FX Markets Stay Quiet, Government Bonds Pause After Selloff

Swissquote Bank Ltd | May 13, 2015 05:58AM ET

Market Brief

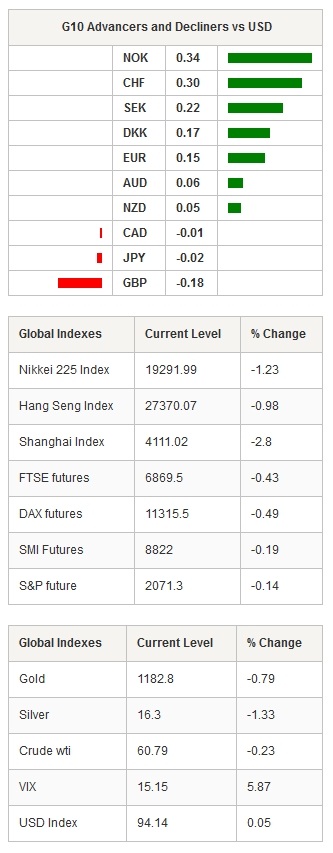

It was a quiet session in Asia, FX markets stabilised amid yesterday’s light economic calendar. Asian equities are almost all green this morning, Japan’s Nikkei 225 gained 0.71%, Shanghai Composite edged lower by 0.78%, Hang Seng fell 0.39% as China released disappointing retail sales (10%y/y verse 10.4% exp) and industrial production (5.9%y/y verse 6% exp). In Australia the S&P/ASX 200 is up 0.71%. Yesterday’s sharp equity sell-off in European and American markets hasn’t spilled over, albeit Japanese sovereign bonds were on sell and stabilised in the late session. Seller focused on the mid-long end of the interest rates curve. USD/JPY continues to slide lower and is trading slightly below 120. AUD/USD consolidates previous gained after jumping from the bottom of its uptrend channel. The Aussie will find resistance at 0.8076 (high from April 29th). On the downside, an escape from the uptrend channel would be validated by the break of 0.79 and 0.7869 (Fib 38.2% on April rally).

In Europe, equities suffered the most and retreated all across Europe. German equities took the biggest hit and lost 1.72%, followed by the FTSE down -1.36%, Euro Stoxx 50 down -1.41% while Swiss stocks declined by -0.79%. However, equity futures are blinking green this morning, slightly higher across all European countries. EUR/USD moved sideways after yesterday’s early rally. The euro reached 1.1279 and is stabilising around 1.1235, waiting on the release of Eurozone and US economic data.

GBP/USD printed a 4-month high (again!) at 1.5711 and broke the 200dma. The cable therefore validates the break of the long-term 38.2% Fibonacci level at 1.5569 (on July 2014 – April 2015 sell-off), which is now support. On the upside, the closest resistance stands at 1.5879 (Fib 50%). EUR/GBP erased completely previous session’s gains, on its way to the following support standing at 0.7118 (multi lows). Another support can be found at 0.7014 (low of March 11th).

In Brazil, USD/BRL wasn’t able to break the resistance implied by last week’s high and is grinding lower since then. The dollar lost almost 2% to 3.0197 from yesterday’s high at 3.0770. The IMF released Brazil Country Report. The report said that the country is “in a tough spot” and that “economic activity is expected to contract in the near-term”. However, the IMF expects growth over the medium term but warns that it will be highly dependent on the implementation of reforms aiming at improving the country’s financial situation and controlling inflation to restore credibility.

Gold also stabilised after jumping higher in the previous session. XAU/USD edged higher by 0.15% to 1,194. Brent crude is on its way to erase losses from last week’s small correction, trading at $67.48 a barrel.WTI gained 1.17% to $61.48 a barrel.

USD/CHF sits on the Fibonacci 50% (January 16th – March 12th) level at 0.9255, unable to validate the break of the level. The dollar stands at a turning point and can use that level as a support in its way to the next resistance standing at 0.9463 (Fib 38.2%). EUR/CHF is treading water, using 1.0390 as support.

Currency Tech

EUR/USD

R 2: 1.1529

R 1: 1.1450

CURRENT: 1.1246

S 1: 1.1111

S 2: 1.1000

GBP/USD

R 2: 1.6189

R 1: 1.5879

CURRENT: 1.5685

S 1: 1.5569

S 2: 1.5156

USD/JPY

R 2: 122.03

R 1: 120.10

CURRENT: 119.83

S 1: 118.91

S 2: 117.94

USD/CHF

R 2: 1.0240

R 1: 0.9571

CURRENT: 0.9259

S 1: 0.8936

S 2: 0.8823

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.