FX Update: Market Doesn’t Know What To Do With The Euro

Saxo Bank | Jun 30, 2015 06:44AM ET

The market is clearly very confused on what to do with the euro as the uncertainty over Greece hangs over the market.

The one correlation that seems to hold, regardless of whether we can discern the logic, is that weak risk appetite is generally rather euro supportive, as yesterday’s late meltdown in risk appetite in the US saw the USD generally on the back foot and EURUSD spiking all the way back to 1.1250. Elsewhere, weak risk appetite continues to support the JPY in particular.

Signs of deep confusion on what to do with the euro after yesterday’s action only seem to show that euro remains negatively correlated with risk appetite, for whatever reason. Is it position unwinding of European stocks and related short euro hedges or

further unwinding of outright short euro positioning?.

This may continue to drive the action, but at some point, signs of an existential crisis for Europe can hardly be considered a euro positive. For example, exploding EU peripheral spreads like we have seen recently will serve as a strong headwind for further euro gains if they continue to widen.

Spain and Italy are now well over 150 basis points wide of Germany at 10-year yields and at the highest level in almost a full year, in the case of Spain. Eventually, as well, the wider spreads and general turmoil are going to have the European Central Bank on the quantitative-easing warpath to do “whatever it takes” to bring yields back lower.

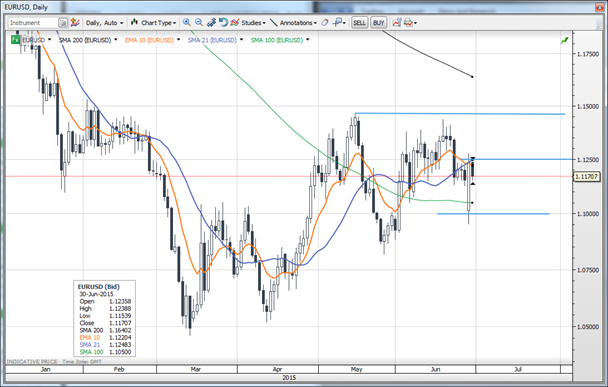

EURUSD confusion reigns

Confusion for the market after yesterday saw EURUSD closing the gap opening on Monday and then some – we may need to wait for the other side of Sunday’s referendum to find a resolution here – either above 1.1400 or below 1.1000, as few may be willing to commit to a directional move amid the intense uncertainty of whether we’ll see a Grexit and if so, the contagion risks.

The G-10 rundown

USD: the weakest of the G3 when the pressure is on risk appetite, perhaps due to the previous focus on pro-cyclical reasons to buy USD. Eventually, USD has to have credibility as a safe haven if the pressure on risk continues – possibly only playing second fiddle to the yen.

EUR: Market is anxious on what to do with the euro on the conflicting themes, but positioning is much lighter now and a further squeeze on weak risk appetite may quickly run into a ceiling, despite yesterday’s action.

JPY: Acting like the JPY of old at the moment, as a safe-haven proxy. A return of confidence and strong US data would help us avoid the structurally critical 122.00/121.50 zone, while a further meltdown risks ending the bull market with any weekly close below this zone.

GBP: The EURGBP gap was also eliminated here as we rallied all day yesterday from the gap opening lower, perhaps as the GBP upside story, as with the USD, is a pro-cyclical one of divergently hawkish Bank of England policy, a story that is weakened in an environment of fear/risk off.

AUD: Oddly resilient, perhaps as USDJPY pressure is wearing off a bit here and on AUDNZD buying, but pressure should be on the downside if US data comes in strongly later this week.

CAD: Rangebound, with weak oil and weak risk appetite suggest upside risk, with the biggest test the US data later this week.

NZD: Weak again on a multi-year low in Business Confidence, which has deteriorated sharply this year and is almost back to early 2009 levels – suggesting this NZDUSD could continue to steam lower for now toward 0.6600/0.6500.

SEK: Note much focus here, and given the circumstances, the EURSEK stability suggests the predominant risk of downside if market confidence returns.

NOK: EURNOK higher as oil prices selling off and as risk off leaves NOK out of favour. Seeing is believing on a break of the 8.87 highs in EURNOK, which could put 9.00 into play, though a return of confidence/sentiment could see NOK rallying.

Economic data highlights

- New Zealand May Building Permits out at 0.0% MoM

- UK Jun. GfK Consumer Confidence out at 7 vs. 2 in expected and vs. 1 in May

- Australia May HIA New Home Sales fell -2.3% MoM

- New Zealand Jun. Business Confidence out at -2.3 vs. +15.7 in May

- Japan May Real Cash Earnings fell -0.1% YoY vs. +0.2% expected and vs. -0.1% in Apr.

Upcoming economic calendar highlights (all times GMT)

- Germany Jun. Unemployment Change/ Unemployment Rate (0755)

- UK Q1 GDP revision (0830)

- UK Apr. Index of Services (0830)

- Australia RBA’s Stevens to Speak (0840)

- Euro Zone Jun. CPI Estimate (0900)

- Euro Zone May Unemployment Rate (0900)

- Canada Apr. GDP (1230)

- US Apr. S&P/CaseShiller Home Price Index (1300)

- US Jun. Chicago PMI (1345)

- US Jun. Consumer Confidence Index (1400)

- US Fed’s Bullard to Speak (2200)

- Australia Jun. AiG Performance of Manufacturing Index (2330)

- Japan Q2 Tankan Survey (2350)

- China Jun. Manufacturing/Non-manufacturing PMI (0100)

- Australia May Building Approvals (0130)

- Japan Jun. Final Nikkei Manufacturing PMI (0135)

- China Jun. Final HSBC Manufacturing PMI (0145)

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.