FOMC Preview: What FX Traders Can Expect From Powell

Kathy Lien | Dec 10, 2019 04:31PM ET

Daily FX Market Roundup 12.10.19

By Kathy Lien, Managing Director of FX Strategy for BK Asset Management

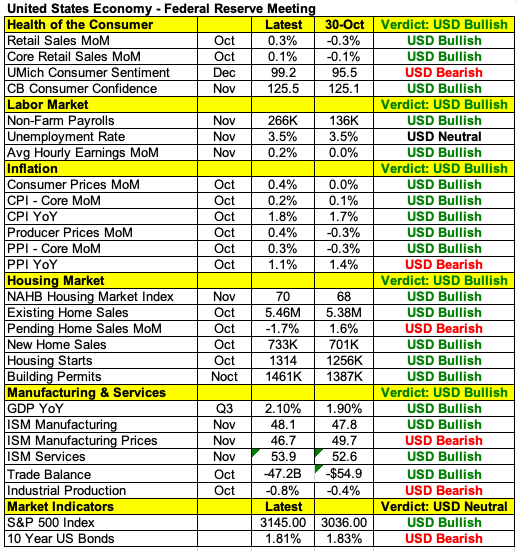

Wednesday's Federal Reserve monetary policy announcement is one of the most important events of the week but we don’t expect fireworks. This is the last FOMC meeting of the year and there’s zero chance of a change in policy. However a press conference follows every central bank meeting and there’s always the possibility of market-moving comments from Fed Chairman Jerome Powell. At their last policy meeting in October, the Fed cut interest rates for the third time in a row and instead of emphasizing the need for such aggressive measures, Powell described the reduction as a move to insure against softening global growth and uncertain trade developments. While these 2 problems persist, the economy has taken a turn for the better since October (see table below). Consumer spending improved, more jobs were created, inflation ticked higher, there’s more housing-market activity with the manufacturing- and service-sector ISMs increased. Therefore Jerome Powell has very little reason to focus on the risks and vulnerabilities of the U.S. economy. Instead, he’ll most likely reiterate that policy is in a good place because of the strong labor market and consumption.

This means that the U.S. dollar should hold onto its gains against the Japanese yen on the hopes that President Trump will deliver the gift of a Christmas rally by delaying the December 15 tariffs. Powell’s speech will be far more interesting than the FOMC statement and if his outlook is as rosy as we expect, USD/JPY could extend its gains to 109. However if he emphasizes uncertainties and suggests that there may be a need for additional stimulus, it would be an unexpected shock that could send the dollar sharply lower.

We’re nearing the end of the year, which is why investors don't react kindly to surprises. The most important of which will be President Trump’s announcement on Chinese tariffs. So far, a decision has not been made but according to the Wall Street Journal and Bloomberg news, Washington may delay the new tariffs and possibly even reduce existing ones. With only a few days left before the deadline, this will go down to the wire and Trump could even wait until the market closes on Friday or over the weekend to make the announcement. If that’s the case, the impact of FOMC and ECB will be limited. However if President Trump makes a decision before the end of the week, the only thing that will matter to FX traders is whether tariffs are on or off.

Tuesday's best-performing currencies were sterling and the swiss franc. The UK’s general election is on Thursday and all signs point to an easy victory for Boris Johnson. Euro also extended its gains toward 1.11 on the back of stronger investor confidence. The German ZEW survey beat expectations with the expectations component rising to 10.7 against a forecast of 0.3. The Eurozone ZEW survey also turned positive in December. Better-than-expected data from Germany helped euro rally ahead of ECB but we expect central-bank President Lagarde to emphasize continuity by focusing on the need for ongoing accommodation. The Australian and Canadian dollars also traded lower while the New Zealand dollar held onto its gains. All 3 currencies are consolidating as they wait for President Trump’s big decision.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.