Fixed Income 101: The Ins and Outs of U.S. Aggregate Bond ETFs

ETF Central | Nov 30, 2023 09:21AM ET

As of November 15th, according to the ETF Central screener, the current universe of fixed income ETFs is vast and diverse, comprising approximately 619 offerings.

Out of these, 345—or about 56%—are passively managed, meaning they track a specific index rather than relying on active management decisions.

Within this category, the most popular bond ETFs, in terms of assets under management (AUM), often include terms like "aggregate" or "total" in their names.

These ETFs are, in many ways, the fixed income counterpart to broad or total stock market index ETFs. They provide exposure to a wide range of bonds, encapsulating the diversity of the bond market in a single investment vehicle.

U.S. aggregate bond ETFs are therefore designed for investors looking for a comprehensive, one-size-fits-all solution for their fixed-income allocation.

These funds typically track a benchmark index that includes a mix of government, corporate, and other types of bonds, offering a balanced approach to bond investing.

In this guide, we'll dive into how these ETFs work, what makes them a suitable choice for many investors, and explore some alternatives for those seeking different types of exposure in the bond market.

What is an Aggregate Bond ETF?

An aggregate bond ETF is a type of exchange-traded fund that tracks a broad-based index covering a significant portion of the U.S. bond market.

A prime example of such an index is the Bloomberg Aggregate Bond Index, often referred to as the "Agg." This index is characterized by a few notable features:

- It includes a range of bond types, such as U.S. Treasury bonds, mortgage-backed securities (MBS), and investment-grade corporate bonds (rated BBB and above).

- The index encompasses bonds with a variety of maturities, ranging from less than one year to over 20 years. On average, the bonds in the Agg have a maturity of about 8.5 years and a duration of around 6 years, with duration being a measure of the sensitivity of a bond's price to changes in interest rates.

- The focus of the Agg is predominantly on the domestic U.S. bond market.

However, the Agg does exclude certain types of bonds, such as non-investment grade high-yield bonds (commonly known as junk bonds), floating-rate notes, senior loans, Separate Trading of Registered Interest and Principal Securities (STRIPS), Treasury Inflation-Protected Securities (TIPS), and tax-exempt municipal bonds.

The primary goal of this index, and the ETFs that track it, is to provide comprehensive exposure to the overall bond market.

Similar to how investors utilize low-cost total stock market ETFs as core components in their portfolios for broad market exposure ("cheap beta"), ETFs tracking the Bloomberg Aggregate Bond Index serve a similar purpose in the fixed-income space.

They offer investors a simple, cost-effective way to gain extensive exposure to a wide cross-section of the U.S. bond market.

Some notable NYSE-listed options in this niche include the iShares Core U.S. Aggregate Bond ETF (AGG) and the JPMorgan (NYSE:JPM) U.S. Aggregate Bond ETF (BBAG), which charge expense ratios of just 0.03% and 0.07% respectively.

Benefits of Aggregate Bond ETFs

The main advantage of aggregate bond ETFs lies in their ability to offer a cheap and straightforward way to lower volatility and drawdowns in a portfolio.

