Focus On China, Not Europe

Cam Hui | May 28, 2012 04:21AM ET

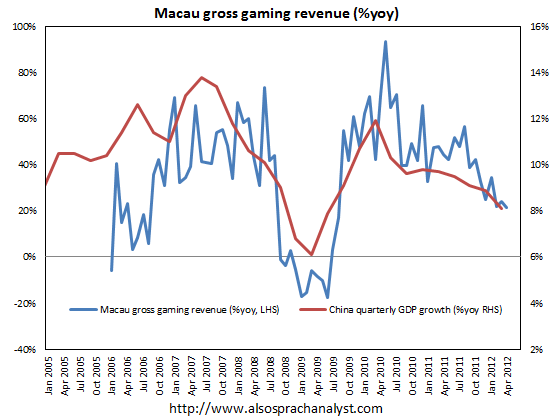

While everyone is focused and worried about the news flow from Europe, I am less concerned about the prospects for Greece and the eurozone. As I wrote in my last post (see this analysis shows a a tight correlation between Macau gaming revenues and Chinese growth - and gaming revenues are falling.

Next door in Hong Kong, the Hang Seng Index is not behaving quite as well as the Shanghai Composite. The index rallied in February to fill the downside gap that occurred in August 2011, but the rally couldn't overcome resistance. The index has now violated an important support zone and weakening rapidly.

Further north from Hong Kong, South Korea is an economy that is highly sensitive to global economic cycle. In particular, the South Koreans export a lot of capital equipment and other goods to China. That country's stock market isn't behaving well either. In fact, it's cratering.

China has been an enormous consumer of commodities. Commodity prices have also been weakening as the CRB Index is in a downtrend and has violated an important support level.

Australia is not only a major commodity exporter, it is highly sensitive to Chinese commodity demand because of its geography. The AUD/USD exchange rate is falling rapidly.

Just to show how bad things are, the Canadian economy is similar in characteristic to Australia's. Both are industrialized countries that are large commodity exporters. The only difference is that Australia is more levered to China, whereas Canada is more sensitive to US growth. Take a look at the AUD/CAD cross rate as a measure of the forward expectations between the level of change in Chinese and American growth.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.