Fed At Risk Of Missing Window To Hike Rates

Lance Roberts | Jun 10, 2015 03:11PM ET

For much of the last year, the Federal Reserve has been repeatedly discussing the potential increase in the overnight lending rate. That rate, more commonly known as the "Fed Funds" rate, has been held at a historic low of .25% for an unprecedented 78 months, and counting, as the economy struggles to recover from the previous recession.

As a reminder, the Federal Reserve uses monetary policy to control inflationary pressures, or maintain price stability, and stimulate employment. This is what is known as the "Fed's Dual Mandate," which is an important concept to understand when discussing the Fed's current and future monetary policy stance.

During the "financial crisis" the Fed drastically lowered the Fed funds rate in an attempt to stimulate economic growth, employment and boost inflationary pressures. The near-zero interest rate policy was supposed to spur consumers and businesses into action by using low borrowing costs to jump-start economic growth. The problem for the Fed has been that while the economy did stabilize, exceptionally low-interest rates and massive "Quantitative Easing" programs, have been unable to put "Humpty Dumpty back together again."

In recent months, the Federal Reserve has become much more vocal about the probability of increasing interest rates sometime in 2015. Early speculation was that rate hikes would begin around mid-year, but the recent spate of economic weakness has pushed expectations out to later this year.

However, with the recent decline in many of the economic indicators, combined with the sharp fall in inflationary pressures, the question is why would the Federal Reserve risk tightening monetary policy at such a critical juncture? This is a question I pondered recently, stating:

"While the Federal Reserve clearly should not raise rates in the current environment, there is a possibility they will anyway - "data be damned." (Which is ironic for a "data dependent Fed.")

They understand that economic cycles do not last forever, and we are closer to the next recession than not. While raising rates would likely accelerate a potential recession and a significant market correction, from the Fed's perspective if just might be the 'lesser of two evils.' Being caught at the "zero bound" at the onset of a recession leaves few options for the Federal Reserve to stabilize an economic decline. The problem is that it already might be too late."

It is the last part that is most critical.

The Federal Reserve is hoping to lift interest rates from "zero" while the economy and inflation remain at sub-optimal levels. As I discussed in "The Mistake Everyone Is Making About Fed Rate Hikes:"

Get The News You Want

Read market moving news with a personalized feed of stocks you care about.Get The App"Therefore, rather than lifting rates when average real economic growth was at 3%, the Fed will not start this process at less that half that rate.

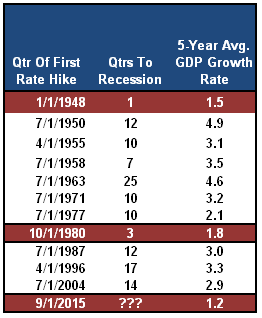

Fed-Rates-Vs-GDP-Table-050515Think about it this way. If it has historically taken 11 quarters to go fall from an economic growth rate of 3% into recession, then it will take just 1/3rd of that time at a rate of 1%, or 3-4 quarters. This is historically consistent with previous economic cycles, as shown in the table to the left, that suggests there is much less wiggle room between the first rate hike and the next recession than currently believed."

Treasury Rates Jumping The Shark

While the Federal Reserve hopes that they can effectively raise interest rates without cratering economic growth, the problem is that the bond market may have already beaten them to the punch.

While I do not expect Treasury rates to rise very much, the increase in borrowing costs in an already weak economic environment has an almost immediate impact. The chart below shows the periods in history where Treasury rates have risen and the impact of subsequent rates of economic growth.

While the Fed is hoping that they will be able to safely raise borrowing costs in the months ahead, the recent surge in rates will quickly impact the housing, auto and other variable rate credit markets that support consumption.

It is important to remember that while interest rate movements from very low levels have little ACTUAL impact on payments, it is the psychology of consumers that is affected. Consumers buy payments - not houses, cars or other items. Therefore, if the rate goes from X% to Y%, consumers, due to "recency bias," tend to reduce activity either because they cannot afford the new payment OR in hopes that the previous cheaper rate will return.

For the Federal Reserve, this is a problem. If the recent spike in interest rates continues, the economy will begin to show further signs of weakness. This will make it much more difficult for the Federal Reserve to hike rates in the future. Furthermore, any action the Fed does take to "tighten monetary policy" will only exacerbate the effect that the recent surge in Treasury rates is already having.

The Federal Reserve may have missed their window for hiking rates for the time being. However, as I stated earlier, the clock is ticking toward the next recession and for the Fed this could be a real problem.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.