Forex Analysis: GBP/USD And USD/CAD

FXeeda | Apr 10, 2014 07:01AM ET

The Bank of Japan kept stimulus unchanged on Tuesday, sparking a sell-off in the USD/JPY and sending the currency below the 102 level. Meanwhile, stock markets recovered from a 3-day stretch of losses to post mild gains amid the start of earnings season.

Looking at the fundamentals this week, we see potential opportunities developing in the GBP/USD and USD/JPY.

GBP/USD

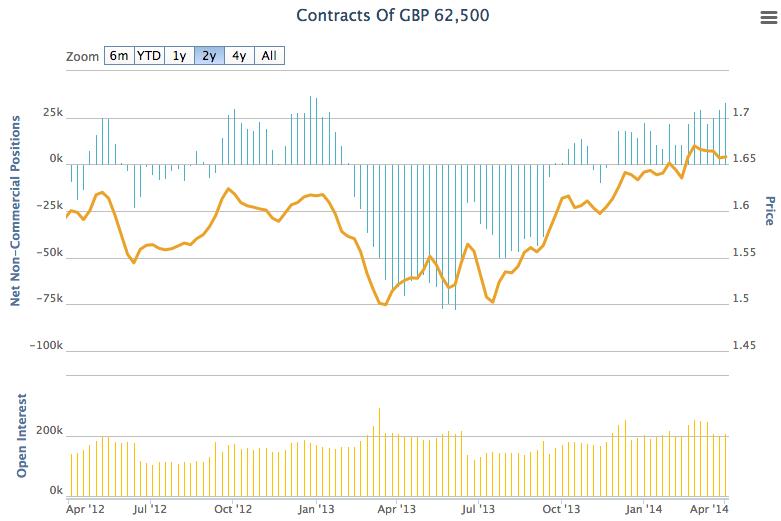

The Commitment of Traders (COT) report is released by the CFTC (US Commodity Futures Trading Commission) each Tuesday and provides an up to date breakdown of open positions in a wide number of futures markets. It’s useful for analysis as it allows us to see how commercial and non-commercial traders are positioned in the market and this data can often be used to find turning points.

This week’s data for GBP/USD indicates that non-commercial traders have become the most bullish since December 2012. Net non-commercial positions increased to 33,572 contracts and have now increased for 4 weeks in succession.

Meanwhile, the GBP/USD has moved up to 1.675 although the currency has not been able to take out it’s previous high of 1.6824. This is despite the rise in longs by non-commercial traders. The price action therefore suggests that the GBP/USD is toppy here and open position data also suggests that the market is becoming increasingly one-sided. the 1.68 looks to be a good area for short traders.

USD/CAD

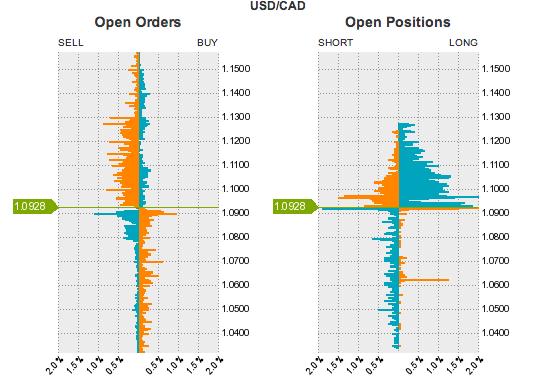

The open position ratio for the USD/CAD looks relatively well balanced with 59% of open positions long positions and 41% short. This alone is not enough to make any assumptions, however, a closer look into the order book shows a more bearish than bullish outlook.

As you can see from the chart, there are significantly more open orders that are short orders than there are long orders. In other words, traders are looking to short the USD/CAD and there is more support for bearish positions.

Likewise, there are very few open long positions below the market and this is despite the open position ratio of 59:41 discussed earlier. This gives further indication that the USD/CAD could continue to drop over the short term horizon.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.