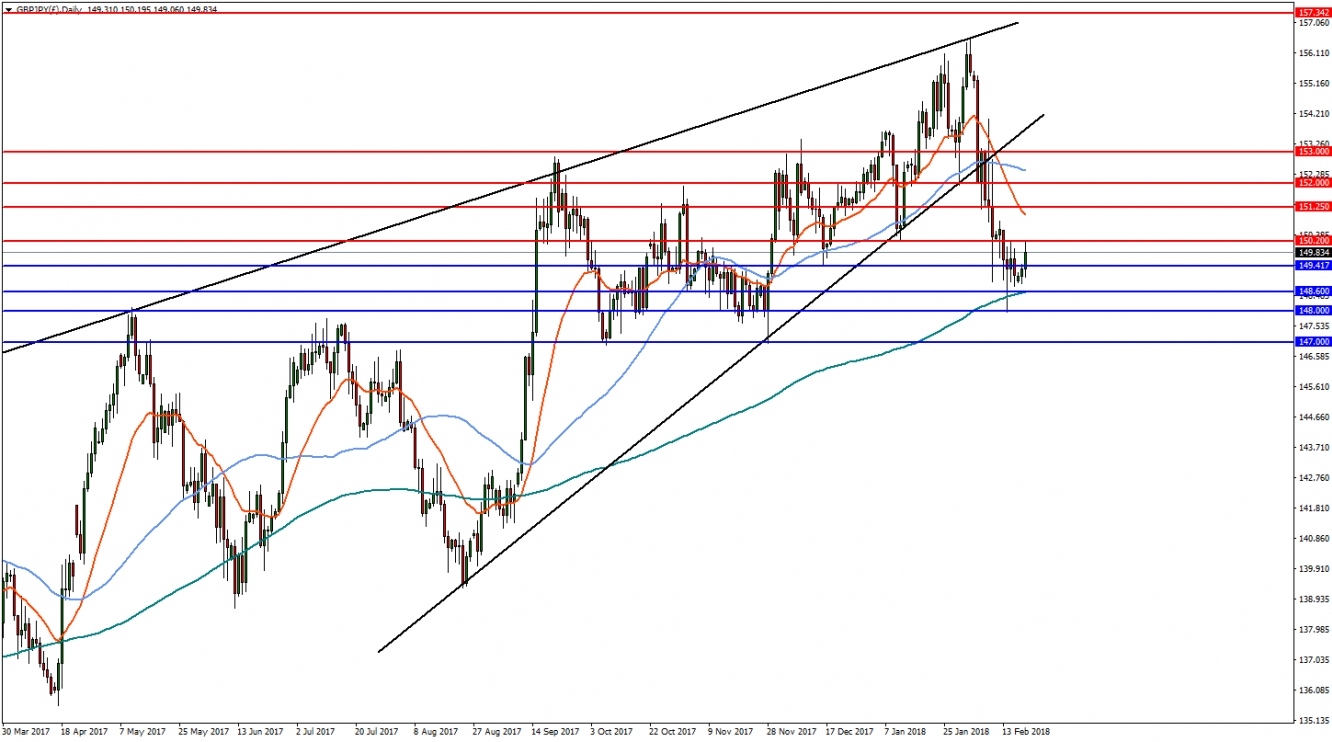

GBP/JPY

The GBP/JPY pair broke out of a rising wedge in the daily time frame and has found strong support at 148.60, near the 200MA and 50% retracement of the move from August 2017. The pair has failed to break this level for a few days and a reversal is possible, with upside resistance to be found at 150.20 and then 151.25. A decisive break of 148.60 is needed for a continued downside, with supports at 148.00 and 147.00.

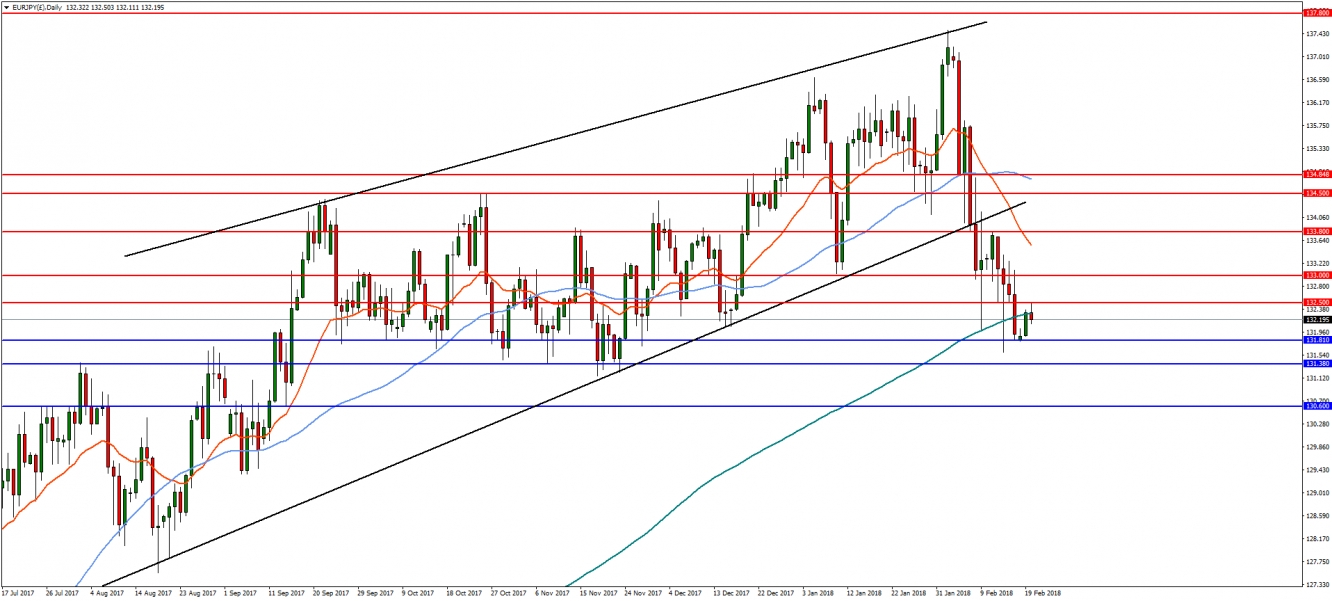

EUR/JPY

The EUR/JPY pair broke down from a rising channel and slipped below the 200MA, before finding support at the 38.2% Fibonacci of the move from May 2017. If the recent euro weakness persists, this pair may continue trading with a bearish bias below the 200MA. In this case, a break of 131.81 would find downside support at 131.38 and 130.60. On the flip-side, any bullish reversal above 132.50 will find resistance at 133.0 and then 133.80, where trend line resistance will come into focus.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.