Fed Hints at Cut but Dollar Unbruised, Pound Slips Ahead of BoE

XM Group | Aug 01, 2024 06:33AM ET

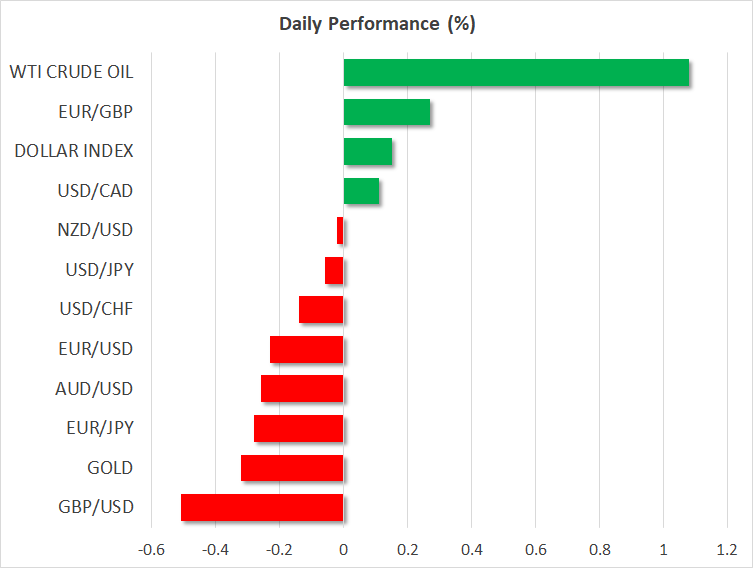

- Fed’s Powell opens the door to a September rate cut, stocks rebound

- But dollar only tumbles against the yen, which surges after BoJ hike

- BoE rate cut bets intensity ahead of decision, pressuring sterling

- Oil comes back to life as ME conflict takes another dangerous turn

Powell Flags a Possible September Cut

The Federal Reserve delivered no surprises on Wednesday, keeping interest rates unchanged as expected. But markets mostly got what they were hoping for – a clear signal that rates could be cut at the next meeting in September.

As had been widely predicted, the FOMC statement was tweaked to highlight the dovish shift. Officials cited “some further progress” on meeting their inflation objective and saw the risks as no longer being one-sided.

But what really cheered markets were Jay Powell’s remarks in his press conference where he told investors that “a rate cut could be on the table at the September meeting” if certain conditions are met.

In a further boost to rate cut hopes, Powell revealed that there was a “real discussion” on whether there was a case to move at the July meeting. Yet, he stopped short of fully committing to a September cut.

Dovish Fed Helps Tech Stocks Bounce Back

One likely reason why policymakers are maintaining caution is that despite the progress, the data isn’t going entirely the Fed’s way, as shown by last week’s upside surprises in the GDP and core PCE readings. Friday’s nonfarm payrolls report will be another test for the dovish expectations.

Investors have almost fully priced in a 25-bps rate cut at the three remaining meetings of the year and Treasury yields have also come under pressure.

The 10-year yield brushed a six-month low yesterday, giving Wall Street bulls a helping hand. US tech stocks staged an impressive rebound, with the Nasdaq 100 jumping by 3.0% after a dreadful two weeks.

Reports that Washington’s proposed ban on the sale of chips to China will come with exemptions also lifted chip stocks.

Nvidia and Meta Shine

Nvidia (NASDAQ:NVDA) was the star of Wednesday’s session, rallying by 12.8% on expectations that demand for AI chips will remain strong as companies increase their spending on AI.

Both Alphabet (NASDAQ:GOOGL) and Microsoft (NASDAQ:MSFT) have ramped up their AI capex, sparking investor jitters, and Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN) will likely follow their lead when they announce their earnings later today.

Facebook (NASDAQ:META) parent, Meta, has been the exception, whose stock is expected to surge today after its results, announced after yesterday’s close, impressed.

Dollar and Yen Stand Tall, Pound Slips, Oil Climbs

The US dollar escaped a broad selloff on the back of the Fed’s near pivot and is edging up today against a basket of currencies despite extending its slump against the Japanese yen. With the Bank of Japan now seemingly in a tightening cycle and the Fed close to pressing the cut button, the yen’s fortunes have turned.

The pound on the other hand has been on the backfoot lately as investors increasingly expect the Bank of England to announce a rate cut today at 11:00 GMT.

Although the decision could well be a ‘hawkish cut’, the rising odds, which stood at just 50-50 a few days ago, are proving a headache for the sterling.

Meanwhile, oil prices are up sharply for a second day as tensions in the Middle East escalate once again. Israel’s strikes in recent days, killing a senior Hezbollah commander and the leader of Hamas, will likely result in some kind of retaliation by Iran, raising fears of a wider conflict in the region.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.