Should You Buy Chinese Shares For Portfolio Diversification?

James Picerno | Apr 07, 2022 12:39PM ET

In a series of articles, I’ve looked at alternatives to the standard 60/40 stock/bond benchmark using mostly US securities (see links below). This is the fourth article of the series.

Let’s add another flavor to the analysis using a portfolio of China stocks and bonds.

Why China? The reasoning starts with economics. China is the world’s second-largest economy and by some estimates is on track to overtake the US in the near future. The last several decades have shown that investment opportunities in the country have been among the most impressive in the world. On that basis, it’s reasonable to wonder how a China stock/bond portfolio compares.

The challenge from a US investor perspective is that the choices for investing in China are limited and problematic for several reasons. For one thing, China’s markets aren’t fully accessible to foreigners. What is available to US investors has a limited history in terms of publicly traded funds.

As a first approximation of what a China 60/40 portfolio, let’s use a pair of ETFs: iShares MSCI China ETF (NASDAQ:MCHI) and VanEck China Bond ETF (NYSE:CBON).

The US 60/40 mix is built with Vanguard Total Stock Market Index Fund Shares (NYSE:VTI) and Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND). I use a Dec. 31, 2014 start date and rebalance to the respective 60/40 allocations at the end of each calendar year.

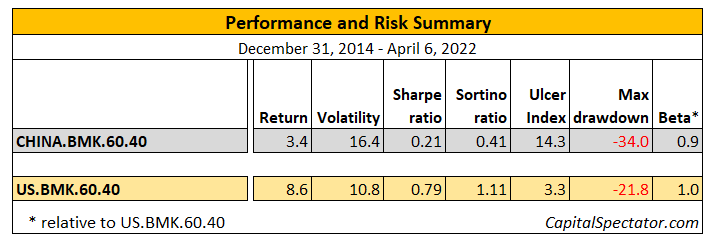

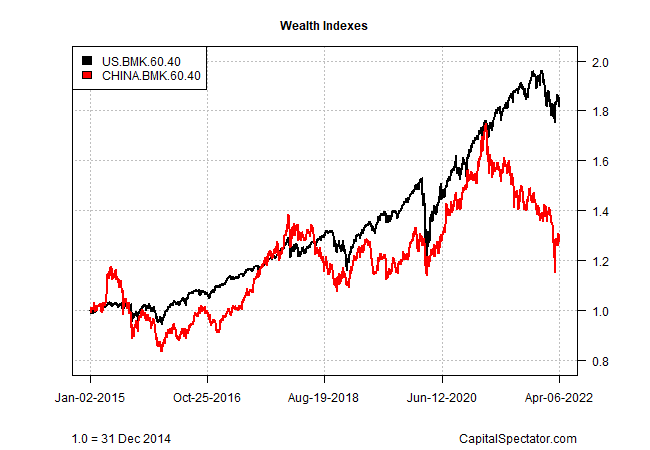

The main result: the China portfolio lags the US mix by a substantial degree. The US 60/40 portfolio earned an annualized 8.6% over the sample period, more than twice as much as the China 60/40 benchmark. Looking at the the results after adjusting for risk doesn’t change much.

Part of the challenge with China is that geopolitical risk has increased in recent years as Beijing has taken a more authoritarian turn that favors a political agenda at the expense of economic logic. This shift has been especially conspicuous via markets over the past year or so. Over the trailing one-year horizon, VTI is up 7.4% vs. a 35% loss for MCHI.

There are, of course, many flavors of China ETFs and mutual funds available in the US and so there’s a case for a deeper look into the possibilities for 60/40 benchmarks. Based on our initial review, however, the results don’t look encouraging.

In turn, that suggests that US investors looking to invest in China should favor a relatively tactical, nuanced approach to allocating assets in the country.

In addition, while China’s large economy suggests a relatively hefty weight in a globally diversified portfolio, the political risks associated with the country warrants a lesser allocation vs. what a purely economic profile implies.

Previous articles in this series can be found here:

Exploring Alternatives To The US 60/40 Benchmark: Part I

Exploring Alternatives To The US 60/40 Benchmark: Part II

Exploring Alternatives To The US 60/40 Benchmark: Part III

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.