Firstextile: Guidance Maintained Despite A Slow Start

Edison | May 22, 2014 05:58AM ET

Guidance maintained despite a slow start

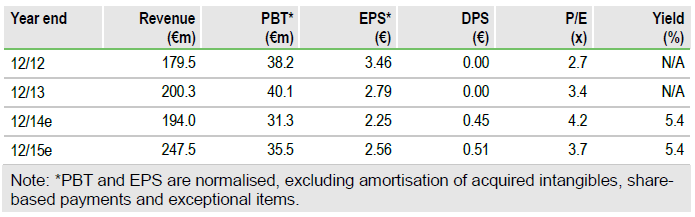

Despite a slow start to the year, management remains very confident of reaching its FY14 targets set in April. With the new production facility expected to come on stream in 2015, Firstextile (XETRA:FT8) looks well prepared to benefit from the high demand for its products over the long term. At 2014 4.2x P/E and 1.6x EV/EBITDA the valuation looks low.

Strong Q113 comparator

Q1 results reflect a slow start to FY14, in part due to the expected quarterly fluctuation in the Uniforms segment and the very strong comparator in Q113, especially in the Fabrics segment. While the comparators remain tough in Q2, in H2 not only will the company benefit from significantly easier comparators, but more importantly from the impact of the new Uniforms contracts the company has recently won with China Telecom, China Unicom, China Mobile and China Post. Revenues and gross profit in Branded products were up 55% and 10.7% respectively in Q1, with gross margin of 54.7% (Q113: 78.7%) reflecting the competitive strength of Firstextile’s branded products, and the success of its strategy to expand its product portfolio. We maintain our forecasts, which we revised in our Update note of 2 May.

On 13 May management released a statement that 100% net profit for FY13 would be retained.

To Read the Entire Report Please Click on the pdf File Below

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.