Dollar Suffers As Fed Sits On Fence

MarketPulse | Jul 28, 2016 07:23AM ET

Thursday July 28: Five things the markets are talking about

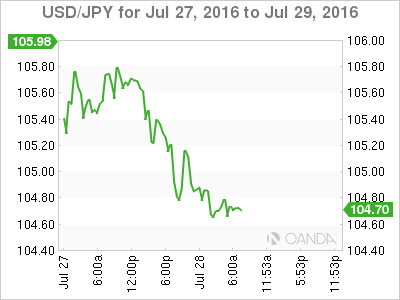

Despite being more upbeat than last months message, yesterday’s Federal Open Market Committee (FOMC) announcement has failed to lift the mighty dollar.

The Fed’s statement is considered evenly balanced. They acknowledged the strengthening labor market and deemed the “near-term risks to the economic outlook as diminished,” but on the other hand, maintained that “inflation measures remain low and expectations for pickup are little changed.”

Net result – Fed funds futures have actually tilted in favor of lower rates. December contract have fallen -5pts and are now below +50% probability of a +25bp hike. With the Fed having no reason to speed up its tightening cycle when market-based inflation expectations continue to trade below +2% would suggest that the dollar has room to move lower.

The dollar index is down -0.75% against a basket of currencies, while the hunt for yield remains the main game in town for investors.

Market focus is now expected to center on upcoming data and of course tonight’s Bank of Japan (BoJ) rate announcement.

1. BoJ’s Kuroda in the spotlight

Tonight’s Bank of Japan (BoJ) announcement could have a bigger market impact that this week’s FOMC statement. Market expectations are high that Governor Kuroda will deliver with more easing, either with expanded asset purchases, deeper cuts in interest rates, or even both.

However, the BoJ has had a habit of disappointing the markets recently, hence, why the degree of uncertainty surrounding this evening’s announcement is relatively high.

Yesterday, PM Abe said his government would compile a stimulus package of more than +$265b (+¥28T) next week to reflate the flagging economy, nearly double more than expected, yet, the PM was very short on details. Abe is expecting the BoJ to step in line with his ‘vague’ fiscal spend plan, but will Kuroda fall short?

In the overnight session, former BoJ chief economist Hayakawa endorsed more easing and a more flexible CPI target.

2. Equities stall on ‘amber’

To date, positive corporate earnings and signs that central banks will step in to support economic growth have helped lift global equities to their biggest monthly gain since March.

This morning, euro equity indices are trading mixed as the market continues to digest yesterday’s Fed policy decision, leaving rates unchanged as anticipated.

Lower rate hike expectations hurt financials, hence banking stocks are generally trading lower on the Euro Stoxx 50 ahead of the open stateside. The commodity and mining sector is providing some tentative support to the FTSE 100 index.

Today’s North American session is likely to be dominated again by earnings releases, with a large number of U.S and European companies scheduled to release their Q2 reports. Thus far, U.S. futures have pushed modestly higher, supported by earnings optimism and by Fed’s comments perceived as dovish.

Indices: Stoxx50 -0.2% at 2,991, FTSE -0.1% at 6,742, DAX +0.1% at 10,325, CAC 40 +0.2% at 4,457, IBEX 35 -1.0% at 8,573, FTSE MIB -0.8% at 16,725, SMI +0.1% at 8,225, S&P 500 Futures +0.2%

3. Pound under pressure across the board

The pound has dropped to its lowest level in two-weeks against the EUR (€0.8420) in anticipation that the “Old Lady” will lower interest rates for the first time in more than seven-years at next week’s BoE monetary policy meeting (Aug. 4).

Currently, fixed income traders are pricing in a +100% chance that Governor Carney and the MPC will cut their key rate from a record-low +0.5%. That compares with odds of about +15% on June 23, the day of the historic Brexit vote.

Already this week U.K’s Q2 data beat expectations (+0.6% q/q), however, the market considered it a pre-Brexit composition. With fundamentals remaining negative for the pound, sterling is expected to remain under pressure ahead of the BoE announcement.

4. Crude cannot find its “sea legs”

Heading stateside, oil prices continue to hover near their three-month lows, as unexpected growth in U.S. inventories keep pressure on the market. It would be trading lower, except a weaker dollar is providing some support.

Brent crude has fallen -0.9% to $43.07 a barrel, while WTI futures trade down -0.3% at $41.80 a barrel.

Oil prices fell after the EIA showed a surprise +1.7m uptick in U.S. crude stockpile, keeping total inventories at a historical high. Gasoline inventories rose by +500k barrels, also well above the upper limit of the average range.

Both oil benchmarks have lost nearly -6% this week so far, as a growing surplus of gasoline is not expected to move the needle on the markets supply ‘glut’ problem anytime soon.

Expect crude ‘bulls’ to get a tad more nervous if a weaker dollar does not provide crude price traction.

5. Sovereign yields trade in a tight range

First, it was the Fed and now it will be the BoJ that fixed income dealers will look to for guidance on where sovereign yields next move will go.

Currently, the yield on the benchmark U.S 10-year note is +1.508% in European trading, little changed from yesterday’s close (+1.516%).

Already this week, demand for recent Treasury debt sales has been considerably tepid. A +$34B sale of U.S five-year notes Tuesday drew the weakest demand in seven-years, while Monday’s +$26B sale of U.S two-year notes attracted the smallest demand in eight-years.

Currently, any uptick in yield seems to be short lived as fresh buying interest, particularly from pension funds, domestically and especially from Japan and Europe (NIRP policy), are there waiting to acquire high-grade long-term debt that offers decent returns.

The prospect of a “go-slow” stance by the Fed to raise rates is one of the factors keeping a lid on U.S. bond yields further out the curve.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.