Financials Accelerate To Top Sector Performer For 1-Year Return

James Picerno | Jun 29, 2017 10:06AM ET

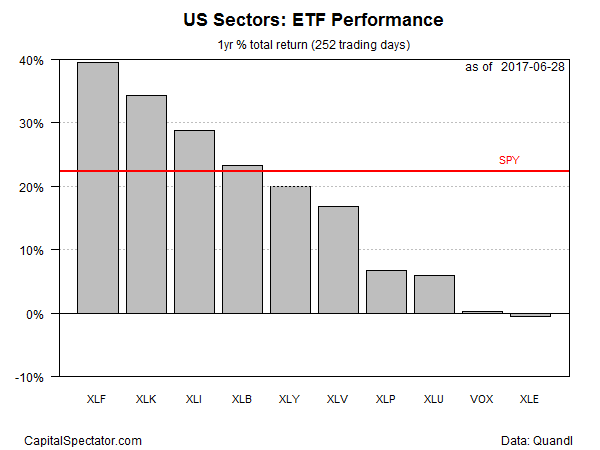

Thanks to this month’s rally in financial shares this corner of the US equity market has become the top-performing sector for the trailing one-year period, based on a set of proxy ETFs as of June 28. Meanwhile, the tech sector, the second-best performer over the past 12 months, has stumbled in recent weeks, opening the door for financials to pull ahead.

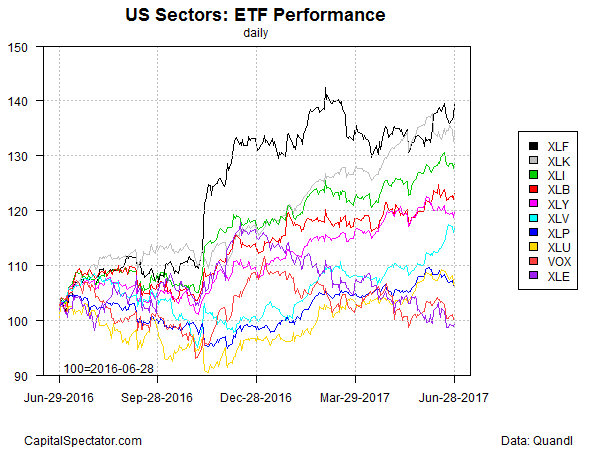

Financial Select Sector SPDR (NYSE:XLF) is up a strong 39.6% for the 12 months through yesterday, moderately ahead of the 34.2% one-year total return for Technology Select Sector SPDR (NYSE:XLK). June has witnessed diverging paths for the two sectors, with XLF climbing more than 4% month to date through June 28 while XLK has dipped almost 1%.

One rationale driving financials higher is the outlook for rising interest rates and the sector’s relatively low valuation, says David Kostin, the chief US equity strategist at Goldman Sachs. “Financials are most sensitive to changes in bond yields, as higher rates boost net interest margins. Our interest rate strategists expect that the US 10-year Treasury yield will rise to 2.75% by year-end.” The forecast for the benchmark rate represents a modest increase over the current 2.22% yield.

XLF’s absolute gain also looks impressive relative to the broad market, based on the SPDR S&P 500 ETF (NYSE:SPY). At the moment, XLF’s 39.6% one-year gain is nearly double SPY’s 22.3% increase.

The recent surge in financials can be seen in the performance chart below, which shows XLK (black line at top) taking the lead in recent weeks while momentum in tech (XLK) – gray line – has faltered recently.

Although the financial sector is the top performer for the one-year window, XLF currently ranks third in terms of current price over its 200-day moving average. The leader on this front is Health Care Select Sector SPDR (NYSE:XLV), which yesterday closed at a premium of nearly 11% above its 200-day average price.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.