FOMC Recap: Technical Tweaks Do Little To Dissuade Doves

Faraday Research | May 01, 2019 02:39PM ET

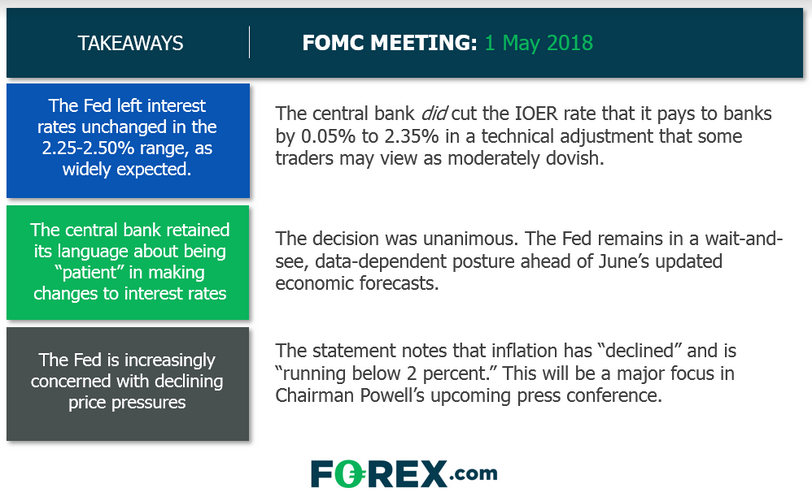

In Tuesday’s FOMC preview, we noted that we were unlikely to see any immediate changes to monetary policy, apart from a possible technical tweak to the central bank’s interest on excess reserves (IOER).

As it turns out, that’s precisely what we saw…and not much else. In a unanimous vote, policymakers decided to leave the primary Fed Funds rate unchanged and cut the IOER by 0.05% to 2.35%. Beyond that, the central bank made several minor tweaks to the first paragraph of its monetary policy statement:

- Noted that economic activity “rose at a solid rate” (from “slowed” in March)

- Removed a reference to payroll employment being “little changed”

- Noted that growth slowed (from “indicators pointed to slower growth” in March)

- Removed a reference to inflation declining “largely as a result of lower energy prices”

- Noted core inflation has “declined” and is “running below 2%”

With little else to go on, we expect the downgrade to the central bank’s inflation assessment to take center stage in Chairman Powell’s upcoming press conference.

Source: FOREX.com

Market Reaction

The initial market reaction has been somewhat subdued, reflecting the minor changes to the statement. That said, we have seen continued weakness in the US dollar, with EUR/USD tacking on 20 pips from pre-release levels. The biggest move has been in short-term Treasury bonds, where the 2-year yield has shed a quick 6 pips on the IOER adjustment; looking ahead, Fed Funds futures traders are now pricing in 75% chance of an interest-rate cut by year-end, up from about 65% on Tuesday. US indices, gold and oil have all seen minimal reaction to the release so far.

Cheers

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.