Fed FOMC Update: Stagflation On The Horizon

Phoenix Capital Research | May 04, 2018 12:23AM ET

The Fed is fast approaching its worst nightmare.

Stag-flation.

Stagflation is when inflation is rising at the same time that the economy is weakening, if not contracting.

The Fed has always argued that low levels of inflation (2%) were acceptable provided the economy was also growing. Indeed, this is the very gimmick the Fed has utilized to mask the fact that quality of life has been falling in the US since the early ‘70s (by understating inflation, the Fed has overstated economic/ income growth).

All of the negative effects of inflation (wealth inequality, higher costs of living, increased debt required to maintain living standards) are “masked” by the Fed’s argument, “look how well the economy is doing! If we weren’t running things everything would be much worse. A little inflation isn’t a bad thing after all!”

Not with stagflation.

With stagflation you’ve got the economy shrinking, meaning people are losing their jobs and incomes are falling at the SAME time that the cost of living is exploding higher and thing are getting more expensive.

Cue Wednesday's Fed FOMC statement in which the Fed REMOVED its claim that the “economy outlook has strengthened.”

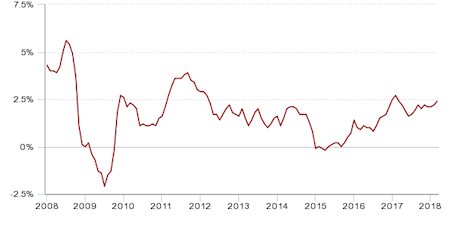

So the Fed has noticed that the economy is slowing and no longer has a great outlook. And this is happening at a time when the Fed’s official inflation measure, the CPI, is clocking in at 2.36% year over year (which incidentally the Fed is trying to ignore).

Put simply: stagflation is here.

We just published a Special Investment Report concerning a FIVE secret investments you can use to make inflation pay you as it rips through the financial system in the months ahead.

The report is titled Survive the Inflationary Storm.

We are making just 100 copies available to the public.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.