FX Daily Update

The National Bank of Canada | Nov 26, 2015 08:35AM ET

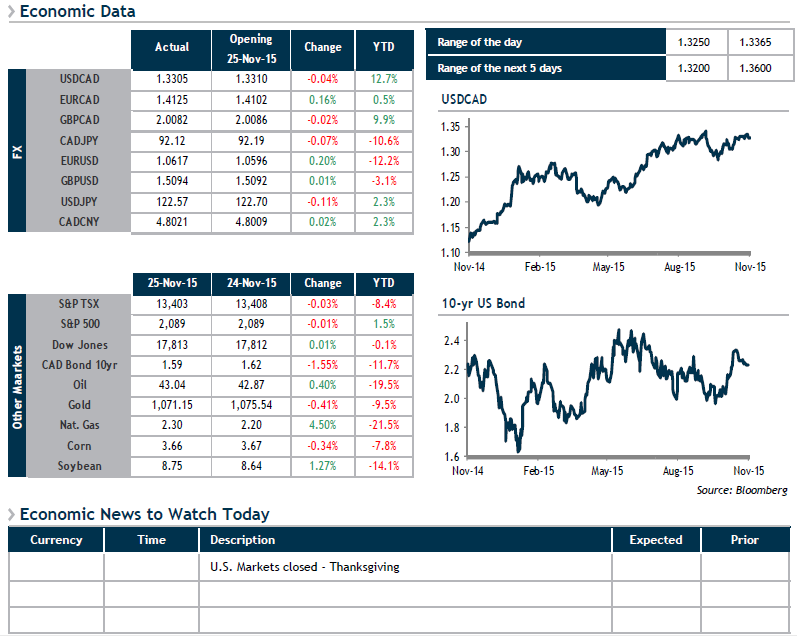

U.S. markets celebrating

We’re one step closer to a first U.S. key rate hike after yesterday’s lineup of economic indicators south of the border all produced positive readings. Durable Goods Orders rose across the board, New Home Sales were respectable, the Services PMI was at its highest level in 7 months, in short, nothing but blue skies. We also learned yesterday that U.S. crude oil inventories rose by 961,000 barrels last week, which helped keep pressure on prices. For those of you keeping score, the likelihood of a key rate increase on December 16 now stands at 72%.

It is highly likely that the result will no longer be in doubt after next week when U.S. job data is announced on December 4. Any respectable showing will give market observers the last piece in the puzzle to set their expectations.

In the meantime, China has taken one more step toward becoming a world market player, as a first cohort of central banks, financial institutions and sovereign wealth funds have registered to access its interbank market. Next Monday (November 30), we will also learn whether the yuan will be granted reserve currency status.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.