GBP/CHF Slides Below Key Support Of 1.2950

JFD Team | Oct 23, 2018 07:31AM ET

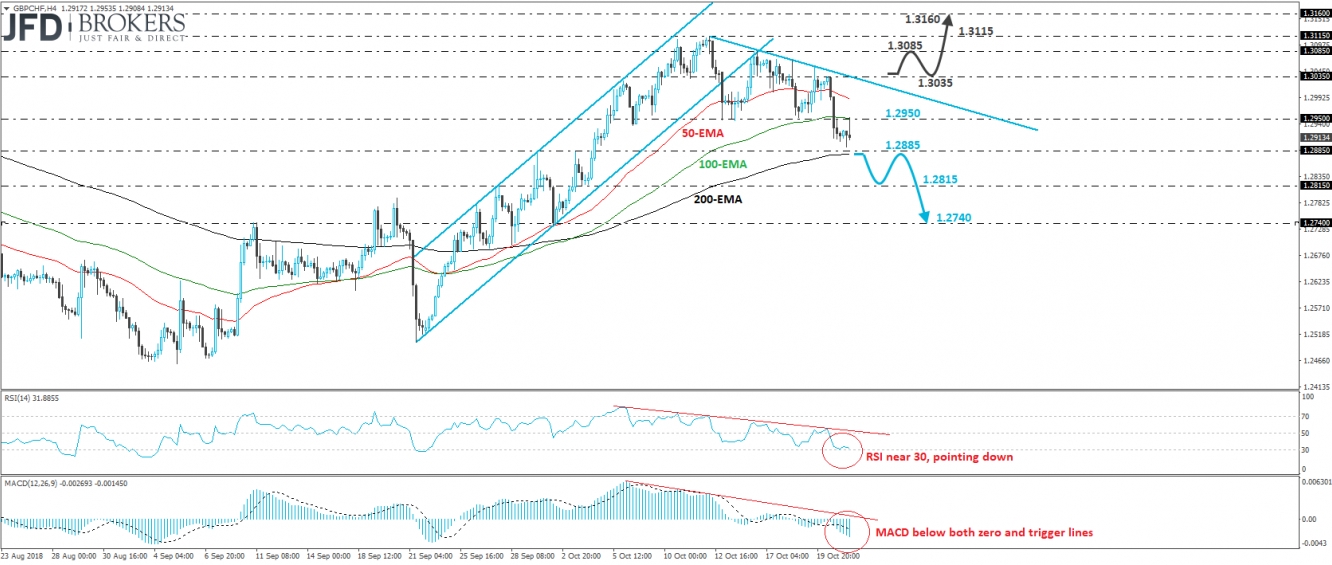

GBP/CHF tumbled yesterday, after it hit resistance near 1.3035. The slide brought the rate below the key support (now turned into resistance) of 1.2950, a move that confirmed a forthcoming lower low on the 4-hour chart. On the 15th of October, the rate fell below the lower bound of the upside channel that had been containing the price action since the 21st of September, but up until yesterday, it remained supported by the 1.2950 zone. In our view, the break of that level has turned the short-term outlook negative.

A decisive break below 1.2885 may suggest that the bears are willing to stay in the driver’s seat and perhaps push the rate down for a test near the 1.2815 level, marked by the low of the 4th of October. Another move below 1.2815 could carry more bearish implications and perhaps open the path for the our next support of 1.2740, defined by the low of the 2nd of the month.

Taking a look at our short-term oscillators, we see that the RSI hit support near its 30 line, rebounded somewhat, but turned down again. It could fall below 30 soon. The MACD lies below both its zero and trigger lines, pointing south as well. These indicators detect negative momentum and support the notion for some further declines.

Even if the pair recovers back above 1.2950, as long as it stays below the downside resistance line taken from the peak of the 12th of October, we would still see a decent likelihood for the bears to jump in and drive the battle lower. We would like to see a clear break above 1.3035 before we start assuming that the bears are headed towards the exit. Such a break could initially aim for the high of the 16th of October, at 1.3085, or the peak of the 12th of the month, at 1.3115. Another break above 1.3115 could pave the way for the 1.3160 territory, defined by the inside swing low of the 13th of July.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.