FX Snapshot

The National Bank of Canada | Apr 05, 2016 04:59AM ET

Range of the week : 1.2800-1.3300

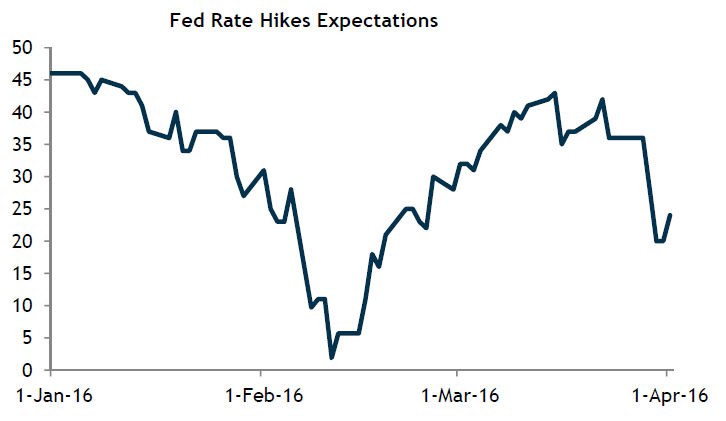

Last week was relatively charged with economic news and events, both in the U.S. and Canada. Speeches given early in the week by several members of the Federal Reserve (the Fed) created some confusion in the markets, due to the often inconsistent remarks they contained. For example, John Williams, President of the Federal Reserve Bank of San Francisco, said that he favoured the Fed staying on course with rate hikes, as he is convinced that they will attain their inflation target. This type of remark is usually favourable to an appreciation of the U.S. dollar. Several hours later, Janet Yellen, Chair of the Fed, took care to temper investors’ expectations regarding any new tightening of U.S. monetary policy. She said that the Fed must proceed cautiously in an environment where global developments have increased the risks. Furthermore, Ms. Yellen even mentioned that the FOMC would still have considerable scope to provide additional accommodation to the U.S. economy if necessary. Of course this made the greenback fall against all currencies, as did U.S. bond yields. In the face of all this confusion, on Friday the market appeared to have ruled out any rate hike at the FOMC’s April 27 meeting, and was giving the probability of a rate hike at the June 15 meeting at 26%.

The U.S. employment figures released on Friday morning revealed consistently good labour market conditions south of the border. The U.S. economy created over 215K jobs in March, exceeding expectations. It is interesting to note that market watchers were also pleasantly surprised by the full-time employment data. In addition, there were gains in salaries, a particularly important variable in the eyes of Fed members. Compared to last year, the average salary was up 2.3%, which is important in itself. In sum, this was another strong jobs report for the U.S. In the wake of this news, the U.S. dollar index rose close to 4%, but ultimately ended the week down 2%.

In Canada, the most important news of the week was the GDP growth indicator for January 2016, released on Thursday. Although one month cannot be considered a trend, the figures surprised most market watchers. The Canadian economy grew 0.6%, while economists were expecting an increase of only 0.3%. This was the strongest monthly gain since July 2013. Several indexes were particularly

encouraging:

• The manufacturing sector contributed a third of this growth;

• The services sector has continued to grow at an impressive rate;

• Gains were recorded in many sectors of the economy.

Our economists have nevertheless reminded us that it is still too early to get excited, since the Canadian economy is in a transition period and the U.S. economy may slow in 2016, as mentioned by the Chair of the Fed last week.

In commodities, the major event last week was undoubtedly the comments made by Mohammed bin Salman, a Saudi Arabian prince. During an interview on Friday he said that his country was ready to freeze production as long as all the other main producing countries would do the same. Should one of them decide to increase production, he said that Saudi Arabia would not rule out increasing its own. To put this comment into context, it should be remembered that a few weeks ago Iran said that it intended to raise its crude oil output once international sanctions were lifted. Some observers have taken this to mean that the agreement to freeze production would fall apart. Since the agreement was the main cause for the spectacular jump in the price of a barrel of oil over the last few weeks, it should come as no surprise that the prince’s comment placed downward pressure on crude oil prices. Consequently, on Friday the price of WTI crude fell almost 4%, closing the week down by almost 7%.

For many months the drop in oil prices has been associated with a depreciation in the value of the Canadian dollar. However, last week it would appear that investors gave more importance to the remarks made by Janet Yellen than to the price of oil, as the USDCAD ended the week down approximately 250 points. The other interesting point is that despite the sharp drop in oil prices on Friday, the value of the Canadian dollar was virtually unchanged on the day. Despite last week’s events, we expect a new drop in the price of oil to exert upward pressure on the USDCAD, i.e. downward pressure on the Canadian dollar.

This week in the U.S., market participants will be paying attention to several indictors: factory orders, durable goods orders, the balance of trade and growth in wholesale inventories. In Canada, we will be looking forward to seeing the employment data to be released on Friday.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.