FX Update: FOMC Minutes Throw A Rope To USD

Saxo Bank | Apr 09, 2015 05:55AM ET

Yesterday’s Federal Open Market Committee minutes were far more hawkish than the market believed they would be, as there was a robust discussion of whether the US Fed should already move in June, a scenario the market had entirely priced out coming into this meeting.

This provided a solid boost to short-term USD positioning that was looking the wrong way, but the reaction in Fed Funds futures was rather modest, suggesting the fundamental boost here is rather modest.

As I mentioned yesterday, these minutes came before the latest weak employment report and the Fed has been rather clear that it is highly dependent on incoming data for the evolution of policy.

Today’s economic calendar looks very thin, with no interest in the UK. Yesterday, the opposition Labour party leader Ed Miliband spoke out against the non-domicile tax rules that allow wealthy foreign residents in the UK to pay lower tax rates.

This should serve as a reminder that a Labour victory might be GBP-negative on the risk to capital flows into the UK on fears of a new tax regime. Such a development would mean that the positive capital account would have a harder time offsetting the country's still awful current account deficit.

On that note, we have the latest Visible Trade Balance data today, and let us remember that even during the recent years of a very weak pound, the trade deficit only worsened. This will mean something someday – but probably not today.

USDCAD saw perhaps the most interesting turnaround among USD pairs yesterday on the combination of a sharp oil sell-off punishing CAD, while the FOMC minutes boosted the greenback.

The US oil inventory data released yesterday shows that North America is swimming in oil after another massive build of nearly 11 million barrels. If this continues to weigh on the oil price, then USDCAD may finally be set to pull to the range highs and test that critical 1.3000 area that is the obvious next objective to the upside.

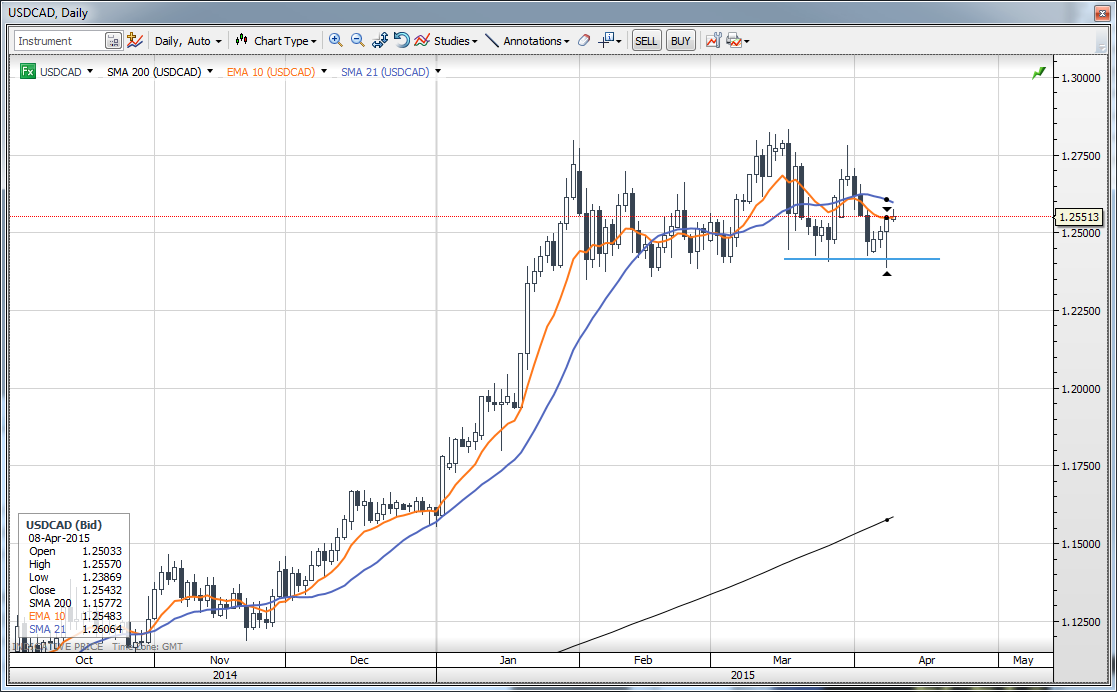

Chart: USDCAD

USDCAD’s reversal came just in time for the bulls, as yesterday’s action sat aside recent lows. The smart hammer reversal will have the bulls getting involved again here with the expectation that the range will hold and that we head back towards the highs of the cycle and beyond toward the massive 1.3000 area (the post-global financial crisis highs).

Risks to the upside view include tomorrow’s Canadian jobs report, any fresh strength in the oil market, and incoming US data.

The G10 rundown

USD: Finding strong support on the FOMC minutes – mostly because the market was looking the wrong way rather than any dramatic rhetoric. Next, even risks for USD until the Retail Sales report next Tuesday. Further out, we have an FOMC meeting that comes before the April employment report.

EUR: On the defensive across the board as quantitative easing continues to pressure, though we’re nearing important local support now in EURUSD and EURGBP.

JPY: USDJPY back higher, but again, we’re in the middle of the limbo and we need to at least take out 120.50 to the upside to even bother having a look at the situation.

GBP: A big M&A deal announced yesterday, but such deals take forever to complete and are minor relative to overall flows over the time frame of the FX flows involved – even for a deal of this magnitude. No reaction likely to Bank of England today (as there will be no news from this).

CHF: EURCHF trading rather heavy, but still in the 1.0400-1.0500 range as CHF probably retains a premium due to the ongoing uncertainties over Greece (where the 3-year rate remains above 20%).

AUD: We have yet to resolve the tactical situation here as we've seen three mini-rallies since last Friday, each one unable to hold the fresh highs, but the reversals are also failing to stick. Watching 0.7800 as the last line in the sand for maintaining a bearish view and noting the next major event risk is next Thursday’s employment report.

CAD: Steep oil inventory numbers in the US scotched the crude oil rally and therefore the CAD rally near key technical levels in USDCAD. The subsequent reversal higher looks compelling as noted above.

NZD: New Zealand's prime minister, John Key, was out talking down the kiwi (if gently) in an interview. Still watching AUDNZD for the relative strength of NZD in the crosses, while NZDUSD remains in limbo between 0.7600 and 0.7400.

SEK: Waiting for fresh impulse here as we’ve gone nowhere fast for weeks. Next Tuesday’s CPI data is the next data point of interest.

NOK: Surprising resilience given yesterday’s sell-off in crude oil as 8.75 in EURNOK has twice provided resistance. Immediate pressure appears lower within range.

Economic Data Highlights

- Australia Mar. AiG Performance of Construction Index out at 50.1 vs. 43.9 in Feb.

- Germany Feb. Industrial Production out at +0.2% MoM and -0.3% YoY vs. +0.1%/+0.6% expected, respectively and vs. 0.0% YoY in Jan.

Upcoming Economic Calendar Highlights (all times GMT)

- UK Feb. Visible Trade Balance (0830)

- UK Bank of England Announcement on Interest Rate/Asset Purchase Target (1100)

- Canada Feb. Building Permits (1230)

- Canada Feb. New Housing Price Index (1230)

- US Weekly Initial Jobless Claims (1230)

- US Feb. Wholesale Inventories (1400)

- China Mar. CPI/PPI (0130)

- Australia Feb. Home Loans (0130)

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.