Explaining My Portfolio

Tiho Brkan | Aug 27, 2014 07:12AM ET

I have received quite a lot of questions regarding the newsletter portfolio as well as my major holdings. In this article I will try and explain some of the basic points of what my asset investments are, as well as what is and what isn’t on my watch-list.

However, before I continue I would like to say to all those who subscribe and follow my portfolio: you shouldn’t do what I do. You shouldn’t listen to me or anyone else on the internet / tv / radio. There is a particular reason why I hold various assets and these reasons might not make any sense to you. You should buy and sell assets which make sense to you. Therefore, do your own research so that you can win (or lose) your own money. That is always the best way.

Chart 1: Where does one see value in current global macro environment

Source: Internet

The question I recently receive is why do I chose to invest into “strange” assets such as Silver and Sugar? Wouldn’t it be just smarter to own the SPDR S&P 500 (ARCA:SPY) ETF? Well, there are variety of reasons. Firstly, they are not strange. I believe these assets are extremely cheap on historical basis, unlike the SPY ETF, particularly when adjusted for inflation. And with the on going global currency devaluation, eventually the price of everything will rise and these raw materials will not be an exception.

Away from the fundamentals and the price valuations, I chose to own Silver and Sugar because these assets are some of the most volatile in the world. Historically, both Silver and Sugar tend to move up and down with incredible buying and selling pressure. You see, I am young and therefore my risk appetite is high. I want to get rich and that is why invest.

I understand the risks involved, therefore I am prepared to live with the volatility and huge drawdowns. I understand that its very common for Silver or Sugar to experience bear markets of 50% or more every several years, the same way it is just as common for Silver or Sugar to rally 3 to 4 fold in a very short space of time (sometimes even more in only a couple of years).

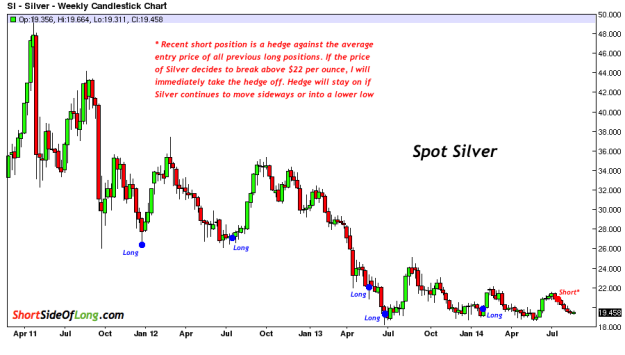

Chart 2: Silver’s bear market is now ongoing for almost 3 and half years

I started to accumulate Silver once again as it sold off about 50% from its record highs in April 2011. Initial purchases were conducted in late December 2011 and July 2012. However, a bear market follow through occurred in 2013, as Gold crashed. That did not stop me, as I continued to accumulate Silver first in May 2013 and later in July 2013 and January 2014. Silver is by far my largest holding, at times reaches over 80% of my NAV. Therefore, keep in mind that my other positions are at times, almost irrelevant.

Despite the fact that Silver’s bear market is now almost 3 and half years old, and has declined by more then 60%, my average entry is only a few dollars above the current level. However, I am not so sure that the final low is in as of right now. Therefore, I’ve recently placed a hedge on my overall long position. If I am wrong and Silver starts to take off above $22, I will immediately take the hedge off.

Chart 3: Sugar is one of the most disliked agricultural commodities…

Sugar is the other commodity I also favour in coming years. It is not as easy to buy-and-hold Sugar as it is with Precious Metals. The commodity tends to fluctuate from a backwardation to a contango and back again. Nevertheless, I started to accumulate Sugar around 50% sell from its recent 2011 highs as well. Initial purchase was conducted in early December 2012. Not the best of purchases I must admit, as the price just slowly rolled down for months (haha!).

However, I continued to accumulate the soft commodity in August 2013, December and January 2014; and once again only a couple of days ago . Keep in mind that while my average entry looks pretty decent in the chart above, Sugar has been suffering from a contango in recent quarters, so the drawdowns are a little bit bigger.

Chart 4: Uranium is one of the most oversold industries in the world…

With the global stock market screaming ever higher, mainly thanks to the S&P 500′s record breaking run, it is very difficult to find value in shares. I know a lot of “experts and gurus” on CNBC and Bloomberg will disagree with me, but I’m in charge of the capital and I judge value my own way.

I also understand that certain investors single out various European or Emerging Markets opportunities with low valuations. Others focus on Taiwan and Japan after a prolonged secular bear market, and a few are even nibbling into Chinese & HK shares despite the potential property cycle risks.

Personally, I have chosen to invest into the Uranium sector during the recent sell off in May of 2014. Down more then 75% from peak in early 2011 and on track for a forth consecutive annual loss, this is probably the most oversold and least liked industry.

Chart 5: Australian economy has not suffered a recession for 23 years!

Australian economy has been in a mega-boom since the early 1990s, when the country saw its last official recession. After 23 years of constant growth, we have a whole generation of young people who believe that “property prices can never fall” & that “good jobs and highs salaries come easy”.

Could they be wrong? Could Australian growth falter after a 23 year record run? Could the Australian property market finally correct? And if any of those occur, would the RBA “stimulate” the economy through global monetary policies by following the likes of Bernanke, Yellen, Draghi, Kuroda, King and the crew. You know the drill… cut rates, print money and devalue the currency!

This is what I have been betting on since late 2012, when I initiated my first large Aussie Dollar short. It was quite a big contrarian bet at the time, as hedge funds held record net long positions believing in further currency appreciation. Several weeks ago I opened another smaller short, adding to my existing position.

To be quite honest, despite a strong USD rally in recent months, Aussie has held up well so far and I am not happy with my new position. Therefore, I’ve put a tight stop loss at 94.00 cents for the 2nd trade, initiated recently.

Chart 6 & 7: I do not want anything to do with US stocks or US bonds!!!

There are many other trades that I hold and have held in my portfolio over the years. But they are very very small compared to my NAV and therefore quite irrelevant for this article.

Now, let us focus on some future prospects. Let me just say that since you are smarter then I am, you probably see more opportunities around the world then I would. While I could sit here and number variety of trades I am currently looking at, I will just focus on a few existing and new ones.

Let me first say that I do not see any value in the broad US stock market or the US government / junk bond market right now (refer to Chart 6 & 7). This could change if the prices were to decline meaningfully. However, with a recent powerful bull market in both of these assets, future expected returns could be a real disappointment in the coming decade… at least according to Ray Dalio and his BridgeWater team (thanks for the charts).

Chart 8 & 9: I am closely tracking Russian stocks & Gold Mining Juniors

Personally, I continue to hold both Gold and Silver in high regard. If prices do eventually go lower, my plan is to add to my current positions and start a new position in Gold as well. I will use new cash inflows as well as profits from the current hedges. On the other hand, if the price breaks out on the upside, I will still continue to add positions as I build my overall portfolio around the PMs theme. The same can be said with Sugar, but just on a much smaller scale.

Two assets I have not yet purchased in a meaningful way are Gold Mining Stocks and Russian Stocks (I do own a small position in Russia equities from early March of this year). Both of these indices are extremely cheap and could outperform in superb fashion in coming years. However, I am still waiting patiently on both, because further selling and lower lows could be in the cards. I believe the main catalyst will the end of the US Dollar bull market and we are just not there yet.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.