Finding A Balanced Solution To The Fiscal Cliff

Blog of HORAN Capital Advisors | Nov 25, 2012 02:39AM ET

Since November 15th the S&P 500 Index has managed to gain over 4% in spite of the rhetoric surrounding the consequences of going over the fiscal cliff. Finding a "balanced" solution to the budget issues in Washington is more than a near term issue.

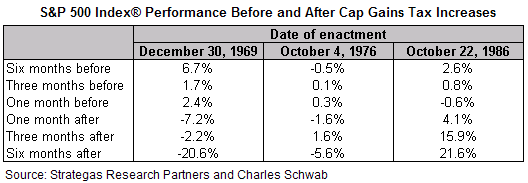

As the below chart shows, total credit market debt to GDP has been on an increasingly higher growth trajectory. A contributor to this debt increase is the growth in debt at the U.S. government level due to the significant budget deficit from year to year. Additionally, the economy continues to grow at a recent market comment by Liz Ann Sonders, Chief Investment Strategist for Charles Schwab & Co. She notes the mixed market results that occurred when capital gain tax rates were increased. However, she goes on to note, "but looking more closely, you can see that the capital gains tax hike in 1986 was met with very strong market performance. Why? Because it was part of President Ronald Reagan's bipartisan tax reform, which slashed marginal and corporate tax rates while also eliminating many deductions. I hope our policy-makers heed the message of this particular history."

The important takeaway from the above table is the necessity to craft a budget solution that includes components that are conducive to economic growth.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.