FOMC Minutes To Guide Asset Classes Next Move

MarketPulse | Nov 29, 2018 06:39AM ET

Global equities have been better bid overnight after a surprisingly ‘dovish’ tone from Fed chairman Powell supported sentiment ahead of this weekend’s G-20 meeting in Argentina. The ‘big’ dollar has slipped along with U.S Treasury yields.

Yesterday, Mr. Powell said there is “no pre-set policy path” as far as future interest-rate increases are concerned, adding, “the bank’s decisions will be shaped by new economic data.”

Note: Futures pricing suggests the Fed is nearing a pause and show the market pricing for just +25 bps, the equivalent of one Fed rate hike in 2019.

Today’s FOMC minutes (02:00 pm) is expected to confirm expectations for another rate increase in December despite Powell’s dovish speech.

The market is also trying to position itself ahead of a meeting between the U.S and Chinese leaders on the weekend. Many are expecting an easing of tensions rather than any express agreement that involves major concessions from either side.

Elsewhere, crude oil has managed to recover some of yesterday’s losses after an unexpectedly large increase in U.S crude inventories, while gold prices have edged a tad higher.

1. Stocks see the light

Asian stocks mostly rallied overnight, tracking Wall Street higher, after Fed chair Powell suggested they might be nearing an end to its three-year rate tightening cycle.

Japan’s Nikkei share index rose +0.4%, but gains were trimmed by concerns over the outcome of a meeting between Presidents Trump and Xi Jinping on the sidelines of the G20 summit. The broader Topix also advanced +0.4%.

Down-under, Aussie shares closed at a two-week high overnight. Broad-based gains pushed the S&P/ASX 200 index +0.6% higher at the close of trade. Both metals and mining stocks rallied +1.3% to dominate the gains. In S. Korea, the KOSPI closed up +0.28%, extending its gains into a fourth session.

Note: South Korea’s central bank is expected to raise rates at its monetary policy meeting tomorrow.

In China, stocks fell on weaker investment sentiment ahead of this weekend’s Sino-U.S trade talks. At the close, the Shanghai Composite index was -1.4% lower, while the blue-chip CSI 300 was down -1.3%. In Hong Kong it was a similar story. The Hang Seng index closed down -0.9%, while the China Enterprises Index lost -0.5%.

In Europe, regional bourses trade higher across the board, although off the earlier highs. In the U.K, banking names trade slightly higher after passing the BoE’s stress test.

U.S stocks are set to open in the ‘red’ (-0.2%).

Indices: Stoxx600 +0.30% at 358.60, FTSE +0.55% at 7,042.75, DAX +0.38% at 11,341.42, CAC 40 +0.58% at 5,012.16, IBEX 35 +0.12% at 9,114.00, FTSE MIB +0.04% at 19,122.50, SMI +0.80% at 8,969.50, S&P 500 Futures -0.30%

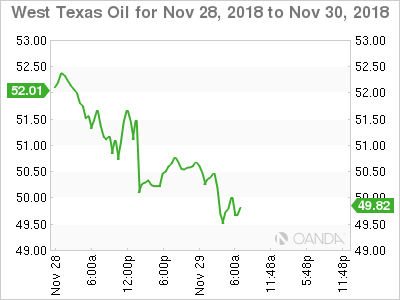

2. Oil prices firm ahead of G20, gold higher

Oil prices have edged higher this morning on investor optimism that trade talks at the G20 could help the global economy and improve demand. However, gains are somewhat capped after yesterday’s U.S crude inventories hit their highest in 12-months.

Brent crude has gained +6c, or +0.1% to +$58.82 a barrel, having dropped -2.4% yesterday. U.S crude futures have rallied +20c, or +0.4% to +$50.49 per barrel. Yesterday’s session closed out down -2.5% at +$50.29 a barrel.

Nevertheless, rising supplies are keeping a lid on prices. According to the EIA yesterday, U.S crude inventories for the week to Nov. 23 added +3.6M barrels to the most in a year at +450M barrels.

OPEC and non-OPEC members will meet in Vienna, Austria next week (Dec. 6) to discuss a new round of production cuts of -1M to -1.4M bpd and possibly more.

Ahead of the U.S open, gold prices have firmed overnight as the ‘big’ dollar falters after Fed Chair Powell comments. Spot gold is up +0.3% at +$1,224.13 per ounce, while U.S gold futures are little changed at +$1,223.2 per ounce.

Note: Spot prices climbed about +0.6% on Wednesday, their biggest one-day percentage gain in a fortnight.

3. Sovereign yields fall on Fed comments

It’s no surprise to see sovereign yields come under pressure after Fed Powell’s ‘dovish’ comments yesterday.

In Europe, government borrowing costs have fallen to their lowest level in over two-months this morning, following U.S Treasury yields lower.

Powell’s comments triggered a rally in equities and pushed the U.S Treasury 10-year bond yield as low as +3.01%, its lowest level since mid-September and well away from this month’s high of +3.25%.

Elsewhere, Germany’s 10-year Bund yield has hit a three-month low of +0.328% this morning, down -2.5 bps. French and Dutch government bond yields have also dipped to new lows since early September at +0.716% and +0.472% respectively, down about -2 bps each on the day.

Italy’s five-year bond yield has dipped -4 bps to +2.36% and the 10-year yield was lower -1.5 bps at +3.25% and the spread over Bunds is at +294 bps.

4. Dollar finds traction difficult

The ‘big’ dollar is finding it difficult to find meaningful traction, especially now that U.S 10’s trade atop of the psychological +3%.

In Europe, softer growth and inflation data is failing to push the EUR (€1.1352) currency lower, but did dent any upside momentum for the time being.

Note: France Q3 GDP y/y reading was revised lower in its second reading, while Spain misses expectations for its Nov CPI and various German States saw lower readings compared to October.

GBP/USD (£1.2764) saw all of its early gains evaporate, as futures dealers pushed back their call for the next BoE rate hike by a few months into May 2020 over concerns that the upcoming Brexit vote would not pass parliament (Dec 11).

Note: The BoE did present its on “Brexit Scenarios” yesterday and noted that the GBP currency could fall -15% in disruptive and -25% in disorderly Brexit.

Finally, a surprise contraction in Sweden Q3 GDP (-0.2%) has some dealers pricing out a December rate hike by the Riksbank. EUR/SEK was higher by +0.3% at €10.30.

5. Eurozone business confidence steadied in November

Data this morning showed that business confidence across the eurozone steadied this month. The release suggests that regional economies are perhaps leveling off after a yearlong slowdown.

The Economic Sentiment Indicator for the eurozone fell to 109.5 in November from 109.7 in October. Digging deeper, the decline in the measure was due to weakening consumer confidence. Sentiment in the services and construction sectors was unchanged m/m, while manufacturers and retailers became slightly more upbeat.

There are a few outliers, the main exception being Italy, where the government’s standoff with Brussels over its proposed budget has raised borrowing costs for businesses.

Elsewhere, French businesses appeared untroubled fuel tax demonstrations, while others took the possibility that the U.K could leave the E.U in 2019 without a new trade agreement in their stride.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.