FOMC Minutes: The New Narrative Takes Shape

Alhambra Investment Partners, LLC | Feb 21, 2019 01:21AM ET

Nothing the Fed did yesterday or before changed the yield curves. Eurodollar Futures and United States Treasurys are both still inverted. The former is sharply inverted. The only thing that has changed since early January is the narrative – and not in a charitable way. It is treated as a positive when it is a pretty visible signal of deteriorating circumstances.

Interpretations Matter

Conventional wisdom seems settled on some version of Quantitative Tightening. And why not? Foreign central bankers (now former central bankers) were complaining about it all the way back last June. Fed Chair Powell simply ignored it. They immediately dismissed the “strong worldwide demand for safe assets” as irrational mispricing.

Now they are convinced? Even QT has been to blame, that doesn’t speak very highly of our own monetary technicians.

The emerging new narrative is this: the Fed broke it, so now that the U.S. central bank has realized its own error, it can fix everything. Problem solved, a minor disturbance in the grand scheme of resumed globally synchronized growth. A reflation within a reflation, if you will.

You aren’t supposed to notice how drastically things have changed during this period. It starts with 240, as in EFF of 240 bps cannot possibly be a problem for a superstar economy. Powell at this time last year when first taking office was resolutely hawkish; because, in his view, one widely shared at the time, inflation was by far the biggest economic risk out there. Things were in danger of becoming too good.

There is absolutely no way a topline federal funds “corridor” of 2.50% is responsible for what the latest meeting minutes describe in the emergence of dreaded downside risks. In February 2018, the FOMC was increasingly sure they couldn’t wait on more rate hikes. In February 2019, suddenly there is no danger to doing nothing.

Some participants noted that some factors, such as the decline in oil prices, slower growth and softer inflation abroad, or appreciation of the dollar last year, had held down some recent inflation readings and may continue to do so this year. In addition, many participants commented that upward pressures on inflation appeared to be more muted than they appeared to be last year despite strengthening labor market conditions and rising input costs for some industries.

Translation: we appear to have been wrong about that whole boom/overheating thing.

That’s no longer the crux of our current dilemma, though. In fact, this was what markets were doing back in the last three months of last year; digesting the growing likelihood that Powell had it all wrong. He now agrees.

The emerging question is what happens next. Since it couldn’t have been EFF at 240 meaning rate hikes that changed everything, people are betting on QT. Like flipping a switch, some are thinking that if the Fed becomes much clearer on the topic of balance sheet “normalization” this will be more than enough to alleviate fears over liquidity problems. Strong worldwide demand for safe assets is, at root, overwhelming liquidity hedges.

As I’ve written before, many times, there is no such thing as QT. Even if there was, that the Fed’s balance sheet reduction leading to fewer bank reserves available, so what? Had the monetary system actually been rebuilt in the wake of the 2008 panic the level of central bank reserves in it would be entirely immaterial.

In fact, that was the plan all along. Whatever the Fed might withdraw, the private system seeing great opportunity would rush to supply if not oversupply.

No liquidity crisis – if the private system has been rebuilt. Eleven years has been enough time for that to happen, if it was ever going to happen.

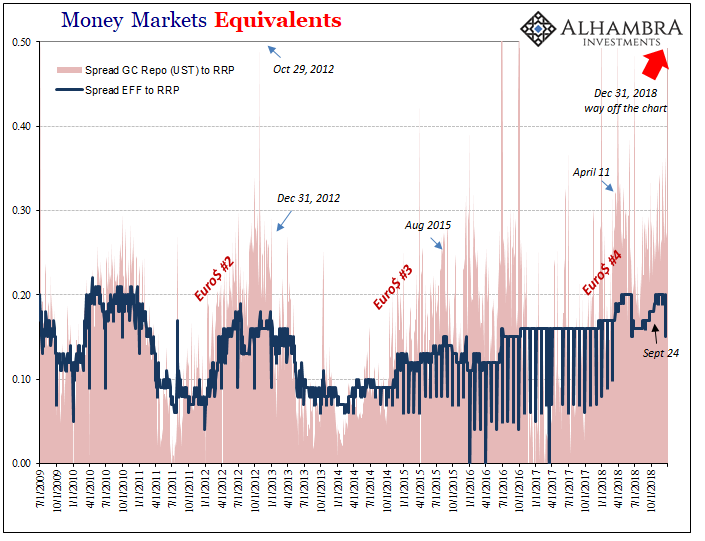

We know very well, too well, that it hasn’t. This isn’t the first liquidity problem for the US$ system since 2009. It is actually the third, the fourth overall counting 2007-09. The only difference is that the Fed, irrelevant to that system, is claiming that it is tightening at the same time.

This is the first instance during this period when monetary policy and effective eurodollar conditions are aligned in the same direction – by pure accident.

If QT and “rate hikes” weren’t the cause of Euro$ #2 or #3, and they weren’t, what’s the chances a more attuned communications policy about QT will end up being the effective solution to Euro$ #4? Somewhere between zero and nil.

What happens now is what my colleague Joe Calhoun always (correctly) emphasizes (over and over). I may know that QT isn’t the issue. You may know that QT isn’t the problem. But so long as the “markets” (not the bond market, obviously) believe QT is, and that the Fed is on it, it is going to take some time and a lot more convincing before reality dawns on them a second time.

They do like to do things the hard way.

And then more time still before Jay Powell and his gang catch back up again (inversion, remember). They are always at the end of the line when it comes to figuring these things out. This is what the current minutes so aptly, if unintentionally, prove for the nth time.

So, perversely, having been the last to arrive at this midpoint it is somewhat laughable in how officials belatedly admitting this it is supposed to add up to an effective answer to the growing 2019 downside. That’s your new narrative.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.