Everyone Is On The Same Side Of The Boat

Lance Roberts | May 03, 2018 08:38AM ET

In early 2018, I penned a post which illustrated the legendary Bob Farrell’s 10-investment rules . Bob, one of the great investors of our time, had a very pragmatic approach to managing money. Investing rules, and a subsequent discipline, should be a staple for any investor who has put their hard earned “savings” at risk in the market. Unfortunately, far too many invest without either which leads to less than desirable outcomes.

As of late, there has been a lot of excitement over two areas of the market in particular: interest rates and oil prices. In fact, at this moment the speculation in these two areas is at record levels.

Why is that important?

First, the speculation that oil and interest rates will go higher are the two areas which have the greatest negative impact on economic growth and earnings. Rising interest rates increase borrowing costs and higher oil prices increase input costs for manufacturers. As I noted previously , with a heavily indebted consumer, there is little ability to pass on higher costs which, if absorbed, reduces profits.

Secondly, the speculation brings forward two of Mr. Farrell’s most important rules:

- Rule #2: Excess in one direction will lead to an opposite excess in the other direction, and;

- Rule #9: When all the experts and forecasts agree – something else is going to happen.

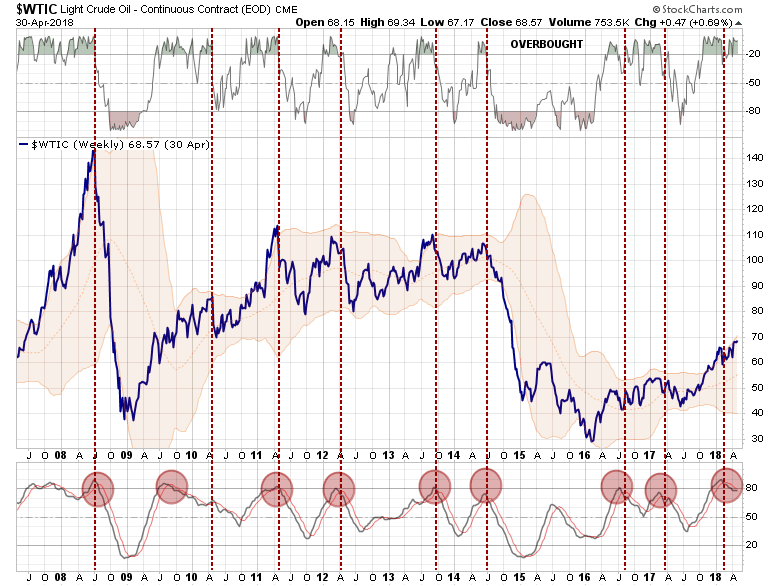

Currently, when it comes to oil prices, there is little room left for more bullishness. As oil prices have risen due to concerns over the potential supply concerns from geopolitical tensions, the price of oil is now as overbought and extended as at every other prior peak.

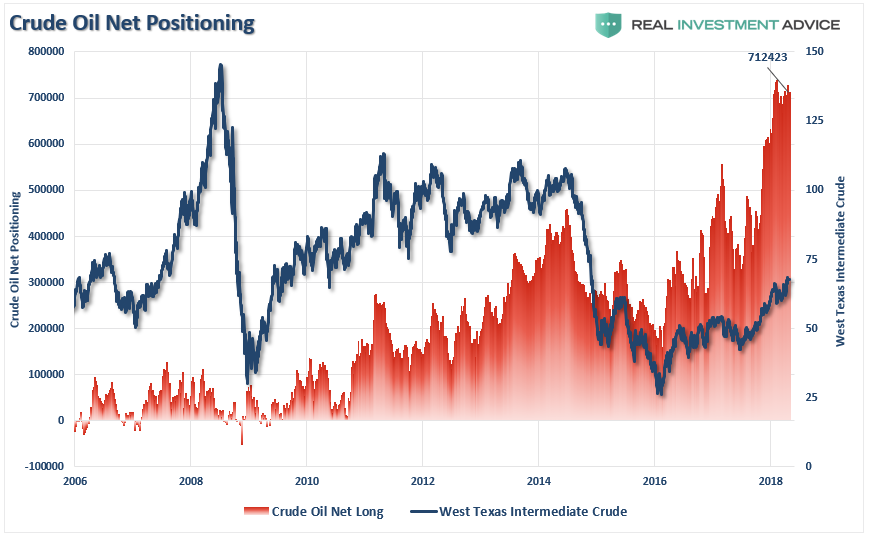

Of course, the cycle of rising oil prices leading to increased optimism which begets bullish bets on oil continues to press prices higher. However, it is also the exuberance which has repeatedly set up the next fall. As shown below, bets on crude oil prices are sitting near the highest levels on record and substantially higher than what was seen at the peak of oil prices prior to 2008 and 2014.

