Fiscal Cliff Not Resulting In Dividend Cliff

Blog of HORAN Capital Advisors | Dec 23, 2012 02:12AM ET

One of the most popular investment topics in the fourth quarter has to do with the impending fiscal cliff discussion taking place in Washington, DC as can be seen in the Google Trends graph below. One area of interest for investors is the impact on the taxation of dividends if Washington policy succumbs to going over the cliff. Going over the cliff would result in the tax rate on dividend income increasing to as high as 43.4% versus the current 15% rate.

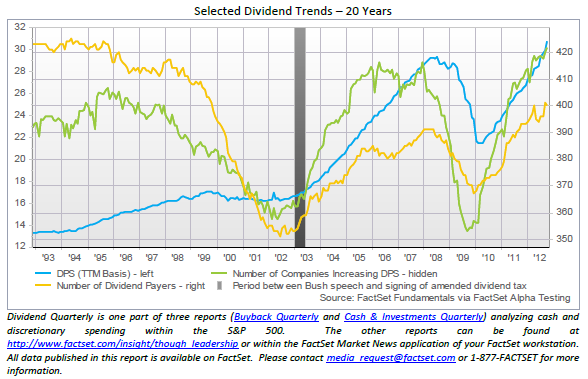

Interestingly, this potentially higher tax rate does not seem to be having a "negative" impact on the long term dividend policy for companies. Factset Research notes in their Dividend Quarterly report for Q3:

- aggregate dividends per share (“DPS”) grew 15.5% year-over-year at the end of Q3.

- the number of companies paying a dividend in the trailing twelve-month period again surpassed 400 (80% of the S&P 500 index).

- the S&P 500 also hasn’t shown a slowdown in companies initiating dividend payments. In Q3, 3.0% of non-payers “initiated” dividends, which is nearly triple the average over ten years (1.2%).

- the aggregate dividend payout ratio is 2.0% below the ten-year median, it is at its highest level (29.1% at the end of Q3) since the recession (when payout ratios were distorted by low aggregate earnings during the recession...).

- while there have been a number of companies that are signaling short-term changes in dividend policy or a shift towards more share buybacks..., a majority of companies have not yet responded, including the top ten dividend-payers in the S&P 500.

- the aggregate, forward twelve-month DPS estimate for the S&P 500 was 10% above the actual trailing twelve-month (“TTM”) payout at the end of November, which is a premium that is well above the ten-year average of 3%... Also, even when excluding the periods during the financial crisis (when forward DPS estimates fell below trailing figures), the forward consensus premium is in-line with the stabilized average starting in 2011.

One reason dividend practices may not be changing for a large majority of companies may be due to the fact that many shareholders own company stock in retirement accounts and/or shares are held by foreign investors. In Factset's Dividend Quarterly one Treasurer cites this very fact.

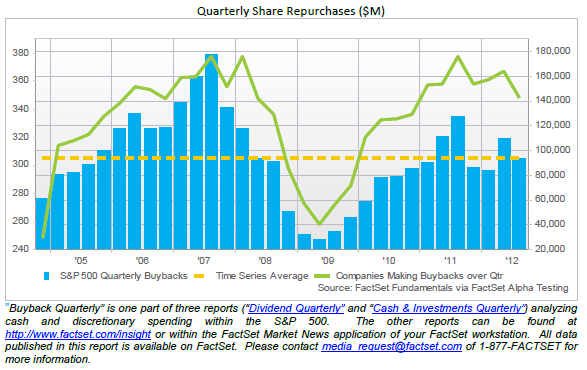

Lastly, just to reiterate a point about dividends versus buybacks we have made on this site in the past is the fact divdend payments are more consequential when evaluating companies. We prefer dividends since company practices around their dividend policy offer more insight into potentially negative financial outcomes since firm's are less likely to cut dividends.

For example, companies may take on debt in order to maintain adherence to a certain dividend growth rate. This may result in debt/equity levels increasing as well as payout ratios increasing. These are red flags for investors and may enable investors to reduce positions before negative financial results are reported.

Conversely, company buyback announcements may be just that and do not equate to a longer term commitment of a company's cash flow. It is far easier for a company to come up short on their buyback program than to announce a change in their dividend policy. As the below chart notes, the number of companies making buybacks and the aggregate dollars spent on buybacks has been on the decline since the fourth quarter of last year.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.