FOMC Preview: Is The Market Too Dovish?

Faraday Research | Mar 19, 2019 01:11PM ET

Spoiler alert: The Federal Reserve won’t be making any immediate changes to monetary policy at the conclusion to this week’s two-day meeting.

Nonetheless, it would be a mistake for traders to ignore the central bank’s economic projections and comments; after all, the Fed is the arbiter of interest rates for the world’s largest economy and supports a nearly $4T balance sheet. With any central-bank meeting (or economic release more broadly), the key factor to watch is how the information compares to the market’s expectations.

Too Dovish

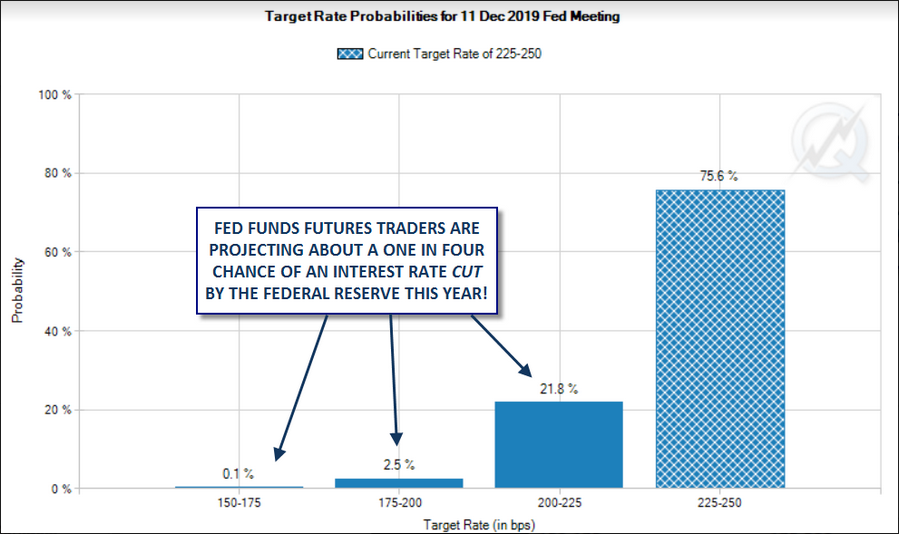

So what are the market’s expectations for the FOMC moving forward? In this author’s humble opinion, traders are far too dovish on the path of monetary policy over the course of 2019.

According to the CME’s FedWatch tool, futures traders are pricing in about a 25% chance of a rate cut by December, in sharp contrast to the Fed’s own projections of two more interest-rate hikes in 2019 (as of the December 2019 meeting – we’ll get new projections Wednesday). While we agree that the most likely scenario leaves interest rates unchanged in the 2.25-2.50% range at year end, there’s still a chance that the central bank can squeeze in another rate hike in Q4.

Source: CME FedWatch, FOREX.com

In essence, the US economy has been bombarded with a series of temporary and one-off weak data points, leading to the market’s overreaction:

- Last month’s disappointing 20k reading in Nonfarm Payrolls was likely distorted by the government shutdown. It comes on the back of two 300k+ readings, meaning the 3-month average of job creation is healthy at 200k+.

- While headline inflation data has ticked lower in the past couple months, the median inflation rate is holding steady at 2.7%, a 10-year high.

- Market-based measures of future inflation have recovered off their turn-of-the-year lows.

- “Financial conditions” have improved, as evidenced by the sharp drop in interest rates (the 10-year treasury yield is down 60bps from its November peak near 2.35%) and the sharp rally in US stocks (the S&P 500 is up 21% off its December lows)

For a group of professional data watchers that is still obsessively focused on the risks of rising inflation, there’s plenty of reason to maintain a (slight) hawkish lean while waiting for additional data.

What To Expect

As far as what to expect in this month’s meeting, the central bank will likely revise down its forecasts for GDP growth in 2019 (from 2.3%), with potential for a slight shave to the inflation forecasts as well. As ever, all eyes will be on the central bank’s interest-rate projections (the infamous “dot-plot"), where the median member may revise down his or her expectation to just one interest-rate hike this year – note that this would still be far more hawkish than traders are anticipating.

Finally, the Fed may announce its strategy for ending its balance sheet drawdown (“quantitative tightening”). The market is keying in on stabilization in the Fed’s balance sheet in the late Q3/early Q4 timeline, so a plan to pause earlier (dovish) or later (hawkish) could lead to a knee-jerk reaction among traders.

As far as market moves, we could see a rally in the greenback and a dip in US stocks if the Fed fails to meet the market’s highly dovish expectations. That said, any new information is likely to be marginal (the precise month when QT will end) or distant (the prospects for a rate hike in Q4), so market movements may be limited as traders refocus on the latest Brexit developments and updates on the US-China trade war.

If you have any questions, a colleague who may be interested in receiving this analysis or if you no longer wish to receive market commentary from us, please do not hesitate to contact me.

Cheers

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.