Forward Inflation Is Nothing To Be Alarmed About (Yet)

Michael Ashton | Feb 02, 2018 12:10AM ET

It’s time to get a little wonky on inflation.

Recently, I saw a chart that illustrated that 5-year, 5-year forward inflation – “what the Fed watches” – had recently risen to multi-year highs. While a true statement, that chart obscures a couple of important facts that are either useful, or interesting, or both. Although probably just interesting.

First, the fact that 5-year, 5-year forward inflation (for the non-bond people out there, this is the rate that is implied from the market for 5-year inflation expectations starting 5 years from now) has recently gone to new highs is interesting, but 5-year-5-year breakevens are still at only 2.20% or so.

Historically, the Fed has been comfortable with forward inflation (from breakevens) around 2.50%-2.75% even though its own target is 2% on core PCE (which works out to be something like 2.25%-2.35% on core CPI). That’s because yield curves are typically upward-sloping; in particular, inflation risk ought to trade with a forward premium because the inflation process exhibits momentum and so inflation has long tails.

Ergo, long-dated inflation protection is much more valuable than shorter-dated inflation protection, not just because there is more uncertainty about the future, but because the value of that option increases with time-to-maturity just like any option…but actually moreso since inflation is not naturally mean-reverting, unlike most financial products on which options are struck.

[As an aside, the fact that longer-term inflation protection is much more valuable than shorter-term inflation protection is one of the reasons it is so curious that the Treasury keeps wanting to add to the supply of 5-year TIPS, as it just announced it intends to do, even though the 5-year auction is usually the worst TIPS auction because not many people really care about 5 year inflation. On the other hand, 10-year TIPS auctions usually do pretty well and 30-year TIPS auctions often stop through the screens, because that’s very valuable protection and there isn’t enough of it.]

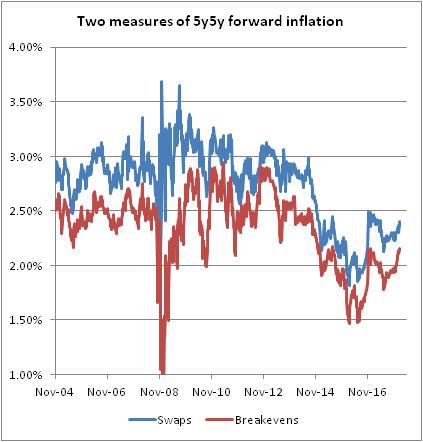

A second interesting point about 5-year-5-year inflation is that it is only at recent highs if you measure it with breakevens. If you measure it with inflation swaps, forward inflation is still 10bps or so short of the 2016 highs (see chart, source Bloomberg and Enduring Investments calculations).

This chart also illustrates something else that is really important: actual 5-year-5-year forward inflation expectations are up around 2.40%, not down at 2.20%. Inflation swaps are a much better way to measure inflation expectations because they do not suffer from some of the big problems that bond-based breakevens have. For example:

- The inflation swaps market is always trading a clean 5-year maturity swap and a clean 10-year maturity swap. By contrast, the ’10-year note’ is a 10-year note for only one day, but remains the on-the-run 10-year note until a new one is auctioned.

- The 5-year breakeven consists of a “5-year” TIPS bond and a “5-year” Treasury, even though these may have different maturities. They are always close, but not exact, and the duration of the TIPS bond changes at a different rate as time passes than the duration of the Treasury. In other words, the matching bonds for the breakeven don’t match very well.

- A minor quantitative point is that the “breakeven” is typically taken as the difference between the nominal Treasury yield and the real TIPS yield, but since the Fisher equation says (1+n) = (1+r)(1+i), the breakeven (i in this notation) should actually be (1+n)/(1+r)-1. At low yields this is a small error, but the error changes with the level of yields.

- A more important quantitative point is that the nominal bond’s yield not only has real rates and expected inflation, but also a risk premium which is unobservable. So, in the construction above, I ignored the fact that the Fisher equation is actually (1+n)=(1+r)(1+i)(1+p), with the breakeven therefore representing both the i and the p. Inflation swaps, on the other hand, represent pure inflation.

- But then why is the inflation swap always higher than the breakeven? This is the biggest point of all: the breakeven is created by buying a TIPS bond and shorting a nominal Treasury security. Shorting the Treasury security involves borrowing the bond and lending money in the financing markets; because nominal Treasuries are coveted collateral – especially the on-the-run security used for the breakeven – they very often trade at “special” rates in the financing markets. As a result, nominal Treasury yields are ‘too low’ by the value of this financing advantage, which means in turn that the breakeven is too low. If TIPS also traded “special” at similar rates, then this would be less important as it would average out. However, TIPS almost never trade special and in particular, they don’t trade as deep specials. Consequently, breakevens calculated as the spread between a TIPS bond and nominal bond understate actual inflation expectations.[1]

This is all a very windy way to say this: ignore 5-year-5-year forward breakevens and focus on 5-year-5-year forward inflation swaps. Historically the Fed is comfortable with that up around 2.75%-3.25%, although that’s probably partly because they are iffy on bond math. In any case, there is nothing the slightest bit alarming about the current level of forward inflation expectations; indeed, central bankers had much more cause to be alarmed when forward inflation expectations were down around 1.50% – implying that investors had no confidence that the Fed could get within 50bps of its own stated target when given half a decade to do it – than where they are now.

But check with me again in 50bps!

much more widely read article by Fleckenstein, Longstaff, and Lustig. But the bottom line is that as the Dothraki say, ‘it is known.’

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.