Importantly, while bullish bets on oil are at extremes, there is also a high correlation between the direction of oil and the S&P 500. (Importantly, rising oil prices have been a major contributing factor to the rise in earnings for the S&P 500. A reversal in prices will be problematic as well.)

As JPM recently noted, via Zerohedge ,

The sharp increase in oil prices over the past month has been accompanied by a further rise in spec positions, which as JPMorgan notes, has now risen to new record highs. This suggests that hedge funds and other speculative investors have been at least partly behind the recent sharp spike in oil prices.

As JPM further notes, both Systematic and Discretionary hedge funds have been building up long positions in oil, with the former induced entirely by momentum and positive carry, while the latter have rushed in due to geopolitical issues, continued inventory declines in the US and expectations of Saudi Arabia engineering a higher oil price ahead of privatizations next year.

Bloomberg confirms the recent surge in commodity fund inflows, noting that hedge funds investing in oil are luring capital at the fastest pace in more than a year. After years of pain, commodity funds have recovered the client outflows they suffered last year. According to eVestment data, investors allocated $3 billion to commodity-focused hedge funds from January through March, the most since the third quarter of 2016.

But it is not only speculative investors such as hedge funds, systematic or discretionary, responsible for the rise in oil prices, it is also real money investors such as retail investors and asset allocators that have been buying oil indirectly via purchases of commodity tracking funds as they seek to increase their overall allocation to commodities.

The last paragraph is problematic as retail investors are always “late to the party.” From a contrarian standpoint, this alone should be worrisome. However, with speculators pushing prices higher, the economics of the cycle are very mature. Higher prices has led to a surge in production to an all-time record. However, demand, which has started to deteriorate over the last 12-months, remains stagnant and more representative of the economic demand-driven side of the equation.

With oil, a direct cost to consumers, the surge in prices acts as an additional tax on consumers which detracts from other economically sensitive discretionary purchases. With production at records, along with net speculative long-positioning by investors, the risk of a reversion caused by an economic slowdown or recession is problematic.

This is where the second “overly crowded trade” comes into play.

The rise in commodity prices, combined with the Fed’s instance on hiking interest rates, has led to a belief that demand-driven inflation is finally set to return to the U.S. This has led speculators to build the largest net-short positioning in U.S. Treasuries on record.

Once again, we see Bob Farrell’s rule in action. Previously, such record net-short positioning has been more indicative of peaks in the interest rate cycle as opposed to the beginning of higher rates. You can see this more clearly if we strip out all of the positionings except those periods where net-short contracts exceeded 100,000.

With the net-short positioning on the U.S. Treasury at records, the net-short positioning on the Eurodollar has also reached a record. Once again, what we find is when the net-short positioning starts to get overcrowded, that too has been a good indication of a bottom in bond prices (or a peak in rates.)

The problem is the tentative rise in inflation is driven by higher costs being pushed onto consumers. This is the wrong type of inflationary rise which negatively impacts economic growth. As opposed to rising prices driven by rising demand, cost-push inflation simply eats away at discretionary incomes reducing consumptive spending which is 70% of economic growth.

With positioning on the US Dollar net-short, along with interest rates and the Eurodollar, there is plenty to suggest that traders, and investors, have all rushed to the same side of the boat.

As our analyst Jesse Colombo explained last week:

If another wave of dollar strength occurs, it would be very bad news for crude oil and the overall energy sector (crude oil and the dollar trade inversely). The U.S. dollar’s surge in 2014 and 2015 was the trigger for the violent crude oil bust. Even more concerning is the fact that the ‘smart money’ are more bearish on crude oil now than they were immediately before the 2014 oil bust, as I discussed in greater detail last week . While oil’s short-term trend is still up for now, and I believe in respecting the trend, there is a very real risk that another violent liquidation sell-off may occur when the trend changes.”

Like all rules on Wall Street, Bob Farrell’s rules are not meant has hard and fast rules. There are always exceptions to every rule and while history never repeats exactly it does often “rhyme” very closely.

Nevertheless, one thing is true, in the short-term it may well seem that everyone is correct in their thesis of higher rates, inflation and oil prices. However, history has a pretty clear record to suggest that when “everyone in on the same side of the boat” it has generally often paid to put on a “life vest.”

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.