FHFA House Price Index: Index Up 0.4% In November

Jill Mislinski | Jan 25, 2018 01:50AM ET

The Federal Housing Finance Agency (FHFA) has released its U.S. House Price Index (HPI) for November. Here is the opening of the report:

The FHFA House Price Index (HPI) reported a 0.4 percent increase in U.S. house prices in November from the previous month. From November 2016 to November 2017, house prices were up 6.5 percent. For the nine census divisions, seasonally adjusted monthly price changes from October 2017 to November 2017 ranged from -1.1 percent in the East South Central division to +0.9 percent in the West North Central division. The 12-month changes were all positive, ranging from +4.2 percent in the Middle Atlantic division to +8.9 percent in the Mountain division. [Read more ]

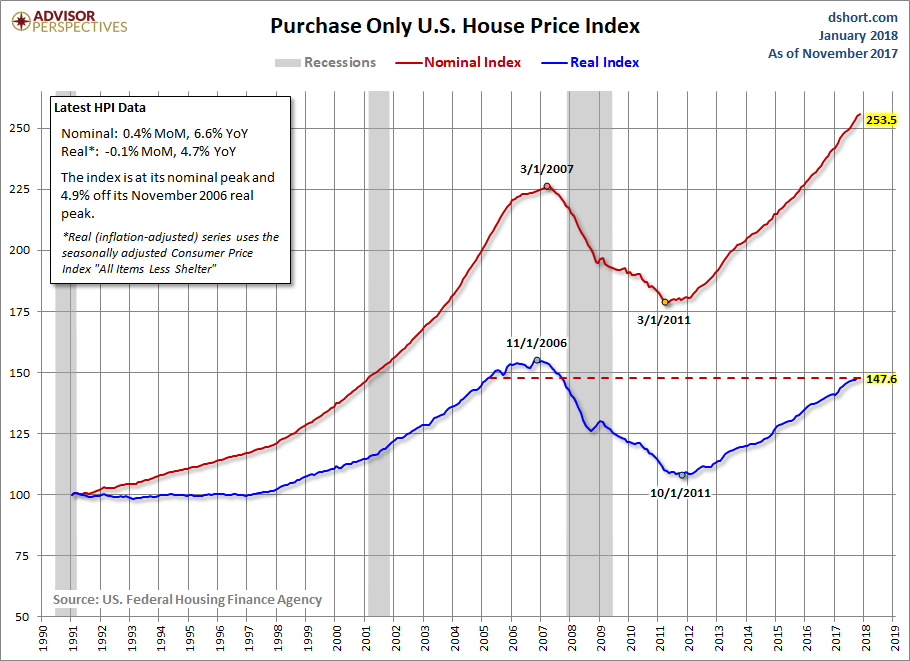

The chart below illustrates the monthly HPI series, which is not adjusted for inflation, along with a real (inflation-adjusted) series using the Consumer Price Index: All Items Less Shelter .

In the chart above we see that the nominal HPI index has exceeded its pre-recession peak of what's generally regarded to have been a housing bubble. Adjusted for inflation, the index remains off its historic high.

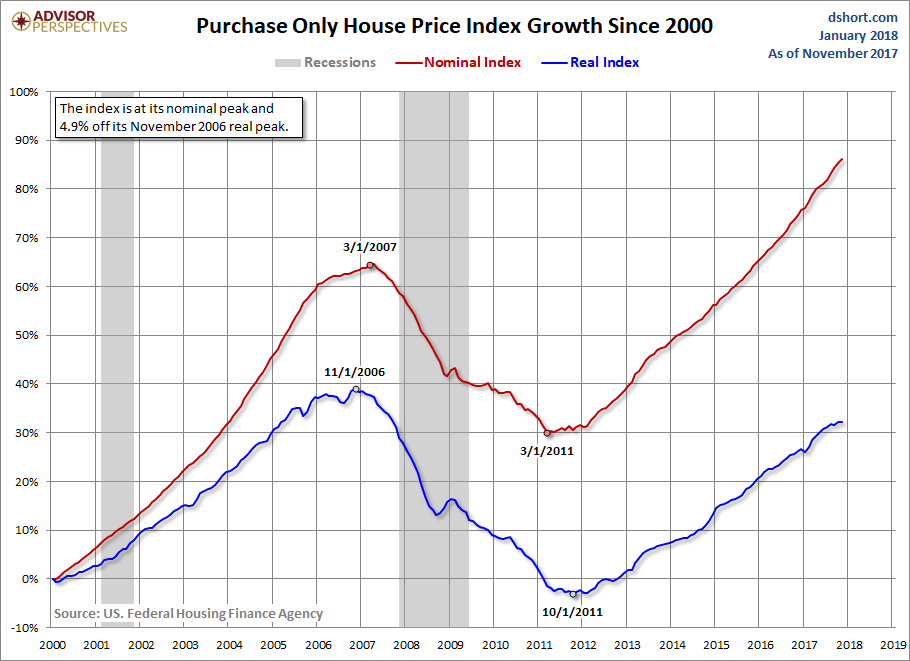

The next chart shows the growth of the nominal and real index since the turn of the century.

For an interesting comparison, let's overlay the HPI and the most closely matching subcomponent of the Consumer Price Index, PDF commentary from the Bureau of Labor Statistics.

HPI and OER moved in close parallel from the 1991 inception date of the former until early 1999, when the two parted company and HPI began accelerating into the housing bubble. HPI then fell 20.7% over the next 48 months to its March 2007 trough. Confirmation of the "bubble" designation for house prices is the 40.1% spread between HPI and OER in January 2006.

Is another housing bubble forming? The current spread is 22.8%.

Here we compare the Consumer Price Index for All Urban Consumers to both the Nominal and Real House Price Index, which is a similar comparison to what we do in our Case-Shiller update . Nominal HPI growth has clearly taken off since 2012. However, when adjusted for inflation, the House Price Index has not seen as dramatic an increase since the late 1990s.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.