FED Goes From ZIRP To NIRP

Chris Vermeulen | Sep 28, 2016 09:14AM ET

The FED has not followed through on their numerous promises of a rate increase that Yellen and other FED officials have made over the past several years. She spoke about purchasing assets of private companies and also mentioned that the FED could modify its inflation target.

Investors will most likely purchase shares in companies whose assets have been purchased by the FED since it is likely that Congress and federal regulators would treat these companies as “too big to fail.” Federal ownership of private companies would also strengthen the movement to force businesses to base their decisions on political rather than economic considerations.

Politicians will never restore sound money policies unless forced to do so by either an economic crisis or a shift in public sentiment, not because a crisis leaving Congress with no other choice.

The failure of the FED's eight-year spree of money creation through quantitative easing and historically low interest rates have failed to “restart” the failing economy. They continue to add new tools to “artificiality inflate” the stock bubble. They will stop at nothing as they discuss implementing NIRP.

The collapse of the “fiat system” will not only cause a major economic crisis, but also the collapse of Capitalism as we knew it. Congress has also failed the American people and its’ economy by refusing to consider meaningful spending cuts, it will not even pass legislation to audit the FED.

The FED has lost even more of its ‘Credibility’

Governor Fischer has lost all his credibility. He predicted four rate hikes at the beginning of the year for 2016. His speech on August 21th, 2016 on the slowdown in productivity: “We just don’t know.” Last week, he was down to two rate hikes for the year.

The perceived first takeaway on the meeting at Jackson Hole was the one that made all the headlines. She is joining the “chorus” of FED officials who have been saying it is time for another rate hike: “Indeed, in light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months.” This appears to be the FEDs’ new “mantra”. She added, “And, as ever, the economic outlook is uncertain, and so monetary policy is not on a preset course. When shocks occur and the economic outlook changes, monetary policy needs to adjust. What we do know, however, is that we want a policy toolkit that will allow us to respond to a wide range of possible conditions.” The FED now calls that “forward guidance.” In other words, they just do not know!

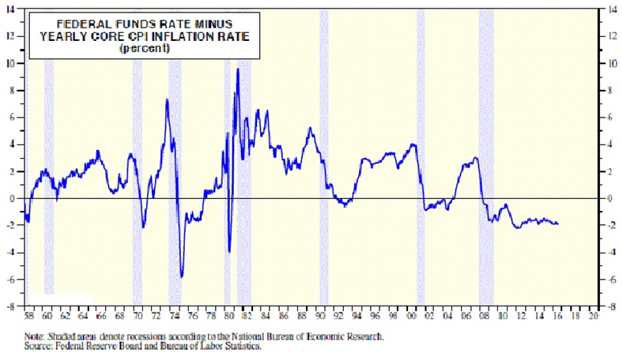

She did mention that QE purchases could be broadened to other assets. The real FED FUND rate has been trading deeply “negative” since 2008.

Negative Interest Rate Policy (NIIRP) Is Dangerous

Yellen has now established the fact that it is legal for the FED to authority the use of NIRP. She has now put it into her tool box and is developing specific plans for implementing it.

The consensus is dangerously wrong by relying on flawed theory and flawed policy assessment. NIRP draws on fallacious pre-Keynesian economic logic that asserts interest rate adjustments can ensure full employment. The consensus is dangerously wrong, resting on flawed theory and flawed policy assessment. A negative nominal rate on money being held by your bank, can be thought of as a form of a tax on deposits that lowers “real wealth” and negative wealth effort on consumer spending and “aggregate demand”.

Gold in your portfolio

Investors should consider doubling their gold allocations amid negative interest rates. The long term effects of these policies are unknown, but I see discouraging side effects: unstable asset price inflation, swelling balance sheets and currency wars to name a few. Looking forward, government bonds are likely to have limited upside, due to their low-to negative yields

Amid higher market uncertainty

We have entered a new and unprecedented phase in monetary policy. Central Banks in Europe, Japan and soon in the United States have implemented Negative Interest Rate Policies (NIRP). Investors, including long term investors, should assess the implications of holding bonds with negative return expectations on portfolio composition and risk management.

My analysis shows that Investors will benefit from increasing their gold holdings up to 2.5 times, depending on the asset mix, even under conservative assumptions for gold. In addition, we expect that demand for gold as a portfolio asset may structurally increase due to NIRP.

The only “recovery” that we have experienced has been an artificially inflated recovery on Wall Street. For the rest of the country, our long-term economic decline continues.

Secular investors should start turning their attention to commodities and precious metals. Golds’ bull market is far from over. The volatility in gold in recent days is principally due to sharp fluctuations in the expected path of US rates amid surprises in the macro data and diverge ring comments from FED officials. The recent consolidations were fueled by profit taking will end shortly. The next FED meeting will result in more dovish FED speech resulting in new and more purchases.

When investors realize that they are holding potentially worthless currencies, the big money will rush into the precious metals sector. Consider this, the total world’s investment holdings in silver are a paltry $50.8 billion, compared to $3.04 trillion in gold, as shown in the below.

Did you know that the hedge funds alone manage around $2.7 trillion, according to Barclay Hedge data? Even if a small portion of the trillions sloshing around out there, decides to enter into silver, the “white metal” will shoot through the roof.

The difficulty in identifying “asset bubbles” is directly related to credit expansion. The problem is not the asset bubbles, whether they be in stocks, housing or student loans. This is merely a symptom of a deeper condition. The real threat is the underlying credit expansion by easy monetary policies that has created these “asset bubble” problems in the first place.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.