False Breakout And A Topping Pattern

Dr. Duru | Aug 22, 2012 02:56AM ET

: 71.7% (fifth day of fifth overbought period since June 29).

VIX Status: 15.0

General (Short-Term) Trading Call: Start or add to bearish position on lower S&P 500. Otherwise hold.

Commentary

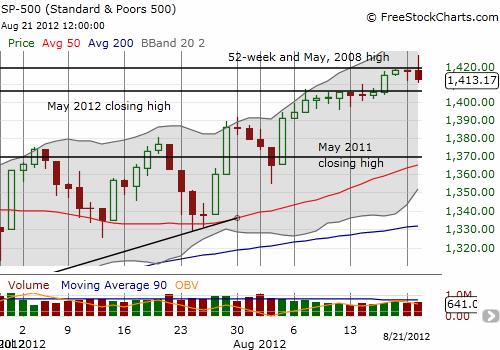

This picture should set off alarm bells with every and any technician paying attention:

This false breakout – where the S&P 500 surged to new 52-week and 4+ year highs only to close below the breakout point the same day – is a stark reminder of why traders wait for confirmation of major moves. Let the market prove that it is strong (or weak as the case may be). Now, this bearish pattern opens up the opportunity to go short with a tight stop at fresh highs. T2108 is still overbought, so I am well within the rules to initiate fresh bearish positions (with SSO puts). Moreover, stochastics are VERY overbought right now.

The day’s fade also produced similar fades across many individual stocks. Those that faded at recognizable resistance levels will be particularly vulnerable to swift selling as traders rush to take profits before they get taken away in September’s seasonal weakness.

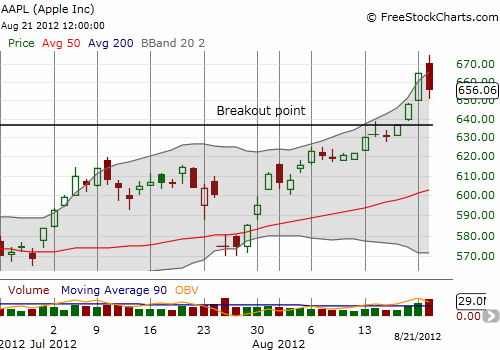

Caterpillar (Apple printed a classic topping pattern .

The next three important things to watch as signs of follow-through weakness: 1) first a break of Monday’s low, 2) then a break of the primary uptrend, 3) and finally a drop and a close BELOW the breakout point (around $636). If Apple retests the breakout point, I am expecting the line to survive the test.

Daily T2108 Vs. The S&P 500

Click chart for extended view with S&P 500 fully scaled vertically:

Weekly T2108

Be careful out there!

Full disclosure: Long AAPL calls, long CAT.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.