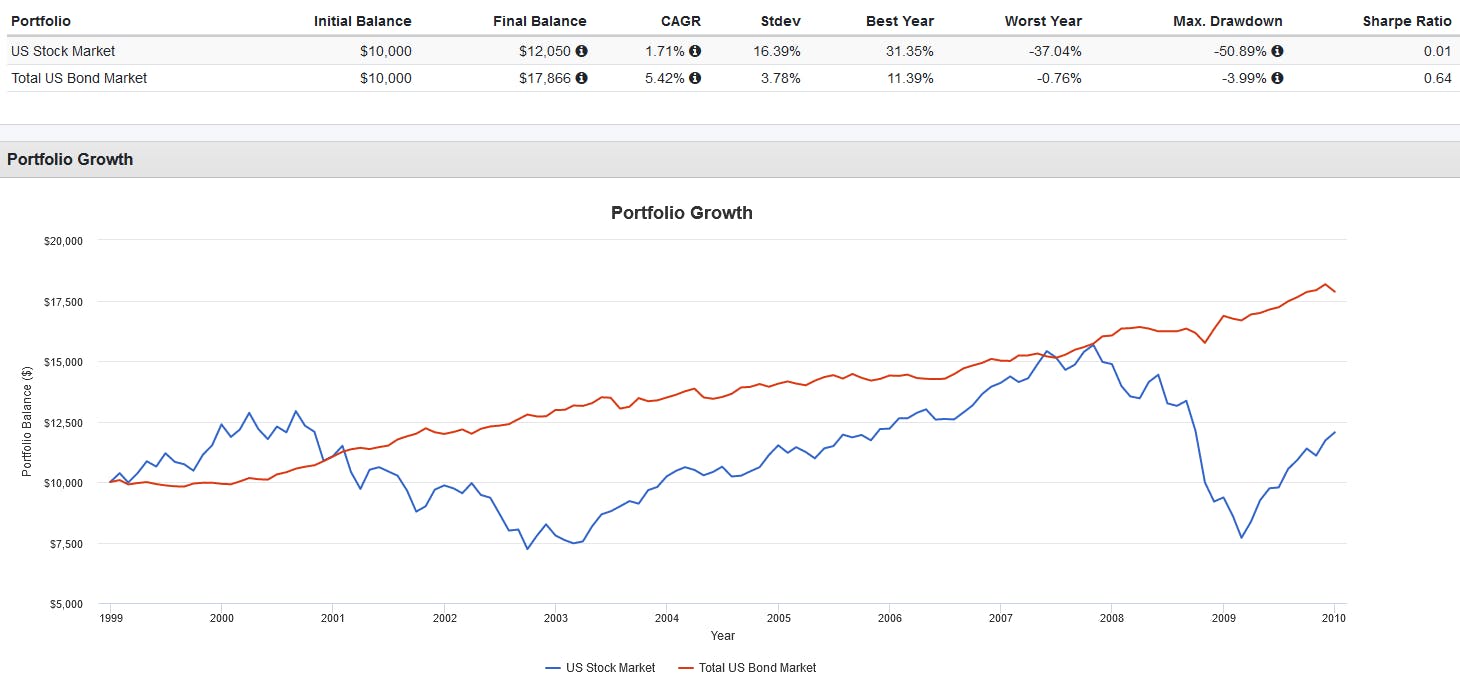

While many people assume that stocks always outperform bonds, there have been significant periods, such as the lost decade from 1999 to 2009, where U.S. stocks underperformed bonds amidst market upheavals like the dot-com bubble and the 2008 financial crisis.

Additionally, popular aggregate bond ETFs like AGG and BND provide excellent liquidity and diversification with their thousands of bond holdings.

For an individual investor, achieving such extensive diversification by purchasing individual bonds over the counter would be a daunting task. These ETFs simplify access to a broad range of bonds through just one ticker and with minimal bid-ask spreads.

Disadvantages of Aggregate Bond ETFs

However, the one-size-fits-all approach of these ETFs can also be seen as a disadvantage, especially regarding credit risk and duration risk.

For credit risk, some investors might find these ETFs too conservative. They might be seeking the potentially higher returns of corporate or high-yield bonds, while others may prefer the safety of an all-Treasury portfolio.

As for duration risk, the average duration of about 6 years can be a concern, especially in an environment of rising interest rates, like what was experienced in 2022. Longer-duration bonds tend to be more sensitive to interest rate changes, leading to significant losses in such conditions.

Furthermore, the passive nature of these ETFs means they lack the ability to make tactical adjustments or take defensive stances in response to market shifts, a flexibility that actively managed funds possess.

To offset these limitations, investors can pair aggregate bond ETFs like AGG with an actively managed bond ETF via a "core and explore" strategy for their fixed income allocation.

For example, one could use BBAG for 75% of their fixed income allocation, while adding in the actively managed JPMorgan Ultra-Short Income ETF (JPST). The latter charges 0.18% and is able to tactically adjust its holdings depending on market conditions, reducing volatility and risk.

This content was originally published by our partners at ETF Central .

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.