FOMC Pushes Gold Prices Down

Sunshine Profits | Sep 23, 2021 10:59AM ET

Brace yourselves, gold bulls, as the Fed clears the way for tapering and shifts interest rate liftoff to 2022. You’ve been warned.

Yesterday, the inflation “is elevated.” (Last time, the Fed wrote that “inflation has risen.”)

However, the most important change is, of course, the signal about a slowdown in the pace of asset purchases. The Fed acknowledged the economy’s progress towards the goals of price stability and maximum employment, and said that tapering of quantitative easing could soon be warranted:

Last December, the committee indicated that it would continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage‑backed securities by at least $40 billion per month until substantial further progress has been made toward its maximum employment and price stability goals. Since then, the economy has made progress toward these goals. If progress continues broadly as expected, the committee judges that a moderation in the pace of asset purchases may soon be warranted.

Although this is not a revolution in the Fed’s thinking and it’s not a surprise for the markets, the move is non-farm payrolls in August. The Fed didn’t provide any date, but investors could expect an announcement in October or November and effective implementation by the end of this year.

Thus, the statement is negative for the gold prices. However, the silver lining is that the FOMC decided to write “moderation” instead of simply “tapering.” For me, this particular phrasing sounds softer, which gives some hope that tapering will be very gradual. So, the Fed’s monetary policy would remain accommodative for quite a long time.

September Dot-Plot And Gold

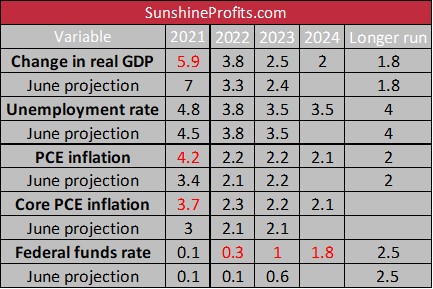

Now, let’s move on to unemployment rate and higher inflation this year compared to its June’s forecasts.

To be more precise, the FOMC expects that the GDP will jump 5.9% in 2021, compared with the 7% rise expected in June. It’s still an impressive surge but significantly slower than it was expected just three months ago. So, it seems that the Fed has taken the negative impact of the spread of the Delta variant of the coronavirus into account. Similarly, the unemployment rate is forecasted to decrease to 4.8% instead of to 4.5% expected in the previous projections.

Meanwhile, the U.S. central bank has also increased its inflation outlook. The FOMC members believe now that the PCE inflation will jump 4.2% this year, compared to 3.4% seen in December. The core PCE inflation is also expected to rise faster, i.e., 3.7%, versus 3% projected previously. So, the Fed expects a slowdown in the GDP growth combined with acceleration in inflation, which sounds stagflationary at the margin. These forecasts, when analyzed alone, should be positive for gold prices.

However, the U.S. central bank also updated its forecast for the federal funds rate .

Given the increase in inflation since June and all the employment progress the economy made, the upcoming dot-plots could be and send gold prices lower. You have been warned.

And, indeed, according to the fresh dot plot , the FOMC considers one interest rate hike next year as appropriate at the moment. On top of that, the Fed sees three additional 25-basis points increases in 2023, and three more in 2024 (and more hikes later in the future). So, instead of two hikes in 2023, we have one upward move as soon as in 2022 and three more in the following year. It means that the curve of the expected federal funds rate has become much steeper, which could make gold struggle.

Implications For Gold

What do the latest FOMC statement and dot-plot imply for the gold market? Well, the Fed cleared the way to taper its asset purchase program and signalled that the first interest rate hike could occur sooner than expected. Not surprisingly, the price of gold declined in response to the shift in the timeline of the interest rates liftoff, in line with my expectations.

When it comes to the future, I believe that when the dust settles, gold may find some short-term relief. However, my guess is that gold will struggle until the Fed’s tightening cycle is well under way.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.