Fed Speeches Key As Draghi Hints At Further Easing

MarketPulse | Nov 12, 2015 07:13AM ET

European markets are lower across the board on Thursday despite more dovish comments from ECB President Mario Draghi that suggest further monetary easing remains on the table in December. With the Fed looking increasingly likely to raise interest rates which has played a big role in the euro falling from 1.15 against the dollar to around 1.07 today, it was possible that the ECB may have delayed its intentions to ease due to the far more favourable exchange rate. Of course, the central bank is prohibited from basing its monetary policy decisions on exchange rates but it’s clear that the stronger euro was having a deflationary impact on the euro area.

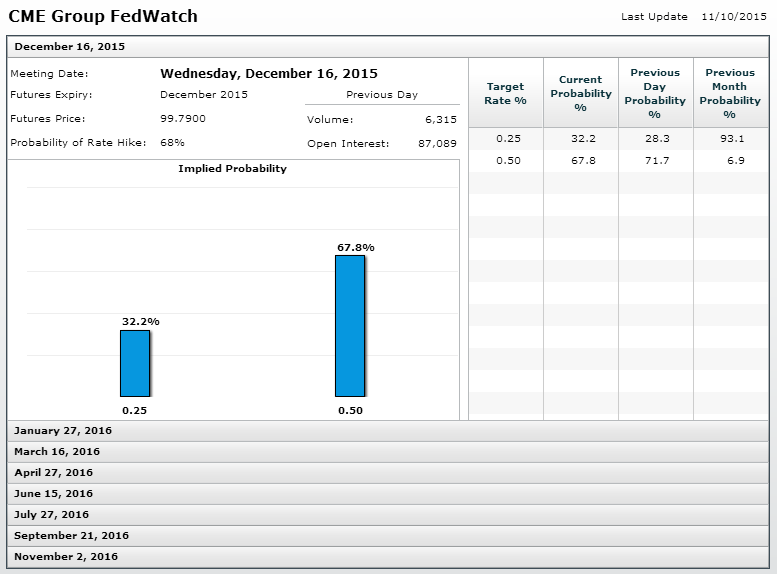

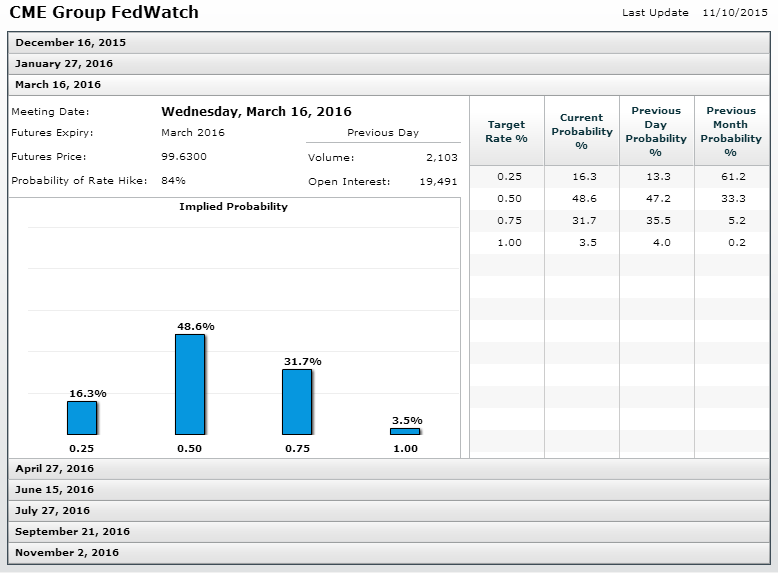

With Draghi appearing to have shown the ECBs hand, it will be interesting to hear the views of the Federal Reserve following last week’s impressive jobs report. The report appeared to tick every box as far as the Fed is concerned which gives them the perfect opportunity to raise interest rates in December. There are a number of Fed officials due to speak today including Chair Janet Yellen and vice Chair Stanley Fischer and it will be interesting to see how influential that jobs report was. Clearly the markets saw it as being extremely influential which is why they are currently pricing in a 68% chance of a rate hike in December and a 32% chance of a second by March.

Source – CME Group (O:CME) FedWatch Tool

It is now up to the Fed to manage expectations in the coming months and to constantly reassure markets that rate hikes will be gradual, as it has repeatedly stressed until now but clearly the markets are beginning to doubt. I expect the message today to be broadly similar to the statement from the October meeting, that December remains a possibility and that the path of rate hikes will be gradual. They may even stress that the jobs report is one small selection of data and that there’s plenty more to come before the next meeting. Under Yellen, the Fed does like to leave the long list of excuses on the table right next to the rate hike, just in case.

There will also be a focus on the data today with JOLTS job openings for September being released. Of course, given that we’ve already had the employment report for that and the following month, the data is already a bit outdated, but it does offer good insight into the sustainability of job creation in the coming months if the trend of job openings is continuing to rise. We’ll also get the latest jobless claims number today as well as crude inventories data which comes as WTI trades near two month lows. Another strong build in inventories could be what it takes to break back towards $41.30, last seen at the end of August.

The S&P is expected to open 5 points lower, the Dow 42 points lower and the Nasdaq 7 points lower.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.