FOMC: Something For Everyone, Not Enough For Anyone

Matthew Weller | Jun 17, 2015 03:06PM ET

Heading into today’s highly-anticipated FOMC meeting, we highlighted three major areas of focus in our preview report. With 2.5 of the key elements now revealed, the message is thoroughly mixed.

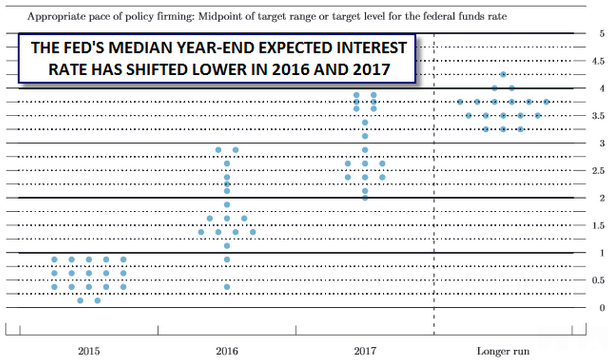

As everyone in the trading world expected, the Federal Reserve left its main Fed Funds rate unchanged in the 0.00-0.25% range, but as ever, the market is looking ahead to the future. On that front, the central bank’s outlook remains as data-dependent and open-ended (some would say intentionally obfuscated) as ever. The central bank’s widely-watched “dot chart” of expected interest rates shifted lower on the whole, though the median year-end 2015 expected fed funds rate just barely held in at the 0.625% level, indicating two expected rate hikes this year. While the central bank’s near-term outlook for interest rates is essentially unchanged, the median year-end 2016 and 2017 forecasts each shifted down by 0.25% to 1.625% and 2.875%, respectively. It’s worth noting that this is still well above the market’s expectations of 1.375% and 2.125% respectively, as shown by the current pricing of Eurodollar futures contracts.

As expected the Fed also revised down its expectations for 2015 economic growth after the sluggish start to the year, but the central bank also surprised traders by ticking its expected year-end unemployment rate forecast up to a range of 5.2-5.3% (from 5.0-5.2% previously). Inflation expectations were effectively unchanged across the board.

Meanwhile, one other potentially dollar-bullish catalyst failed to come in: the decision to hold interest rates steady was unanimous for the fourth consecutive meeting. Some traders had thought that a more hawkish member of the Fed (Jeffery Lacker?) would dissent in favor of raising interest rates immediately, but each committee member stuck to the party line. Perhaps as a result of this unanimity, the implied rate of a September rate hike from the Federal Reserve has edged down to 22% from 28% before the meeting.

This “a little something for everyone, but not enough for anyone” release will prolong the recent environment of sharp (over)reactions to US economic reports over the next few months and sets the stage for a potentially hotly-contested FOMC meeting in September. The upshot for traders is more short-term volatility through the historically slower summer months, regardless of the market.

As we go to press, Fed Chair Janet Yellen is in the midst of her press conference and appears to be striking a relatively neutral tone.

Market Reaction

The market reaction to the less-hawkish-than-anticipated release has been mild, but definitively dollar-negative. EUR/USD has edged back up toward 1.1300, GBP/USD briefly tested its year-to-date high around 1.5800 and USD/JPY is ticking back below the 124.00 level. Meanwhile, US equities were volatile, initially dropping, then rally up to new daily highs as of writing. Perhaps most importantly, the benchmark 10-year treasury yield has come off the daily highs, though like most other markets, the post-FOMC moves have merely unwound the morning’s speculation of a more-hawkish statement…a classic “buy the rumor, sell the news” outcome thus far.

Source: Federal Reserve,FOREX.com

For more intraday analysis and market updates, follow us on twitter (@MWellerFX and @FOREXcom)

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.