Forget Caterpillar, Buy These 5 Industrial Stocks Instead

Zacks Investment Research | Feb 27, 2020 09:02PM ET

Caterpillar Inc. (NYSE:CAT) , the world's leading manufacturer of construction and mining equipment, seems to be in the doldrums at the moment. Notably, the company’s fourth-quarter top line failed to impress investors. Sales declined across the board, thanks to weak demand. Dealers continued to lower their inventory, which weighed on the company’s performance. Nevertheless, the company managed to deliver year-over-year improvement of 3% in earnings driven by strong cost control measures.

Caterpillar’s global retail sales recorded a decline of 7% in the three-month period ended January 2020, following a decline of 5% in December. The decrease in sales in December had put an abrupt end to the company’s sales growth for 33 consecutive months. The company had last witnessed negative sales growth in February 2017.

Muted Guidance

For 2020, Caterpillar expects adjusted earnings per share between $8.50 and $10.00. The mid-point of the guidance indicates a decline of 16% from 2019. End user demand is expected to decline by about 4-9% compared with 2019. Dealers are anticipated to continue reducing inventories, owing to the ongoing global economic uncertainty. Moreover, mining customers remained disciplined with their capital expenditures due to economic uncertainty that will continue to weigh on the Resource Industries segment.

Downward Estimate Revisions

In the last 30 days, 10 out of 11 analysts have revised their earnings estimates downward for the current year. The consensus estimate has declined 11% over the last 30 days. Further, Caterpillar has a trailing four-quarter negative surprise of 0.12%, on average.

The Zacks Consensus Estimate for Caterpillar’s earnings in fiscal 2020 is pegged at $9.41, suggesting a decline of 15% from the prior year. The estimate for revenues is at $49.4 billion, indicating a fall of 8% from the previous year.

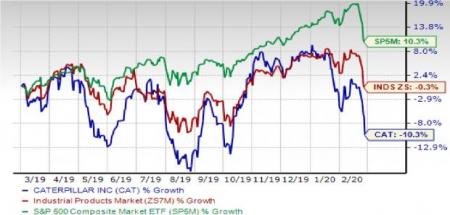

Over the past year, Caterpillar shares fell 10.3% compared with the Zacks Investment Research

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.