GBP/USD: Little Movement Ahead Of US Key Releases

MarketPulse | Mar 13, 2014 04:54AM ET

in Wednesday's North American session. There is little activity on the release front, with only a handful of US releases on the schedule. Crude Oil Inventories looked excellent, as the weekly release hit its highest level in 2014. There are no British releases on Wednesday.

Testifying before parliament, BOE Governor Mark Carney reiterated that the Bank was in no rush to raise interest rates, noting that the economy may have spare capacity of up to 1.5% of GDP. Carney stated that any increase in rates would be done gradually and to a limited extent. With the UK economy continuing to expand, Carney continues to dampen expectations about any rate increases to prevent the economy from overheating. Meanwhile, other policy makers differ with Carey's forecast of spare capacity. Martin Weale, a member of the BOE's Monetary Policy Committee stated that the economy's slack is under the 1.0% level. The divergence in opinion could indicate a split regarding future monetary policy and this could impact on the pound.

US employment numbers remain in the spotlight on Tuesday. US JOLTS Job Openings dropped slightly in February, coming in at 3.97 million. This fell short of the estimate of 4.02 million. Late last week the markets were treated to better news, as Unemployment Claims and Nonfarm Payrolls showed sharp improvement in February. Nonfarm Payrolls, one of the most important economic indicators, jumped to 175 thousand in February, up from 1113 thousand a month earlier. This was well above the estimate of 151 thousand. Unemployment Claims dropped to 323 thousand, a thirteen-week low.

With some solid US employment numbers last week, it's a good bet that the Fed is likely to take its scissors and trim QE next week for the third time since the haircutting began in December. New York Fed President William Dudley stated last week that the threshold to alter the Fed's program to wind up QE was "pretty high". In other words, short of a serious economic downturn in the US economy, we can expect the QE tapers to continue. If all goes well, the Fed plans like to wrap up QE by the end of 2014.

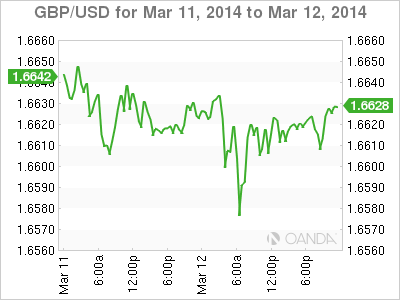

GBP/USD March 12 at 16:45 GMT

GBP/USD 1.6621 H: 1.6636 L: 1.6568

GBP/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.6329 | 1.6416 | 1.6549 | 1.6705 | 1.6765 | 1.6896 |

- GBP/USD is showing little movement on Wednesday. The pair dropped below the 1.66 line in the European session for a second straight day but has since recovered.

- 1.6549 is providing support. This is followed by support at 1.6416.

- On the upside, 1.6705 continues in a resistance role. Next, there is resistance at 1.6765.

- Current range: 1.6549 to 1.6705.

Further levels in both directions:

- Below: 1.6549, 1.6416, 1.6329 and 1.6236

- Above: 1.6705, 1.6765, 1.6896, 1.6964 and 1.7087

OANDA's Open Positions Ratio

GBP/USD ratio is unchanged in Wednesday trading. This is consistent with what we are seeing from the pair, which has not shown much activity on the day. A large majority of the open positions in the GBP/USD ratio are short, indicative of a trader bias towards the dollar breaking out and posting gains.

GBP/USD is trading in the low-1.66 range. The pound is steady in the North American session.

GBP/USD Fundamentals

- 14:30 US Crude Oil Inventories. Estimate 2.1M. Actual 6.2M.

- 17:01 US 10-year Bond Auction. Actual 2.73%.

- 18:00 US Treasury Secretary Jack Lew Speaks.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.