FX Markets Continue To Debate FOMC’s Policy Trajectory

MarketPulse | Feb 08, 2016 06:44AM ET

- Jan - worst opening month for global equities in 7 years

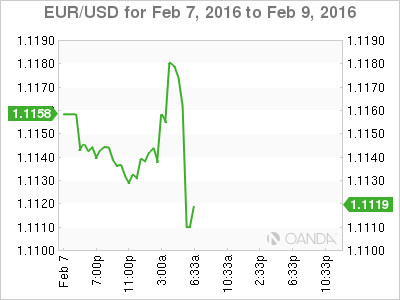

- Feb 3 - worst day for the dollar in 7 years

- Recent dollar move would usually be associated with a Fed policy move

- Is the market pricing in a policy error by Fed?

Last week saw the ‘buck’s’ biggest weekly decline since 2011 (-3%). Even U.S treasuries rallied, pushing 10-Year yields to print +1.79% at one point, its lowest level within a year and within touching distant of its record low yield of +1.38% witnessed in 2012.

It seems that dealers and some analysts were recalibrating their forecasts on Fed policy moves. Gone are the four ‘dot’ plot hikes that the Fed has been referring to. Now it seems many would rather suggest only one or two rate hikes may be possible this year.

Shifting the U.S yield curve lower has hurt U.S financial stocks (new yearly lows). Lower yields have managed to give a temporary boost to commodity prices. Gold moved back above its 200-day moving average for the first time since November ($1,1172), while the mining stocks saw big outperformance. However, weak earnings results from a number of oil and tech names is again providing little relief for some of North America’s main bourses.

Recalibrating Global Yield Curves

A few U.S rate ‘hawk’s seem to be getting cold feet now that a few Fed members got contemplating last week. New York Fed Governor Dudley acknowledged that conditions were “worse now than they were in December” when the Federal Open Market Committee (FOMC) delivered its first rate hike in a decade. He also stated that the FOMC was “not ready to draw very many conclusions” about U.S monetary policy right now. Some of this ‘toing and frowning’ Fed rhetoric has the market pushing the next Fed interest rate hike out to June from March, while lowering its view for the number of increases this year.

However, it has not been rhetoric alone pressuring the dollar. A number of key U.S. January data is raising some tough questions about the state of the U.S’s domestic economy.

Last week’s U.S. ISM manufacturing PMI print remains in contraction territory for the third consecutive month (the employment component dropped to its lowest level in 7 years - 45.9). Even the services PMI has managed to deteriorate to its weakest point in 2 years. Friday’s non-farm payroll (NFP) report was a mixed bag: the headline print came in well below market expectations (+151k vs. +180k), and was the weakest total in 4 months.

On the positive front, the unemployment rate declined, breaking the psychological +5% handle (+4.9%), pushing the U.S economy towards full employment. Hourly earnings were materially higher, which should eventually give the Fed some of the wage inflation it has been looking for.

Bank of Japan (BoJ)

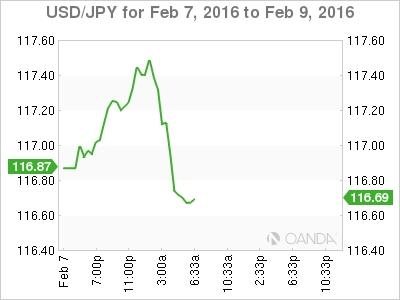

Short-term yields from a number of Tier 1 central banks have been under pressure since the Bank of Japan’s move to negative interest rates in late January (German 2-Year yields fell to -0.5%, -0.2% in Japan). The surprise cut by Governor Kuroda has not been seen as a direct economic stimulus effect, but direct manipulation of its currency policy.

Nevertheless, it seems to have backfired on the governor for now. The weakness of the yen wore off rather quickly – USD/JPY has fallen from ¥121.50, back to the ¥116-118 area it had been occupying prior to the BoJ announcement.

Kuroda has spoken extensively about the decision, stating that just because negative rates were adopted it does not mean the bank is out of ammunition to expand asset buying. Kuroda said he is still concerned that inflation expectations will weaken in medium term, but for now saw the economy recovering moderately. He reiterated the BoJ is prepared to push further into negative rates, if necessary.

Bank of England (BoE)

Last week the BoE’s Monetary Policy Committee returned to “unanimity” for the first time in 7 months, voting 9-0 to keep interest rates on hold at record lows. McCafferty, the MPC’s only real hawk, switched his vote to the majority and conceded to the data, noting that the pick-up in wage growth has been more muted than expected.

On ‘Super Thursday’ the committee cut its economic growth outlook over global growth concerns, stating that a rate hike would be “more likely than not” over the forecast period. Governor Carney insisted that the committee did not discuss negative interest rates and reiterated that the MPC believes the next rate move would likely be higher, not lower.

Sterling managed to retest its one-month highs after the decision (£1.4650) before easing to current levels (£1.4470).

Market to focus on Ms. Yellen

Investors will need to focus on Ms. Yellen’s semi-annual congressional testimony this week for clues over the Fed’s rate policy outlook. Her testimony before Congress could either strengthen, or further reconfigure, market expectations around the prospective pace of Fed tightening.

Fundamentals have not changed for oil

Crude prices continue to be volatile. The current price action would suggest that fundamentals have not changed for the commodity. Despite the snapback on the recent dollar weakness, crude bulls remain nervous, as the commodity has not been able to make a meaningful assault on this year’s high price despite the dollar's weakness.

At the beginning of last week, crude prices dipped on the back of weak China manufacturing numbers and a round of denials that an emergency OPEC meeting would be taking place. WTI sank -11% to below $29.50 and Brent dropped -10% to $32.30 as hopes for coordinated production cuts were dismissed. The plummeting dollar only managed to briefly revive crude prices. Oil prices start a new week again on the back foot as equity price action resumes its soft tone.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.