Forget Index Funds: Buy This For 316% Gains, 7% Dividends

Contrarian Outlook | Oct 31, 2019 05:42AM ET

It’s a line you’ve no doubt heard before. It goes like this: “The market is too efficient to beat, so you may as well just park your cash in a low-cost index fund and call it a day.”

Nonsense! The truly ridiculous thing is, this myth is proven wrong every day—but investors just can’t quit it. And it’s costing them triple-digit returns (and 7%+ dividends) that could leave them well short of what they need to retire.

For proof that this market is far from efficient, just look at the one-day 22% drop in shares of Beyond Meat Inc (NASDAQ:BYND). That came after the company beat revenue expectations and its profits were twice what the market expected.

Markets get even less efficient (and easier for us to tap for 7%+ dividends and market-crushing upside) when we go beyond stocks, to areas like preferred stocks and corporate bonds.

There, human managers have the edge, and for them, crushing the benchmarks is a piece of cake. Take Pmco Crp&In (NYSE:PCN), a closed-end fund (CEF) from one of the biggest CEF managers in the space.

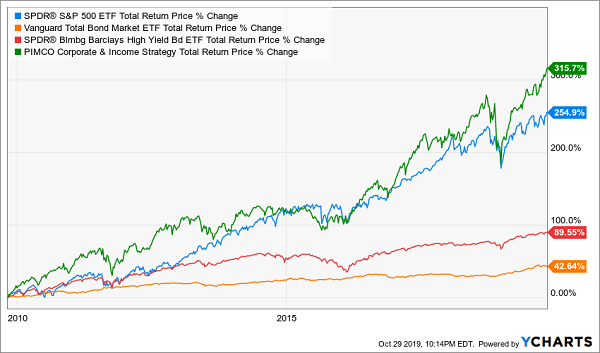

Off the bat, PCN gives us a generous 7.2% in dividends, but there’s more: it racked up a 316% return in the last decade, crushing not only corporate-bond funds like the Vanguard Total Bond Market (NYSE:BND) and SPDR® Bloomberg Barclays (LON:BARC) High Yield Bond ETF (NYSE:JNK), but the stock market itself:

Beating All the Indexes … With Bonds!?

If this doesn’t put the “efficient market” myth to bed, I don’t know what does! Notice that the bond benchmarks (in red and yellow) badly trail the stock market, yet PCN’s human managers have more than tripled their return over a decade by investing in the very same assets.

Mainstream Investors Catch On

With a chart like that, it’s easy to see why, when it comes to bonds, actively managed funds win out. And the mainstream crowd is getting the hint. In 2019, stocks are up over 20%, thanks to a broad recovery from 2018’s panic selloff.

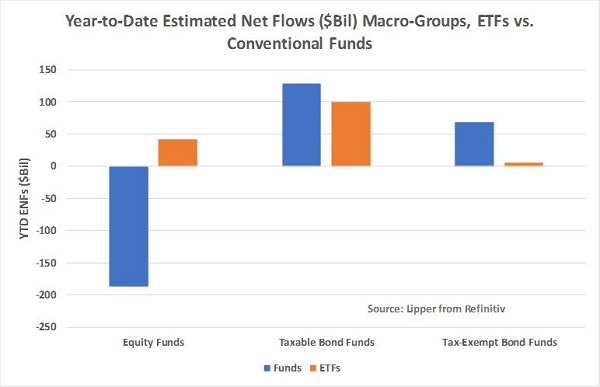

But the part that might surprise you is that more cash has been flowing into actively managed bond funds than into passive equity funds.

According to Lipper Funds, equity ETFs have seen less than $50 billion in net inflows, while the $147.6 billion of inflows into all kinds of ETFs is less than the $227.5 billion in total net inflows to bond mutual funds.

Let me show you why this seemingly obscure fact is crucial to your financial situation now.

ETFs are dominated by passive index funds, while most conventional funds (mutual funds, CEFs and the like) are actively managed. What’s more, on the stock side, the largest inflows have gone to popular index funds like the Vanguard S&P 500 (NYSE:VOO), which has seen $11.5 billion in inflows, and the Vanguard Total Stock Market (NYSE:VTI), which has attracted $8.4 billion of inflows.

These two funds alone represent nearly half of all the inflows into equity ETFs (include the other index funds and it’s almost all of the nearly $50 billion of total inflows to equity ETFs). The bigger inflow to equity ETFs and the huge drop in inflows to equity mutual funds (which you can also see above) tells a clear story: with stocks, the market favors passive index funds.

But notice how the market prefers actively managed funds for corporate and municipal bonds (shown as “tax-exempt bond funds” in the chart above)? If the market is efficient, it’s acknowledging that it isn’t efficient enough to win in the world of bonds—and so it’s relying more on human-managed funds like PCN to drive returns.

So what’s the bottom line here?

As you diversify your portfolio—a wise move with stocks at all-time highs—consider actively managed CEFs like PCN for your bond holdings. With these funds throwing off income streams of 7% or more, you’ll not only crush the market, but you’ll get paid very well to do so.

5 Little-Known CEFs to Buy Now (8% Dividends, 745% Upside)

The bond world isn’t the only place where CEFs are a much better choice than buying investments individually, or through an ETF.

The truth is, you can amp up your returns if you buy just about anything through a CEF: stocks, bonds, preferred shares, real estate investment trusts (REITs)—you name it.

The main reason? You can squeeze a far bigger dividend out of CEFs than you could ever hope for in stocks or index funds. As I write, the average dividend across all 500 CEFs in existence tops 7%. And if you buy them at a nice discount to net asset value (NAV), you can easily set yourself up for market-beating upside, too.

Sure, you could do the research and dig up top CEFs yourself (plenty of subscribers to my CEF Insider service love to do this kind of sleuthing on their own). But if that’s not your thing, or you’re just looking to save a bit of time, I’ve got you covered.

That’s because I’ve just released a special free report outlining my 5 best CEFs to buy now. These 5 powerhouses have 3 things in common:

Here’s something else you should know: these funds are cheap even though they’ve put on massive runs, like Pick No. 1, which has returned a market-crushing 745% in the last 20 years and yields an amazing 9.3% now:

This 745% Gainer Is Just Getting Started

And now, thanks to this fund’s unusual 9% discount, we’ve got a short window to jump in before it makes its next move higher.

This is the kind of income and upside CEFs offer, and these 5 income (and growth) powerhouses are your perfect starting point. Don’t miss out.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.