USD Take A Breather, Crude Oil Confounds

The National Bank of Canada | Dec 16, 2016 08:44AM ET

Redrawing The Economic Landscape

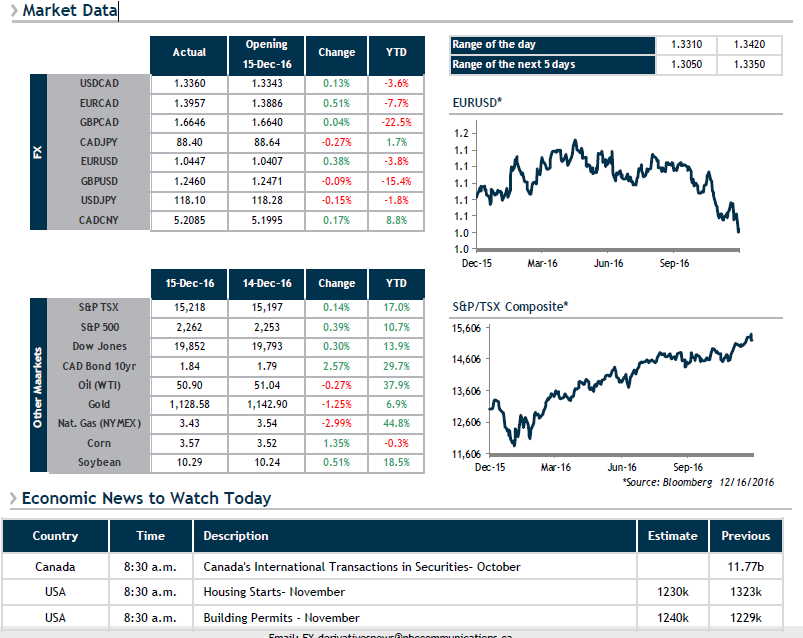

After a relatively agitated week, markets appear to be in somewhat of a lull as the USD takes a breather in its climb this morning. There’s no denying that a certain consensus appears to have been established that the greenback will continue to gain against its peers on the whole. The euro is certainly one of the currencies drawing the most attention, due to the growing possibility that it will reach parity with the USD. Meanwhile, China is leaving nothing to chance and has pegged the value of the yuan to its lowest level in more than 8 years.

Another closely watched topic is crude oil, given the multitude of contradictory developments. Between the announcement that Kuwait will reduce its output for its European and U.S. clients and the fact that U.S. inventories could remain at peak levels, it’s becoming difficult to determine a direction for crude oil prices (WTI). In Canada, yesterday’s disappointing Manufacturing Shipments (-0.8%) may point to domestic economic growth being even weaker. Moreover, with the Bank of Canada confirming yesterday that household debt levels and the unbalanced real estate sector remain a serious risk for the economy, it’s tough to be upbeat about the loonie.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.