Fed Tightening To Push EUR/USD FX Forwards Up Again

Danske Markets | Feb 26, 2019 07:31AM ET

In our view, the decline in EUR/USD FX forwards over the past couple of months is temporary.

Two 25bp Fed hikes and a 40% tightening of USD liquidity are set to push EUR/USD FX forwards higher over the course of the year.

We look for the Fed to provide clarity about the outlook for its quantitative tightening programme (QT) at the upcoming March meeting, including preannouncing an end to QT in Q4 this year.

The 12M EUR/USD FX forwards are currently priced about 15bp too low to fully account for this scenario.

Hence, EUR- and DKK-based clients with USD assets and a hedging mandate may consider hedging further out the curve, i.e. 1Y.

Repricing of EUR/USD FX forward curve

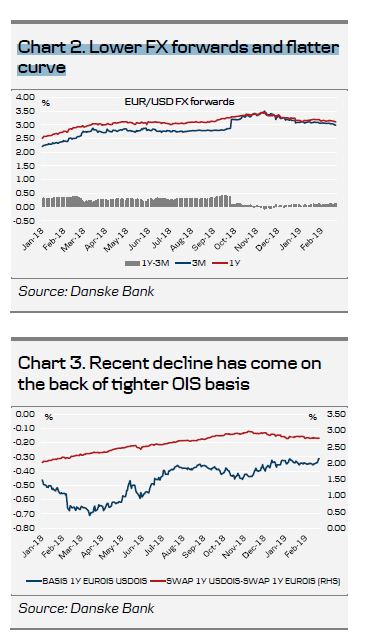

During the past three to four months, there has been a significant repricing of the EUR/USD FX forward curve. EUR/USD FX forwards across the curve have moved to the left and in addition, the curve has flattened (see chart 2). The 12M EUR/USD FX forwards are currently trading around 3.11%, down from around 3.45% at the peak in mid-November last year.

The move is mainly the result of the two following factors. (1) The repricing of the future path of the Fed funds rate since last November. The market has put the brakes on further Fed hikes, which has led to a decline in US rates. (2) The EUR/USD OIS basis tightened the past year – 1Y EUR/USD OIS basis now trades close to -30bp compared to -70bp around this time last year. See chart 3 for an illustration of this development.

Fed to resume hiking cycle in June

We are quite confident that the Fed is set to restart its hiking cycle when we get to the June meeting. In our view, concerns about the outlook for US growth have been exaggerated and we expect the lingering uncertainty with respect to the trade war and Brexit to fade out. Furthermore, market-based inflation expectations have started to recover.

We look for a 25bp hike in June and another 25bp in December. After that, the Fed is likely done hiking rates. The market on the other hand is pricing a slightly lower effective Fed funds rate at the end of this year and a high probability of a rate cut next year. See chart 4 for an illustration.

Until June, it will be interesting to see if the ongoing fall in bank reserves due to, among other things, Fed’s QT, will lead to renewed upwards pressure on the effective Fed funds rate (see chart 5). In the big picture, it will not be important for the direction of EUR/USD FX forwards since the Fed is likely to contain the upward pressure through adjustments of the interest rate on excess reserves.

Fed to announce Q4 end to QT at March meeting

Based on the minutes from the January FOMC meeting and the recent string of comments from Fed members, we now expect the Fed to announce that it plans to end QT in Q4 this year. We further look for the Fed to clarify its intention to swap its holdings of mortgagebacked securities for US Treasuries and gradually reduce the maturity on SOMA. Finally, we expect the Fed to maintain a constant size of its balance sheet for some time after the end of QT.

This outlook has a number of implications for USD liquidity. The total supply of bank reserves will be just north of USD1,000bn when Fed ends QT (see chart 6). However, a constant size of the Fed’s balance sheet means that the supply of bank reserves will continue to tighten since the trend higher in non-reserve liabilities, e.g. currency in circulation, will eat into the supply of bank reserves by more than USD100bn per year (see chart 7).

This passive form of QT will matter as it effectively tightens the available supply of high quality liquid assets (HQLA) to banks. Holding more US Treasuries instead of mortgagebacked securities will have a similar effect due to how these assets are classified. See Research US Fed’s regulatory hurdle for starting quantitative tightening for our 2017 primer on the subject.

Based on this outlook, there is limited scope in our view for the EUR/USD OIS basis to tighten further from the already quite tight levels (see chart 8). An announcement from the Fed on the outlook for QT in March is set to provide clarity to the market, but if we are right that QT will continue until the end of the year, USD liquidity will tighten another 40% from the current level.

The market is currently pricing a premium on overnight EUR/USD FX forwards around 18% over year-end if we take into account that it is a two-day turn. It seems about fair at the current stage compared to price action the past years (see chart 9).

Outlook for EUR/USD FX forwards

Based on our analysis above, in our view, the decline in EUR/USD FX forwards over the past couple of months is only temporary. The Fed is set to continue to tighten on all levels this year, i.e. hiking rates another 50bp in total and tightening USD liquidity another 40% from the current level.

The USD OIS market and EUR/USD OIS basis market are not priced for this outlook. In turn, EUR/USD FX forwards are bound to return towards the highs from last year. The 12M EUR/USD FX forwards are currently priced about 15bp too low to fully account for the scenario sketched above. See chart 1 on the front page for an outline of our projection of 3M (NYSE:MMM) EUR/USD FX forwards relative to current market pricing.

Hence, EUR- and DKK-based clients with USD assets and a hedging mandate may consider hedging further out the curve, i.e. 1Y, which is the horizon we look at here, to hedge the impact of additional Fed rate hikes and tighter USD liquidity on EUR/USD and USD/DKK FX forwards.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.