GBP/USD: Digesting Drop To 14-Month Low

Dailyfx | Nov 11, 2014 03:30AM ET

Talking Points:

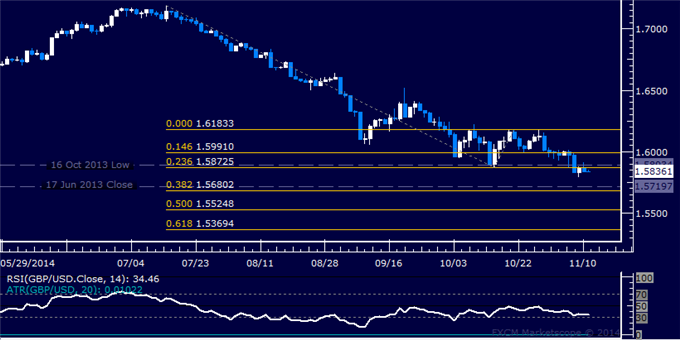

- GBP/USD Technical Strategy: Flat

- Support: 1.5680, 1.5525, 1.5369

- Resistance: 1.5893, 1.5991, 1.6183

The British Pound paused to consolidate losses after plunging to a 14-month low beneath the 1.58 figure against the US Dollar. A daily close below the 1.5680-5720 area (38.2% Fibonacci expansion, June 2013 bottom) exposes the 50% level at 1.5525. Alternatively, a reversal above the 1.5873-93 zone (October 2013 low, 23.6% Fib) clears the way for a test of the 14.6% expansion at 1.5991

Entering short seems attractive from a technical perspective but we will tactically opt against taking on the trade. The upcoming publication of the Bank of England Quarterly Inflation Report may mark a pivotal moment for monetary policy bets, throwing off chart-based direction cues. With that in mind, we will stand aside for now.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.