Fed To Get Hawkish? WSJ Reporter Says He Doesn't Think So, Markets Move

Dr. Duru | Sep 17, 2014 03:40AM ET

T2108 Status: 39.2%

VIX Status: 12.7%

General (Short-term) Trading Call: Hold (TRADERS BE READY FOR WIDE SWINGS)

Active T2108 periods: Day #310 over 20% (includes day #280 at 20.01%), Day #26 over 30%, Day #3 under 40% (underperiod), Day #6 under 50%, Day #8 under 60%, Day #50 under 70%

Commentary

This is what I tweeted after I blinked and noticed that buyers had already taken the market upward off the lows and to flatline. Little did I know at the time just how true these words would ring.

I came into the day with the T2108 Trading Model on my mind . It was predicting a down day so the sudden gap down seemed to confirm another day of selling. It was not until the market exploded higher that I realized I needed to switch to a different mental model: a quasi-oversold market just looking for an excuse to buy. That excuse came in the form of WSJ journalist Jon Hilsenrath – someone whose impact my poor little model simply cannot anticipate.

Hilsenrath is the WSJ’s “beat” reporter for the Federal Reserve. He is the one who typically gets to attend the press conferences and ask questions on behalf of the WSJ. Over time, he has apparently developed quite a trusted reputation as a Fed-watcher, but I do not think I have ever seen him (presumably) move markets like he did today – stocks and currencies combined!

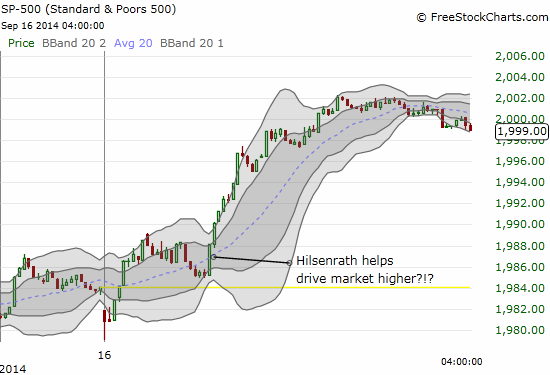

Hilsenrath had a simple message , a message that I have essentially made over and over myself: “do not overthink the Fed.” He basically argued that the Fed is in no rush to get hawkish on monetary policy and will look to qualify its “considerable time” framework for raising rates such that the market does not pin the Fed down on a specific calendar date. That was enough to send the market higher in sweet relief. The first chart below shows the action on the S&P 500 (SPDR S&P 500 (ARCA:SPY)) in 5 minute chunks so the changes in trading are more obvious.

In a blink sellers lost control of the open…and then Hilsenrath sealed the deal

Not quite 2000, but a bullish push for the S&P 500 above 50DMA support and after a “hammer” day on Monday

The NASDAQ also benefited, but it is still underneath a bearish topping pattern.

The market rally also helped the NASDAQ but its bearish topping pattern remains intact for now

I have adjusted the trading call slightly in the wake of this action. I am maintaining a hold for both bears and bulls, but noting that both sides of the fence need to be prepared for wide swings the rest of this week. I am not going to try to “out think” this one and just hope that I can react quickly and appropriately as the action reveals itself.

I forgot to mention in the last T2108 Update that I decided to go back to buying puts on ProShares Ultra VIX Short-Term Futures (ARCA:UVXY) because of my perception (I still have not confirmed with the data!) that the Fed tends to dampen market volatility. Of course today’s rally on rate relief smashed volatility and sent UVXY plunging 9.7%. I am still holding a small amount of UVXY shares given September (and October) typically expose market weaknesses. I am definitely dumping the shares by November. In the meantime, trading puts on UVXY remains the big moneymaker.

The iShares MSCI Emerging Markets (EEM) was also a beneficiary of the rally. I was quick on THIS trade and rushed to load up on a fresh tranche of puts as EEM approached 50DMA resistance.

Dreams of a continuation of zero-interest-rate-policy (ZIRP) and a lower dollar even sent international markets higher with emerging leading the way

As I mentioned, Hilsenrath was even able to move currencies. While the overall dollar index looks like it just swung from one side of a small room to another…

The US Dollar Index in a holding pattern until the Fed bestows its next travelling papers

…individual currency pairs, especially versus the Australian dollar had notable moves. Here is the 15-minute on the Australian dollar versus the U.S. dollar (Rydex CurrencyShares AUD Trust (NYSE:FXA)). I have stretched out the timeframe to show how, in typical fashion, the currency broke a significant technical level at 0.90 only to eventually shoot higher. There was one more tease for good measure.

The Australian dollar’s major technical breakdown does not last long

Given I remain firmly bearish on the Australian dollar, I promptly faded this move.

Through all of the excitement, I cannot forget what happened to Apple (NASDAQ:AAPL).

AAPL gapped down with the market, but its loss at the lows was much more significant, around 1.5%. Like the S&P 500, AAPL shot up immediately off the low. Unlike the general market, it could not manage to close with a gain. AAPL’s ominous behavior just got more ominous.

AAPL has now twice retested the all-time highs set before the September 9th product announcement and failed. This gap down essentially confirms some kind of topping action. As I have said in previous posts, I remain a fan of AAPL, but I think this poor trading action needs to be taken seriously. Only a fresh all-time high can invalidate the bearish reading. The Apple Trading Model (ATM) predicted an up day, but I was much too slow to get in at the great prices on call options at the lows (recall that the best trades on the ATM occur when the stock opens contrary to the prediction). Eventually I decided to match up calls and puts because it seems that AAPL is going to make at least one more big move this week in one direction or another.

It still looks like some kind of top in Apple.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Be careful out there!

Full disclosure: Net short Australian dollar, long AAPL calls and puts, long EEM puts, ong UVXY shares and puts.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.