USD Increases While Stocks Remain Flat, Gold Edges Up

IFC Markets | Feb 05, 2016 06:49AM ET

On Friday the U.S. dollar index increased while the stocks were almost flat. The U.S. labour market data was much better than expected. The unemployment decreased reaching its low since April 2008 at 5%. The payroll increased by 271 thousand being the highest since December 2014. The data made the probability of the rate hike on December 16 considerably higher: it reached 70% against 58% on Thursday. The yield of 2-year bonds reached the 5.5-year high at 0,958%. Markets decided the rate hike would support the financial sector. Stocks of JPMorgan (N:JPM), Bank of America (N:BAC) and Citigroup (N:C) edged almost 3% up. The US employment growth may improve the retailers performance. This week the positive Macy's (N:M), Kohl's C(N:KSS), Nordstrom (N:JWN) and J.C. Penney (N:JCP) statements are expected. Markets expect the gross profits of the S&P 500 components to contract in the 3rd quarter by 3.8% which is better than the October forecast of 6.1% contraction. Today no important macroeconomic data is expected from the U.S.

European stock indices are retracing down today after the slight growth on Friday. The Renault (PA:RENA) stocks fell by 3,2% on the news the French government did not approve of its merger with the Japanese carmaker Nissan (T:7201). The tire producer Continental AG (DE:CONG) saw its stocks loosing 3.9% as its sales were weaker than expected. The Lufthansa (DE:LHAG) staff went on strike with its stocks sliding 2.3% down. Today in the morning the positive external trade data for September was released in Germany. No more macroeconomic data is expected today in EU.

Nikkei was looking up today for the 6th consecutive day amid the weaker yen. The Nippon Telegraph and Telephone revised up its earnings outlook and its stocks increased 4.2%. Tomorrow early in the morning at 00:50 CET the external trade balance and the current account for September will be released. In our opinion, the tentative outlook is positive for yen and can push it down in the chart.

On Sunday the China’s external trade data for October was released. The import and export contracted more than expected but less than in September. For this reason, the data had almost no effect on the commodities markets.

Today the global oil prices have slightly increased on the OPEC comments the demand for oil will remain high next year. Remember that in 2015 the global demand for oil was the highest in 5 years totaling 1.8 barrels a day. According to Baker Hughes, oil service company, the number of active oil rigs has contracted for the 10th straight week to 572 units – the lowest since June 2010. According to Commodity Futures Trading Commission, the oil net longs at New York Mercantile Exchange increased 20% a week. Markets await higher oil prices.

The wheat has become cheaper on the US Agricultural Department report that its weekly export was 84.6 thousand tonnes which is below forecasts.

Gold edged up as investors thought China added 14 tonnes of gold to its reserves. There is no official confirmation on it yet.

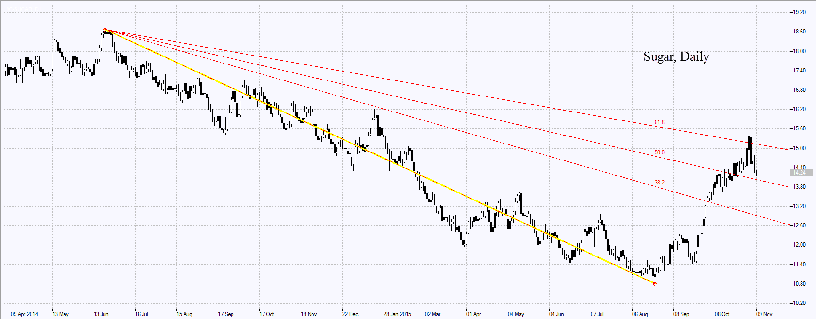

According to U.S. Commodity Futures Trading Commission, net longs for sugar are increasing for the 6th week in a row reaching the 2-year high. Meanwhile, Brazil has revised up its forecast for sugar cane crops in 2016/17 to 32.9-33.7mln tonnes from previous 32mln tonnes.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.